A mixed day on the reporting front (PGH, CSL, NAB, TAH)

WHAT MATTERED TODAY

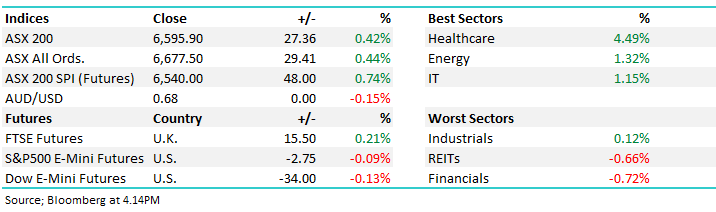

An interesting session played out locally following a strong rebound from US stocks overnight, the Dow Jones adding +372pts underpinning our futures which traded +60pts at their highs, however weak Chinese economic data, some selling in US Futures and a mixed day on the reporting front led to a soft middle part of the session before a late rally played out into the close

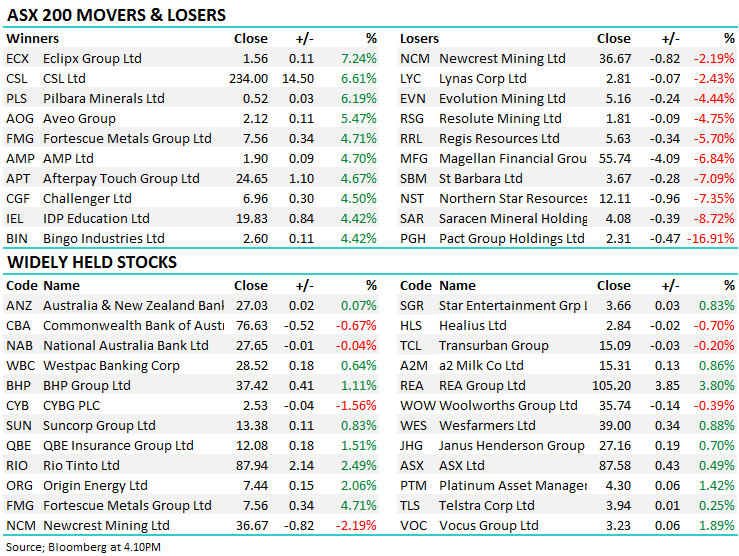

Healthcare had a very strong session thanks to CSL which contributed a significant +21 index points to the ASX 200 on the back of a strong result, offset by CBA which detracted -16pts from the index trading ex-dividend, closing -$2.83 after going ex-dividend by $2.31 plus franking.

Energy stocks benefitted from a strong bounce in Oil overnight while Iron Ore names also had a day in the sun, Fortescue (FMG) +4.71% to $7.56 a standout while RIO added +2.49%. Golds on the other hand were weak, the precious metal off overnight leading to a decent decline locally today. Crude = offense & Gold = defence, offence winning the day. Newcrest (NCM) traded down -2.19% while some the mid-caps were hit harder, Saracen’s (SAR) off by -8.72% to $4.08.

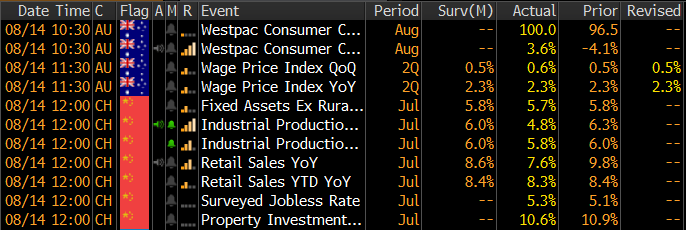

On the economic front today, Chinese data was weak overall while local consumer confidence bounced back.

