A massive thankyou to the MM community (RMD)

WHAT MATTERED TODAY

Firstly, a massive thankyou to the entire Market Matters community for the support of the APEX Postie Ride that Harry & myself are embarking on in August - we have now raised over $20,000 for a great cause. For those that need some further insight into the ride, here’s a quick YouTube clip of a past event: Click Here. For more information, or to donate, Click Here

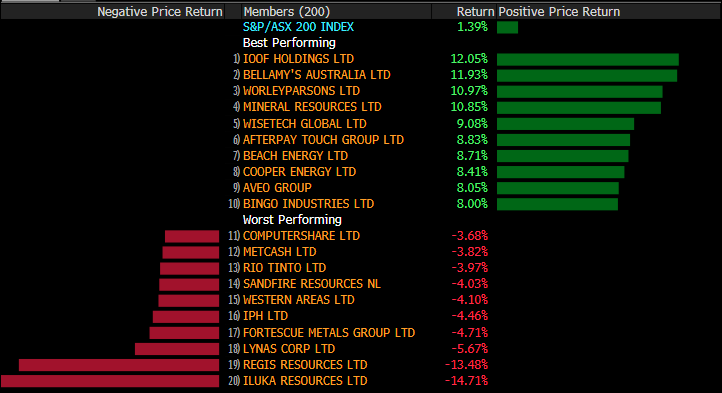

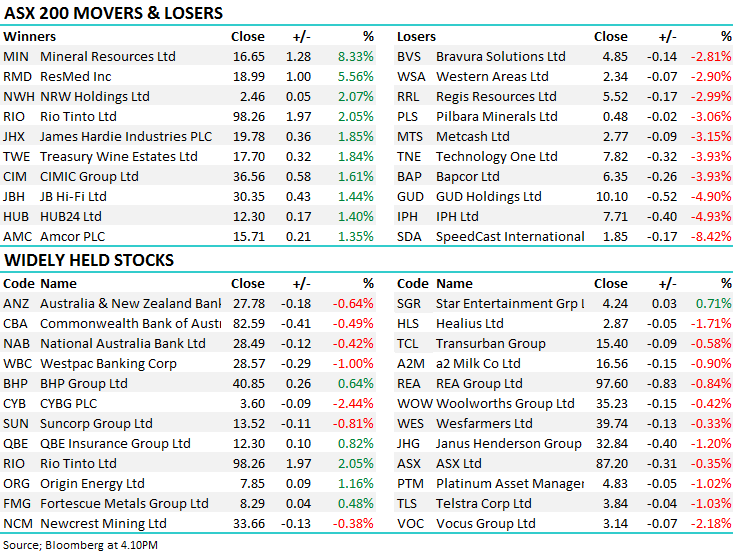

On the market today, stocks were lower thanks to weakness in the US overnight and some profit taking amongst the influential banking stocks – not unexpected after a stellar week for the sector thanks to the expectation of lower interest rates. Reporting season started locally with Resmed (RMD) out with full year earnings that underpinned a +5% pop in that share price today pushing it to new all-time highs, Harry has more on that one below.

Elsewhere, Mineral Resources (MIN) +8% was strong following a decent quarterly update, although it was fairly light on detail which is standard for MIN. The stock now looks interesting here. There were a raft of other quarterly reports out during the week from mining stocks and there were more misses than beats. Iron Ore stocks were also infocus during the week with the likes for Fortescue & RE down between 4-5% in the period – the first sign of weakness after an extended period of strength.

Overall today, the ASX 200 closed down -24pts or -0.36% to 6793 . Dow Futures are trading up +53 points or 0.20%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

Resmed (RMD) +5.56%: The sleep apnoea business was strongly bid today following their FY19 report that was in line with expectations but came with some upbeat commentary around their push into health software where revenue more than doubled in the year. They added MatrixCare to their portfolio in 2018 as the company looks to build out health focused software-as-a-service and expects high growth rates to continue.

Profit for the group was up 28%, helped by an 11% growth in revenue as well as an 80bps expansion in margins. The market is looking for a similar rate of revenue growth in FY20.

