A focus on broker moves (CBA, BHP, A2M)

WHAT MATTERED TODAY

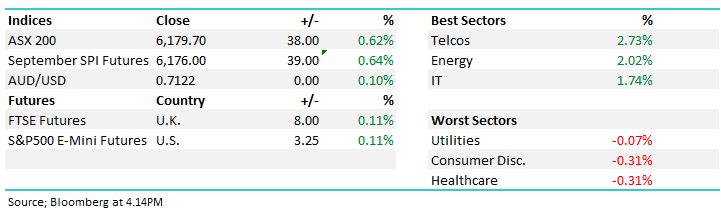

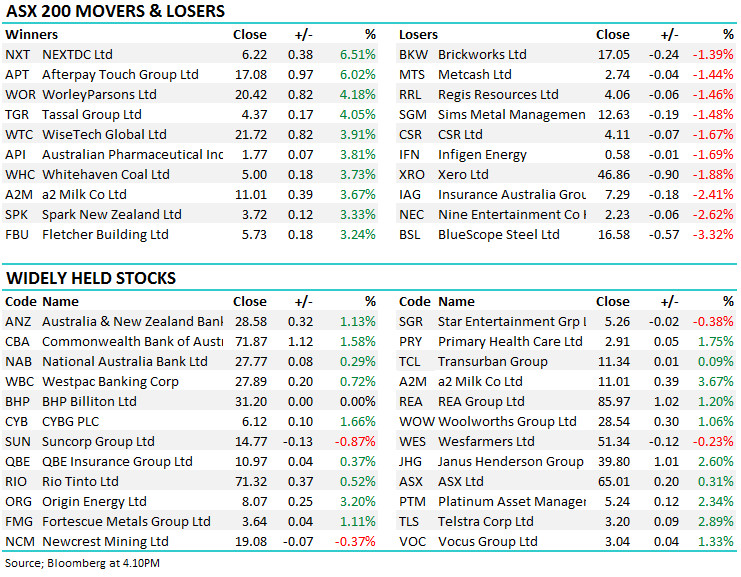

A stronger session than FUTURES pointed to this morning with the market opening flat but firming throughout the day – thanks largely to the Telcos / TLS put on +2.89% and added +3.46 points to the index while CBA was a standout in the banking space adding +1.58% and contributing an impressive +6.58 index points to the ASX 200. We cover CBA in more detail below. Elsewhere, A2 Milk (A2M) re-affirmed earnings guidance and rallied back up above $11, ditto for Macquarie Group (MQG) with the company saying FY19 earnings would be broadly flat on FY18 – the market thinks their understanding it, and the stock ended up +1.82% at $124.87.

Overall, the index closed up +38 points or +0.62% today to 6179. Dow Futures are currently trading up +21pts

Today’s move is a stronger one than expected, although not that surprising giventhe ASX200 had fallen 271-points in an aggressive manor from its high on the 30th of August. 6200 now remains the key level in our opinion and the more time spent below that handle the greater the chance of another leg lower. For our downside target area to be achieved we are likely to need to see some weakness to finally materialise from US stocks but that’s certainly not unfolding at this stage.

· MM remains short term negative the ASX200 with an ideal target ~5800.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