Economic Data Today

Source: Bloomberg

Overall, the ASX 200 added +27pts today or +0.42% to 6595. Dow Futures are now trading down -38pts /-0.14%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

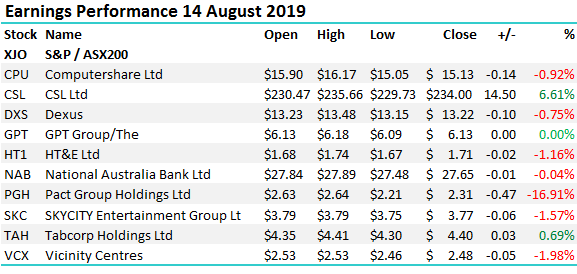

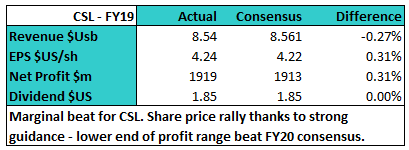

Stocks today…CSL beat in terms of guidance, Computershare (CPU) was inline for FY19, however guidance was soft, offset to some degree by a $200m share buy-back, Pact Group (PGH) delivered an inline result while guidance was a tad soft, although it seemed the rhetoric from the new CEO also played a part saying they would not chase sales for sales sake – seems sensible to me, TAB was fine while NABs Q3 trading update was a shade above expectations.

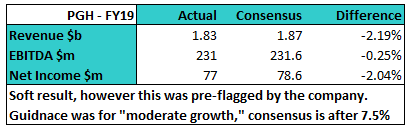

Pact Group (PGH) –16.91%: Hit hard today after they reported results that were broadly in line with expectations, while guidance was a tad soft . The packaging manufacturer had provided a market update in June re-confirming that they would meet the lower end of the $230 to $245m EBITDA range with consensus sitting at $231.6m. As such, FY19 showed little surprises with the company reaching marginally above the lower end. The statutory figures show a worse outcome, with a number of one-off items dragging the full year to a $290m loss, down from a $74m profit in FY18.

The FY20 outlook for Pact Group was a little behind expectations – depending on your interpretation of “modest improvement” on the EBITDA line. The market was expecting EBITDA growth of around 7.5% for the 12 months affording them the capacity to pay down debt, however it seemed that commentary from the new CEO was less focussed on the short term and more focussed on a longer term turn around. Shares are now trading back to near levels seen prior to the spike where the company reconfirmed guidance and also extended the debt maturity profile. The average maturity extended from 3.4 to 3.6 years at this result and debt levels are being closely watched here.

At 3x gearing, many suspect the company has a balance sheet problem, and the statutory number today isn’t painting a pretty picture going forward. The company did try to ease investor concerns saying the input costs that had caused problems to profits in recent times appears to have peaked and margins should recover going forward. Adding further fuel to the fire today, the AFR was highlighting the cut to the full year dividend, although that was no surprise, no analyst worth their salt was expecting a dividend in FY19, while only a couple have one pencilled in for FY20. While the result was weak, it had been well flagged. The share price reaction in our view is an overreaction.

Pact Group (PGH) Chart

CSL Limited (CSL) 6.61%: Blood medicine company CSL has shot higher in today’s session to set new all-time highs on a solid set of FY19 numbers and an even better outlook. Those fearing the company had seen the back of its strong growth rate welcomed the guidance pointing to profit growth of around 9% in FY20.

The FY9 result was broadly in line with expectations, hitting the earnings number on the head. The slight miss in revenue was more than offset by a better effective tax rate. Each division appears to be (at a minimum) delivering on the strategy, while the immunoglobulin & albumin therapies are showing better than expected growth. The company noted a strong rebound of the albumin sales into China in the second half helped see global sales here grow 15% in the year.

The FY20 profit guidance of $US2.05b to $US2.15b was better than expectations at $US2.044b prior to the result. This includes the impact of CSL’s China restructure which will see it develop a direct distributor model, in line with the groups wider model but causing a $340-$370m hit in the financial year (which they view as a one off). The company’s shift in its dividend policy at the last result implied that future growth may have been lower putting pressure on it to justify its 30+x PE multiple, however this result disproves the theory, and 10% growth in FY20 should see the stock supported. CSL is deservedly reaching all-time highs.