Resmed (RMD) Chart

Sectors this week:

Stocks this week:

Broker Moves;

· Gentrack Downgraded to Neutral at Forsyth Barr; PT NZ$5.75

· Gold Road Cut to Neutral at Macquarie; Price Target A$1.40

· Myer Upgraded to Buy at UBS; PT A$0.64

· Virtus Health Upgraded to Buy at UBS; PT A$5.40

· JB Hi-Fi Downgraded to Sell at UBS; PT A$26.85

· Karoon Energy Ltd Upgraded to Outperform at Macquarie; PT A$3

· Bluescope Upgraded to Overweight at Morgan Stanley; PT A$14.50

· Westpac Downgraded to Hold at Morningstar

· Fortescue Downgraded to Neutral at Credit Suisse; PT A$8

· Sonic Healthcare Cut to Underperform at Credit Suisse

· IPH Downgraded to Hold at Bell Potter; PT A$8.35

· Insurance Australia Downgraded to Neutral at JPMorgan; PT A$8.20

OUR CALLS

No changes today

My daughters 8th Birthday party tonight…wish me luck!

Watch out for the weekend report.

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

James Gerrish

Senior Investment Adviser

Level 7, Chifley Tower, 2 Chifley Square Sydney NSW 2000 Australia

T: +61 2 9238 1561 | M: +61 405 711 929 | F: +61 2 9232 1296 | [email protected]

www.shawandpartners.com.au | Follow us

From: James Gerrish

Sent: Friday, 26 July 2019 4:30 PM

To: Nitish Wanzare; Adam Sanders ([email protected])

Cc: Peter White ([email protected]); Alexander Aguilan; Harrison Watt

Subject: PM - out ASAP - Harry to upload

A massive thankyou to the MM community (RMD)

WHAT MATTERED TODAY

Firstly, a massive thankyou to the entire Market Matters community for the support of the APEX Postie Ride that Harry & myself are embarking on in August - we have now raised over $20,000 for a great cause. For those that need some further insight into the ride, here’s a quick YouTube clip of a past event: Click Here. For more information, or to donate, Click Here

On the market today, stocks were lower thanks to weakness in the US overnight and some profit taking amongst the influential banking stocks – not unexpected after a stellar week for the sector thanks to the expectation of lower interest rates. Reporting season started locally with Resmed (RMD) out with full year earnings that underpinned a +5% pop in that share price today pushing it to new all-time highs, Harry has more on that one below.

Elsewhere, Mineral Resources (MIN) +8% was strong following a decent quarterly update, although it was fairly light on detail which is standard for MIN. The stock now looks interesting here. There were a raft of other quarterly reports out during the week from mining stocks and there were more misses than beats. Iron Ore stocks were also infocus during the week with the likes for Fortescue & RE down between 4-5% in the period – the first sign of weakness after an extended period of strength.

Overall today, the ASX 200 closed down -24pts or -0.36% to 6793 . Dow Futures are trading up +53 points or 0.20%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

Resmed (RMD) +5.56%: The sleep apnoea business was strongly bid today following their FY19 report that was in line with expectations but came with some upbeat commentary around their push into health software where revenue more than doubled in the year. They added MatrixCare to their portfolio in 2018 as the company looks to build out health focused software-as-a-service and expects high growth rates to continue.

Profit for the group was up 28%, helped by an 11% growth in revenue as well as an 80bps expansion in margins. The market is looking for a similar rate of revenue growth in FY20.

Resmed (RMD) Chart

Sectors this week:

Stocks this week:

Broker Moves;

· Gentrack Downgraded to Neutral at Forsyth Barr; PT NZ$5.75

· Gold Road Cut to Neutral at Macquarie; Price Target A$1.40

· Myer Upgraded to Buy at UBS; PT A$0.64

· Virtus Health Upgraded to Buy at UBS; PT A$5.40

· JB Hi-Fi Downgraded to Sell at UBS; PT A$26.85

· Karoon Energy Ltd Upgraded to Outperform at Macquarie; PT A$3

· Bluescope Upgraded to Overweight at Morgan Stanley; PT A$14.50

· Westpac Downgraded to Hold at Morningstar

· Fortescue Downgraded to Neutral at Credit Suisse; PT A$8

· Sonic Healthcare Cut to Underperform at Credit Suisse

· IPH Downgraded to Hold at Bell Potter; PT A$8.35

· Insurance Australia Downgraded to Neutral at JPMorgan; PT A$8.20

OUR CALLS

No changes today

My daughters 8th Birthday party tonight…wish me luck!

Watch out for the weekend report.

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.