A rare day of bank buying rather than bank bashing (ORE)

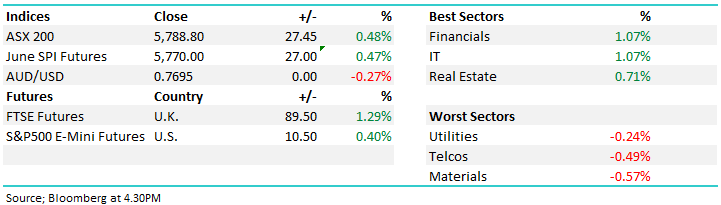

WHAT MATTERED TODAY

Banks underpinned a rebound in the market today with the big 4 accounting for more than half of today’s gains for the ASX 200 while the woes for BlueSky (BLA) continued – the stock down another ~30% today as it continues to exchange blows with Glaucus Research regarding their charging of fees and lack of transparency in terms of their asset carrying values – clearly more to play out here in time however the short seller Glaucus with the upper hand at this stage – the stock down from ~$11.50 to todays close at – $5.62 in 3 trading days - Ouch!

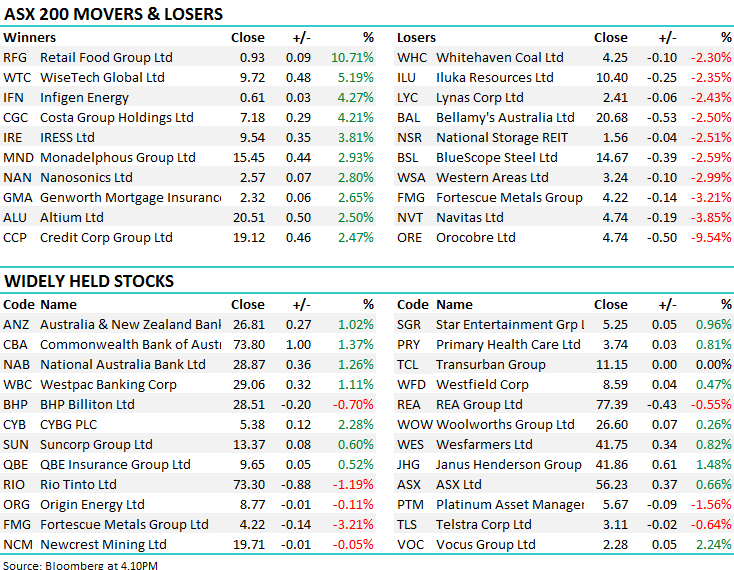

Elsewhere, more pain for our holding in Orocobre today falling 9.54% on a downbeat production outlook – mainly due to the weather however the market still hit the stock hard while the broader sector was also under pressure with Kidman down -4.38% and Galaxy off by 1.03% – so a confluence of factors really for ORE to contend with – more on this below.

Iron Ore was weaker overnight and down again in Asian trade today by another -2.30% which prompted more selling in Fortescue (FMG) which lost -3.21% to $4.22 - a new 12 month low for the stock, while RIO also finished in the red. Today was really a day of bank buying rather than bank bashing and as we suggested yesterday afternoon – the sector simply felt susceptible to a move higher on less / no more bad news – sellers have simply dried up here in the short term and we think CBA has $77.50 written all over it!

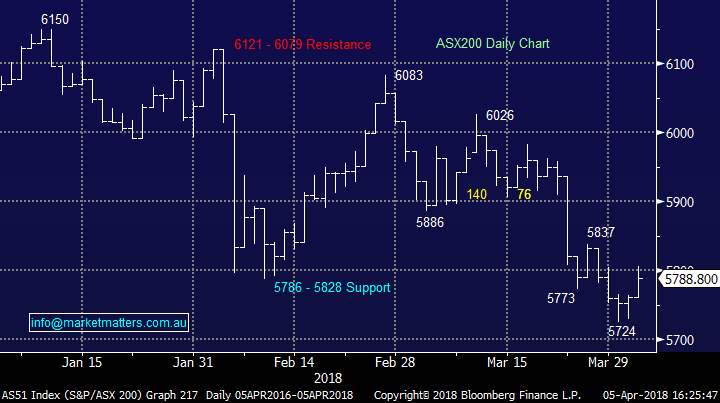

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A few brokers starting to get more positive on the resource sector after recent weakness while some of the stocks that have run hard (Resmed an example) are starting to feel some pain. The theme we wrote about early in the week RE high valuation stocks a risk is clearly starting to play out…

Today we had moves on…

· South32 Upgraded to Neutral at Citi

· ResMed Falls as Citi Cuts ADRs to Neutral on Valuation

· Perseus Upgraded to Buy at UBS; PT Set to A$0.55

· BHP Upgraded to Buy at Citi

Resmed (RMD) Chart

Orocobre (ORE) $4.74 / -9.54% - A day where Lithium stocks were weak overall however Orocobre amplified their woes with a 10% downgrade to production guidance saying that weather related issues will see their output miss guidance, however the announcement went on to discuss the need to improve production capabilities to enhance consistency etc, and that implies that the issues are probably just partially weather related amplified by a weak operational result - whatever the case, the stock was sold off.

Looking at Kidman which provides a clearer technical picture, that stock looks like going to $1.60 so more weakness in the sector would not surprise. We have 5% of the Growth Portfolio in ORE, which is high for a high risk stock and that weighting is enough. If we’d entered using more caution at a 3% holding, we’d be looking to average given our bullish overall stance on the sector.

Orocobre (ORE) Chart

OUR CALLS

No trades in the MM Portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here