A sound result for Cochlear, guidance a little noisy

Stock

Cochlear (COH) $191.97 as at 14/08/18Event

Hearing implant developer Cochlear delivered a reasonable result pre-market, however guidance was well below analysts hopes for FY19 which sent the stock lower today. The company trades on a high forward PE of ~37x which requires a solid growth rate to justify. This morning COH guided to net profit growth of 8-12%, or around $270m for FY19 which is 5% below consensus estimates of 284.5M, enough to worry the market. Working in Cochlear’s favour is commentary that may suggest the guidance may under-promise for the year ahead. The company indicates that guidance doesn’t include any currency tailwinds as it benefits from a falling Aussie dollar, while the board chose a more conservative estimate from emerging markets where they have seen a high level of growth in the second half of FY18. If these trends continue, the guidance will be under done. COH traded as low as $183.05 today, 7.9% below yesterday’s close, however it rebounded reasonably well to trade ~3.5% lower.

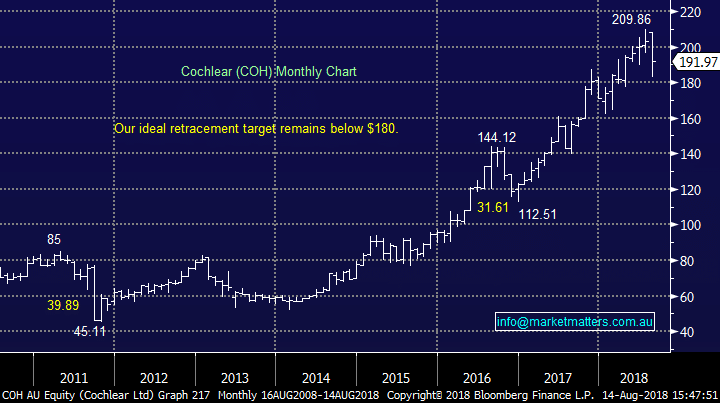

Cochlear (COH) Chart

COH traded as low as $183.05 today, 7.9% below yesterday’s close, however it rebounded reasonably well to trade ~3.5% lower.

Cochlear (COH) Chart