A lethargic session to end of a poor week for stocks (MQG)

WHAT MATTERED TODAY

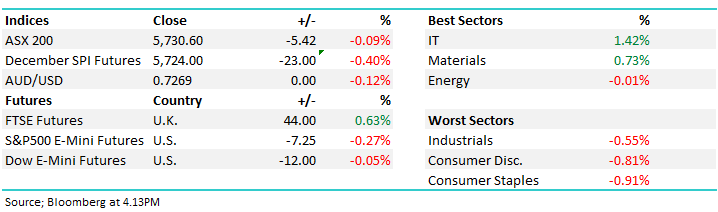

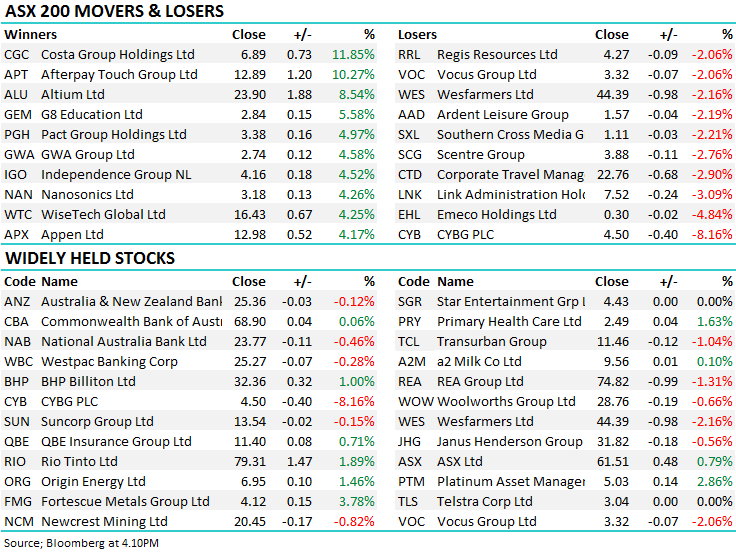

A more lethargic session today to cap off a fairly volatile week for equities. While the market failed to grab the full extent of the positive overseas lead, the aggressive selling that played out mid-week in our market wasn’t there either, and we simply drifted in and out of positive territory to end a tad lower.

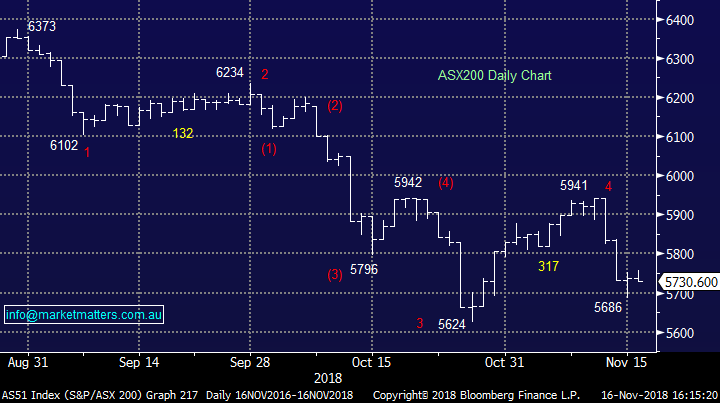

Overall, the index closed down -5 points or -0.09% today to 5730 and was down 3.23% on the week. Dow Futures are trading down 55 points / -0.21%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

RATINGS CHANGES:

· Factor Therapeutics (FTT AU): Factor Therapeutics Cut to Reduce at Morgans Financial; PT A$0

· MACA (MLD AU): MACA Downgraded to Speculative Buy at Hartleys Ltd; PT A$1.27

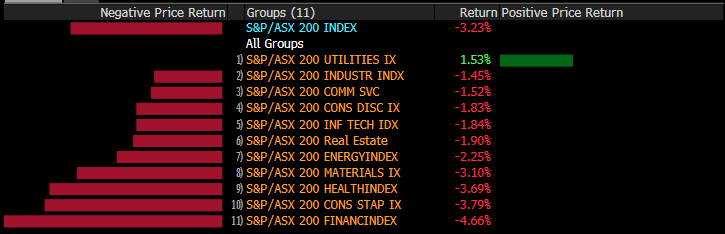

Sectors this week;

