A soft housing market fails to throw REA Group off course (JHX, REA)

WHAT MATTERED TODAY

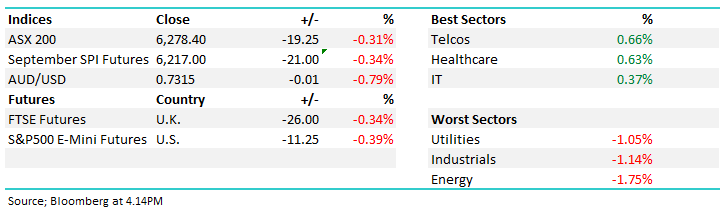

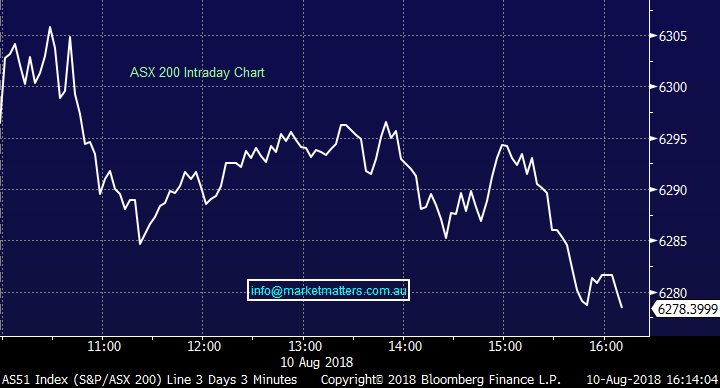

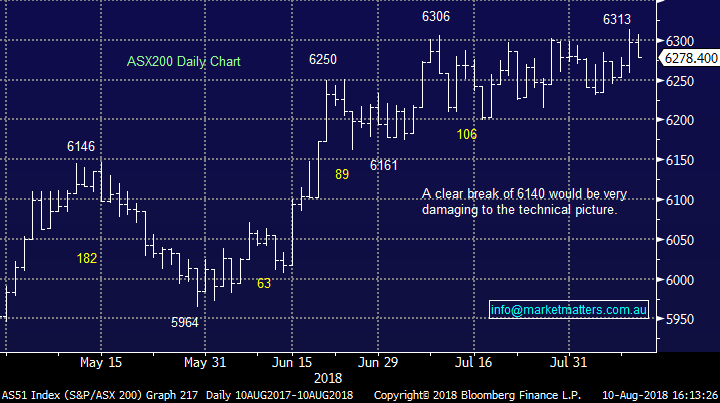

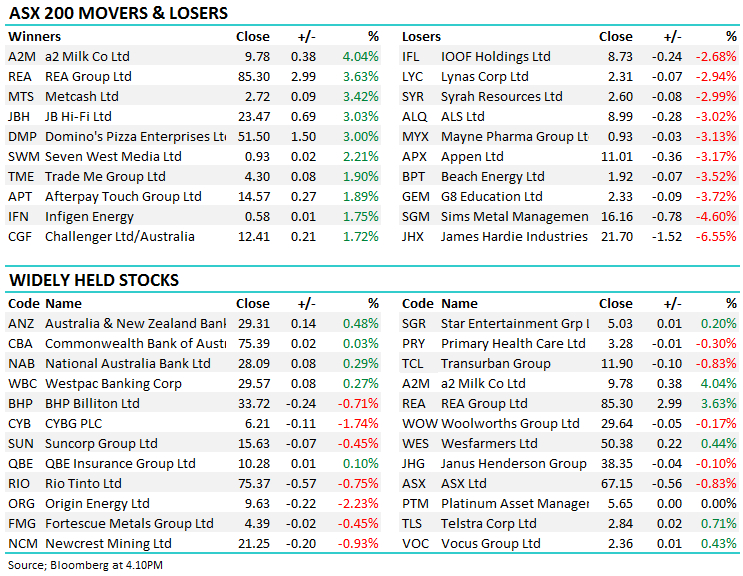

Another attempt above 6300 today and another fail by the ASX200 as sellers took hold of the early strength and sold the index off to end the week. Still, it’s been a positive 5 days for the market with the index edging up just shy of 1% thanks largely to a decent move back into the beaten down financial stocks – a theme we’ve been positioned towards for some time now. Reporting obviously dominated the news flow and as expected, it’s been a mixed bag. Misses have been dealt with harshly - James Hardie (JHX) as example today.

Overall, the index closed down -0.31% or 19 points today to 6278 – up 44 points / 0.7% on the week

We are regularly featured in the media and on various market related news services. This week I appeared various times on Sky Business – click here to view – and we also have contributed to www.livewiremarkets.com.au posting recent analysis on both the Rio Tinto (RIO) and Suncorp (SUN) results which can be viewed here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Weekly Moves – Stocks & Sectors;. Reporting season has clearly dominated the news flow this week with CBA and Suncorp (SUN) helping to support a strong run in the financial sector.

