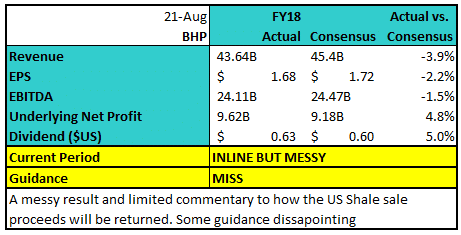

A messy masterpiece from BHP?

Stock

BHP Billiton (ASX:BHP) $32.62 as at 21/08/2018Event

BHP was the next big miner to face the music in their FY18 numbers this morning, a reasonable result if not messy and although shares are trading lower, it is mostly in line with comparable companies as the market also trades lower at the time of writing. The big news shareholders were hoping to gather from this announcement was also withheld – where will the ~$US10B from the sold US shale assets go? BHP gave no update except to say that the money will be returned to shareholders once the transaction is settled in October. Bhp Billiton is still consulting shareholders in order to determine the best way to return the capital. Here are the key takeaways from the BHP Result below: Looking deeper into the result, BHP lowered productivity guidance into FY19, reducing cost benefits from $2b to $1b mostly on the back of few assets to increase productivity, but also poor performance of the Queensland coal business and their Olympic Dam copper project. One word to sum it all up is messy, but heading in the right direction. BHP has done a great job in de-leveraging and debt levels are now around the lower end of their target, productivity is disappointing but many assets are running below capacity and any effort to lift output here will see top line growth.

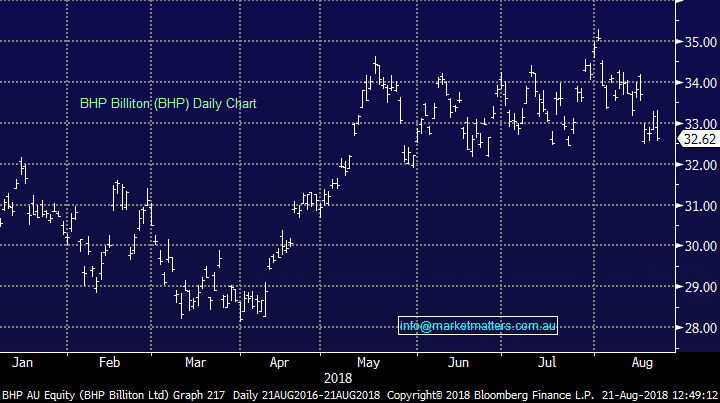

BHP Billiton (BHP) Chart

Looking deeper into the result, BHP lowered productivity guidance into FY19, reducing cost benefits from $2b to $1b mostly on the back of few assets to increase productivity, but also poor performance of the Queensland coal business and their Olympic Dam copper project. One word to sum it all up is messy, but heading in the right direction. BHP has done a great job in de-leveraging and debt levels are now around the lower end of their target, productivity is disappointing but many assets are running below capacity and any effort to lift output here will see top line growth.

BHP Billiton (BHP) Chart