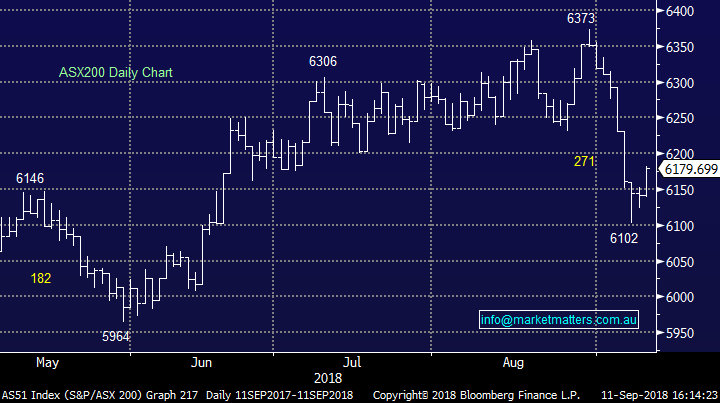

Broker Moves; A lot happening in the broker space today with Deutsche Bank (DB) downgrading BHP to HOLD and Fortescue (FMG) to an outright SELL. Both stocks were sold down on open however they enjoyed a reasonable fight back throughout the session. Capitulation by bulge brackets (DB on FMG) for example with the stock rallying in the face of it, is a good sign. From what we hear, the iron ore miner has been shorted as a proxy against emerging markets which has proven correct, however some semblance of support here in the EM complex and the rubber band will likely snap back hard. FMG is on our radar.

An interesting piece from JP Morgan on the miners today with the broker saying… Unless you think there’s a recession right around the corner, mining stocks are a buying opportunity following their recent sell-off.

Bloomberg published the chart of mining valuations globally, and they’re back to 2013 levels. No argument, they are cheap however the German trader I operated under when first starting in this business reinforced an old adage that is hard to forget.

“BUY resources on a high PE and sell them on a low PE”! Counter to what we would normally do but makes sense – here’s why;

Back in 2013, BHP was trading at a similar level to today, ~$35, before dropping to below $14. Buying resources on low PE’s means you’re buying commodities when commodity prices are high. When commodity prices are high, new production is incentivised and prices ultimately retreat – that’s clearly happened in the Lithium market in recent times. I hate using the term ‘this time is different’ because more often than not – it’s simply not, however right now miners are focussed on returning cash to shareholders over and above putting money into the ground. That reduces production growth which (all things being equal) should be supportive of underlying commodity prices – or so the theory would suggest. So, maybe the adage of buying cheap as JP Morgan suggests might work this time!