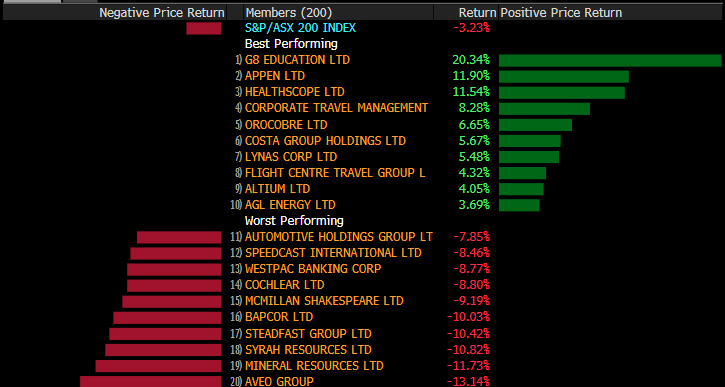

Stocks this week;

During the week we covered a diverse range of topics in our notes, with a number of actionable insights…

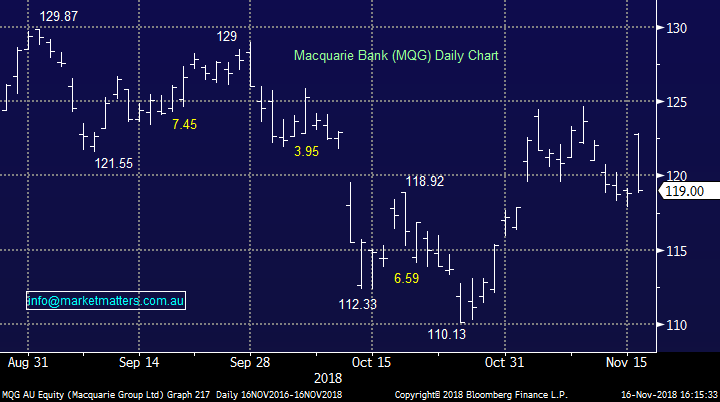

Macquarie (ASX:MQG) was strong early but failed to hold gains this afternoon to close up just 19c at $119.00 after upgrading earnings guidance again, although this is not new news Read More

Macquarie (MQG) Chart

Why we’d sell WAM; The main Listed Investment Company under the Wilsons banner is ASX:WAM and its clearly popular with income investors, delivering a current dividend yield of around 6.5% fully franked. Chris Stott, the Chief Investment Officer for the group has recently resigned to spend more time with family. Simply put, the WAM premium is too high for such a high profile loss of personal while paying a 14% premium for a 30% cash weighting simply does not make sense to us; Read More

Healthscope (ASX:HSO), a stock we own in the Growth Portfolio is now being stalked by two suitors with Brookfield coming to the table on Monday with a revised bid. As we suggested after the first BGH bid was made,we expect there is more to play out for HSO in the weeks / months ahead. While we doubt the $2.36 bid will get up, the purchase of additional stock by BGH suggests they’re the ‘real deal. Read More

Is the new Westpac Hybrid worth buying; Earlier in the week we met with Westpac regarding a new Hybrid security being issued in part to refinance an existing security (WBCPD). The existing security has $1.4b on issue and WBC say they’ll issue a new security worth $750m with the ability to do more or less. Read More

Appen (ASX:APX) – upgrades earnings; On a day where much of the market was heading lower, one stock stood out with Appen jumping higher yesterday thanks to upgraded earnings guidance . We discussed Appen (ASX:APX) in a number of notes this week; Read More on their upgrade here while LiveWire Markets picked up one of our broader articles which touched on Appen and part of a wider article on growth stocks. Read More

Lend Lease (ASX:LLC) was on the other side of the ledger with an earnings downgrade. While we think a spin out of the engineering division makes sense, and could well be underway from the comments of management today, however if problematic projects remain underway, further pain could well be likely. We have no interest in LLC at current levels. Read more

Agricultural stocks were in focus this week with Elders (ASX:ELD) hitting it out of the park with better than expected full year numbers, while we also saw Ruralco Holdings (ASX:RHL) beat expectations; We covered Elders here and Rural Co here

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.