A huge day on the market – ASX down -2.74%

WHAT MATTERED TODAY

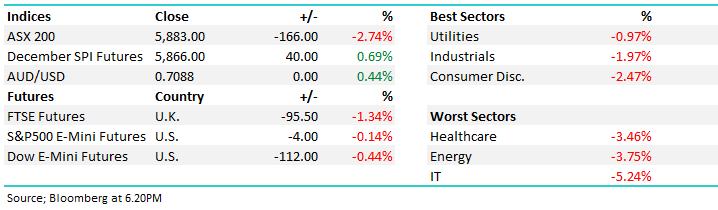

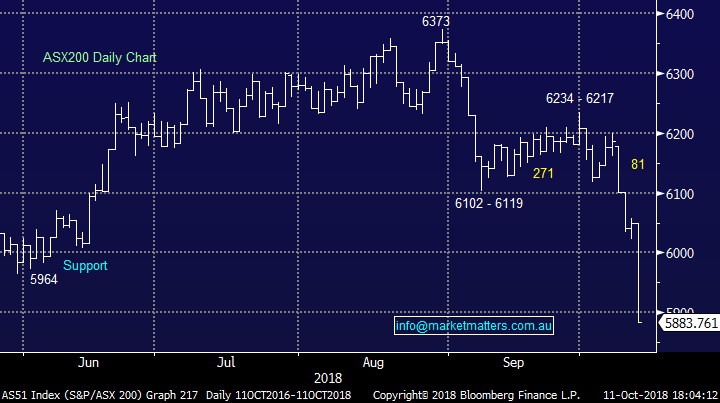

A huge day for the Australian market with the ASX 200 closing down -166pts / 2.74% on the lows of the day at 5883. We opened down -100pts, attempted to rally before midday before another wave of selling hit hard during the afternoon as Asian markets came under more pressure – most down between 3.5% - 5%, China one of the worst in the region, and without stating the obvious, risk was ripped off the table. We went into the session today with some confidence that the 5950 region would be the point where traders stepped in, that was the case in the morning, but weakness throughout Asia + the US Futures (DOW) got hit another ~300pts during our afternoon trade – and selling perpetuated selling. As I tap away at this note at 5.26pm Sydney time, DOW Futures are down ~200pts and the SPI has traded up +20pts since the close. The aggression in the selling today was strong, more so than we thought it would be this morning and depending how the US trades tonight, we may need to amend our overall view on the market. We were bearish the local index, with an initial target of ~5975, which has clearly been surpassed.

Even though the ASX had dropped ~5% leading into today’s trade we took another 2.7% off it today despite no major changes from an economic / market perspective. This is a momentum sell off that started in the HOT tech stocks in America and has subsequently filtered through the rest of the market. I thought this morning that it was time to step up into panic selling, and despite the market finishing on its lows, I still think that’s the case.

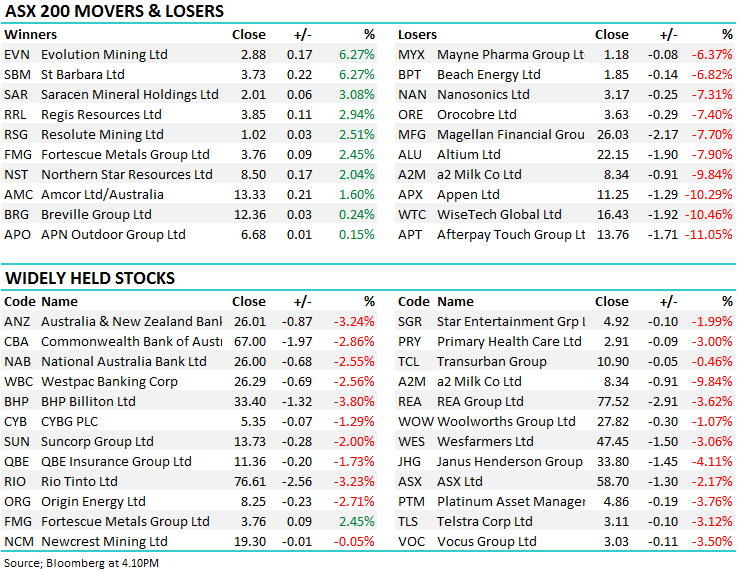

Today was the sort of day that we experienced during the GFC, the only difference being that corporates / balance sheets were stressed at that time, leverage was high and we had a genuine and sustained panic with foundation - there was session after session where stocks were offered hard. To be clear, we don’t think that’s the case this time round. Momentum stocks, that have seen momentum money flow into them have unwound hard. It was the case in the US overnight, and it was the case in our market today… look at the top 10 losers from the ASX 200 today…High value growth was targeted – an area we’ve been cool on for some time now.

ASX 200 biggest losers

After a day like we’ve just had – a huge one on the desk and around the markets generally it can be hard to step back and look at things objectively. A sea of red and all portfolios will be down today – it’s hard to escape it. We stepped in this morning and added Cimic (CIM) to the Growth Portfolio with a 3% weighting, we also topped up on Westpac (WBC) / +3%, Janus Henderson (JHG) /+2%, and the emerging markets ETF (IEM) /+2%, we sold our BEAR yesterday a day early however that’s an unleveraged bearish position on the ASX which added +2.62% today versus the leveraged BBUS ETF which is a leveraged short on the US market which was up 10.48% today – the only bright spot in the portfolio (other than Fortescue) however having one or two positions in the green on a day like this is certainly not a bad thing. In the Income Portfolio we sold ANZPD and up weighted Fortescue (FMG) / +2%, and up weighted Perpetual (PPT) /+2%. Super Cheap (SUL) didn’t get down to around $9, however we are keen to add it.

This week alone the ASX is down over 5% and we’ve got a session to go – the total sell off from the 6373 high set on the 30th Aug is now -490pts / -7.68%. Clearly a big drop and we could fall further. The DOW Jones has fallen -1353pts to the close this morning + another 300pts today on the futures taking that decline to -1653pts / -6.06%. We do often see big falls at the start of October and more often than not, that provides a great buying opportunity ahead of the most bullish period into Christmas. Time will tell, however that’s our current view, and we played that view by buying stock when everyone else was selling. If we’re wrong, we’ll put our hand up and take our medicine, however when I’ve stepped up at times like this in the past, ‘buy the panic’ has proven to be the right call. It’s a hard thing to do, and quite frankly pretty unconformable.

We’ll provide a complete update on our market views in the AM report tomorrow and make some calls from there.

Overall today, the index closed down -166 points or -2.74%% at 5883. Dow Futures are trading down -200pts

ASX 200 Chart

ASX 200 Chart

OUR CALLS

Growth Portfolio: Bought Cimic (CIM), Westpac (WBC), Janus Henderson (JHG) & Emerging markets ETF (IEM)

Income Portfolio: Bought Fortescue (FMG), Perpetual (PPT) & Sold ANZPD

In the movers below – GOLD stocks were clearly the place to hide…

Have a great night – chat to you in the morning

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.