Sectors over the past Week

At a stock level, Magellan was the pick of the reports booking a very strong profit number and a rejig of their dividend policy. On the flipside, Eclipx (ECX) was a major disappointment after downgrading guidance – they are a September year end.

Stock moves over the week

Broker calls; AGL universally downgraded while our friends at Shaw and Partners upgraded Folkestone to a buy on valuation grounds.

· Mirvac Group Downgraded to Neutral at Citi; PT A$2.47

· Flight Centre Downgraded to Sell at Citi; PT A$59

· AGL Energy Downgraded to Hold at Deutsche Bank; PT A$22.25

· AGL Energy Cut to Underweight at Morgan Stanley; PT A$19.44

· Bluescope Downgraded to Hold at Deutsche Bank; PT A$17

· Magellan Financial Cut to Neutral at Credit Suisse; PT A$29

· Beach Energy Downgraded to Underperform at Macquarie; PT A$1.90

· Vital Healthcare Cut to Underperform at Macquarie; PT NZ$2.08

· Nine Entertainment Downgraded to Sell at Morningstar

· Orora Upgraded to Hold at Morningstar

· Sims Metal Downgraded to Neutral at JPMorgan; PT A$17

· Folkestone Upgraded to Buy at Shaw and Partners; PT A$2.89

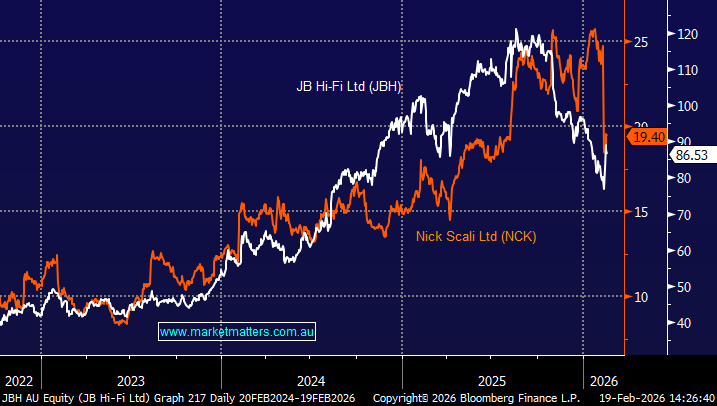

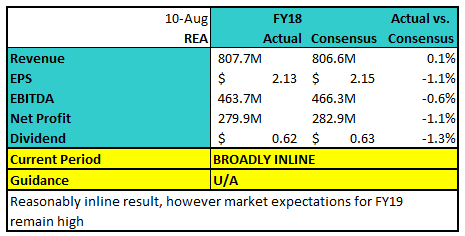

REA Group (REA) $85.30 / +3.63%; This morning REA reported their full year results and they were broadly inline with expectations, however the stock has rallied +3% on the session. It seemed like a recent sell off in the stock was pre-empting a weaker set of numbers and probably a more somber outlook than the one they delivered.

The outlook was interesting from REA and although they don’t give specific numbers in terms of earnings, they gave some commentary about the softness in the local housing market which they believe will persist which will reduce overall listing volumes however price increases that came into effect from July and longer sale times will more than offset the reduction in volumes. As it stands, the market is looking for FY19 EBITDA of $550m up around 20% on the year. Clearly, expectations remains very high for REA Group! A great business with such dominance in its market place will help it push through price rises for its products / services, however market expectations are high and the external environment seems to be getting tougher from here.

REA Group (REA) Chart

James Hardie (JHX) $21.70 / -6.55%; Building material supplier James Hardie was the worst performer in the ASX 200 today following a weak first quarter update, missing expectations and showing signs there is a lot of work required to hit FY19 targets. Despite some impressive growth as EBIT for the quarter reached $US 107.1M, it was -12.5% below analysts’ expectations of $US 122.5M. Also key to the release was guidance, with the company looking for operating profit between $US 300 and 340M. While consensus falls within the range at $US 331m, the guidance relies on a number of factors outside of the companies control – “housing conditions in the United States continue to improve in line with our assumed forecast of new construction starts, input prices remain consistent and an average USD/AUD exchange rate that is at, or near current levels for the remainder of the year. “

Management cautions that although US housing activity has been improving, market conditions remain somewhat uncertain and some input costs remain volatile. The update is a weak one relative to where market expectations were and probably more importantly, the rich valuation the stock currently trades on. We can’t stress enough that highly valued stocks where the market has built in optimism, present a risk in this current environment – JHX is simply another example of this.

James Hardie (JHX) Chart

OUR CALLS

No changes the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here