CSL Limited (CSL) Chart

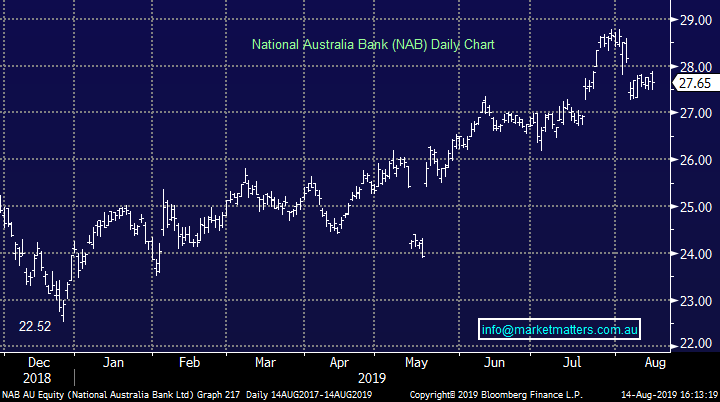

National Bank (NAB) -0.04%: provided a quarterly trading update today that implies they’re on track to meet full year expectations. Here are the highlights:

Reported $1.65B cash profit in 3Q19 with 1% revenue growth and no change in expenses from the quarterly average of 1H19 to 3Q19. Net interest margins improved due to lower funding costs which has been a trend across the banks in recent times. The bad debt charge increased slightly to $247M in 3Q19 and past due loans also continued to increase due to mortgage delinquencies, but not materially so. Their capital position is reasonable at 10.7% after the inclusion of the dividend reinvestment plan.

NAB Chart

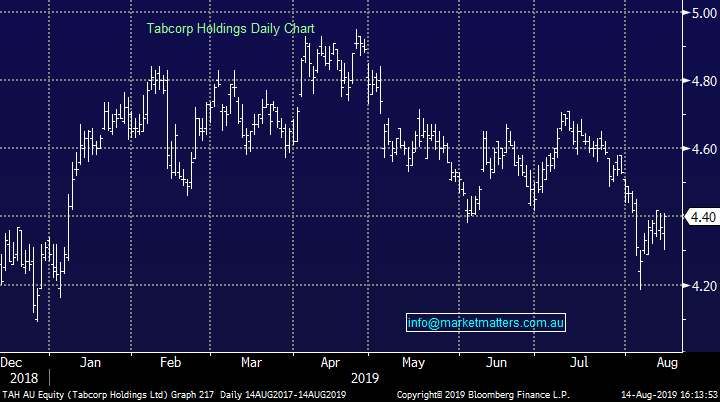

Tabcorp (TAH) +0.69%: Reported FY19 results this morning and they were broadly in-line with expectations. Top line revenue of $5.48bn was slightly ahead of the $5.41b expected as their lotteries business continued to flourish. Net profit after tax was $397.6m, a whisker ahead of the $396.9m expected while the all-important dividend came in at 11c for the half taking the full year to 22cps fully franked, putting it on a yield of 5.04%, or 7.2% gross, which is a 100% payout of net profit.

It’s the first full year where the Tabcorp-Tatts merger has been reported and we continue to believe TAH offers a defensive earnings stream, attractive yield at a reasonable valuation.

Tabcorp (TAH) Chart

Broker moves;

- Centuria Capital Cut to Hold at Moelis & Company; PT A$2.06

- Magellan Financial Downgraded to Sell at Citi; PT Set to A$54

- Magellan Financial Downgraded to Sell at Goldman; PT A$39.83

- Fortescue Upgraded to Buy at Goldman; PT A$9.80

- St Barbara Downgraded to Underperform at RBC; PT A$3.25

- Macmahon Reinstated at Argonaut Securities With Buy; PT A$0.30

- Rio Tinto Upgraded to Overweight at JPMorgan; PT A$105

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.