BHP Billiton Chart

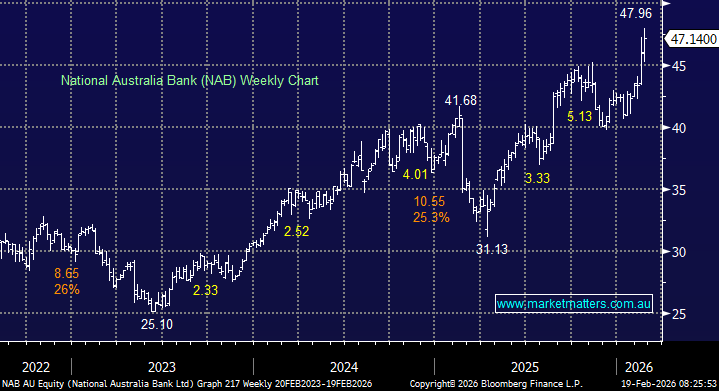

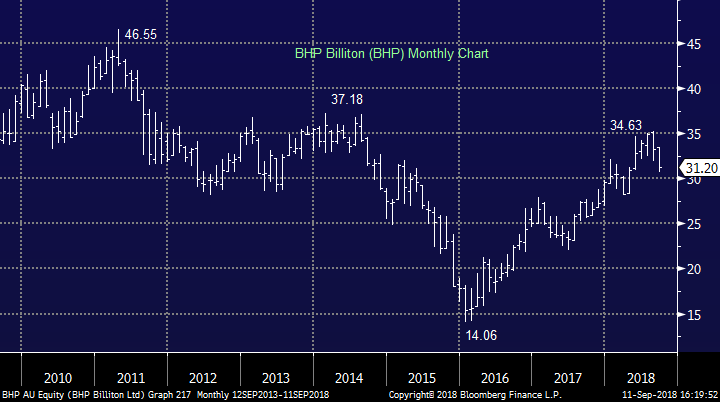

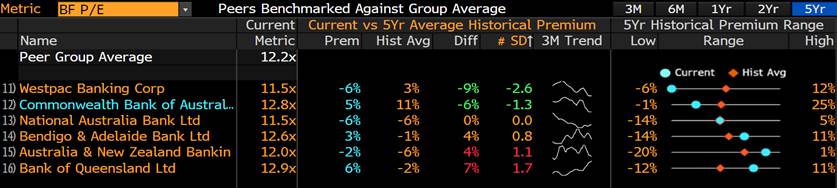

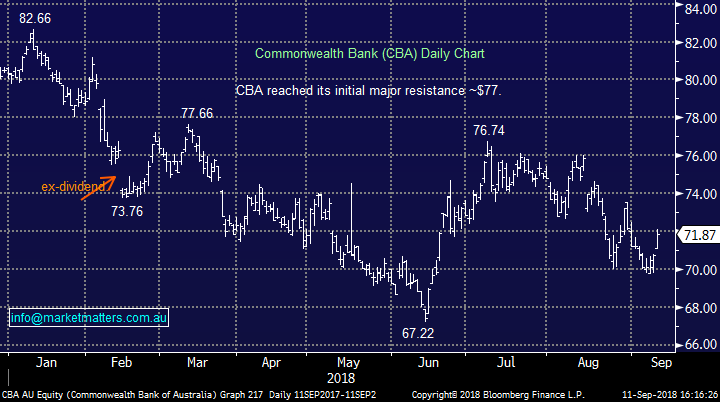

Elsewhere, CBA was upgraded by Citi today – nothing uber bullish with a $72 PT – and they still remain one of the most negative in the market (behind Morgan Stanley with a $65 PT) versus consensus PT of $76.18 however we are seeing the market turn less negative the banks. Interestingly, last week we witnessed an odd phenomenon of late with (wait for it!!) an increase in bank EPS forecasts. On a 12m forward basis, ANZ was up 0.97%, CBA up 0.43%, NAB up 0.32% and WBC up 0.39%. The banks as a whole up 0.47%, or an annualized 27.5% pace! Could the worm be turning on the sector?

Thinking about the recent drop in the market for a moment, banks outperformed into the weakness, a theme we’ve covered (and positioned for) across our portfolios.

In terms of CBA, its trading on 12.8x v a sector on 12.2x, so a slight 6% P/E premium versus the 11% premium it usually attracts. Westpac screens ~9% cheap on a relative basis.

Bank P/E’s Chart

Source; Bloomberg

Commonwealth Bank (CBA) Chart

RATINGS CHANGES:

· Appen Reinstated at RBC With Outperform; PT A$11.50

· CBA Upgraded to Neutral at Citi; PT Set to A$72

· Evolution Mining Upgraded to Overweight at JPMorgan; PT A$3.20

· IOOF Holdings Upgraded to Buy at Morningstar

· Incitec Downgraded to Sell at Morningstar

· Brickworks Downgraded to Sell at Morningstar

· Whitehaven Upgraded to Buy at Deutsche Bank

· South32 Upgraded to Buy at Deutsche Bank

· Fortescue Downgraded to Sell at Deutsche Bank

· BHP Downgraded to Hold at Deutsche Bank

· NextDC Rated New Positive at Evans and Partners; PT A$14.14

· Origin Energy Upgraded to Overweight at JPMorgan; PT A$9.30

· Rio Tinto Raised to Overweight at JPMorgan; PT 4,850 Pence

a2 Milk Co. (A2M) $11.01 / +3.67% ; A2 Milk reaffirmed guidance in their investor presentation for the CLSA investor forum in Hong Kong released to the market today. The stock has bounced 3.84% as a result – broadly in line with other growth stocks (Bellamy’s up 3.4%), but also assisted by the details within the presentation. A2 noted they had achieved 10% market share of the milk market, and over 30% in the domestic infant formula market. The company also noted key milestones had been reached in terms of Asian penetration, while also earning an agreement with Costco who join Walmart in stocking a2 Milk in the US. All in all, not a great deal of new detail, but further justification of the strategy and execution for the a2 Milk team.

While we remain negative most growth companies, a2 trades on a reasonable multiple, justified by its growing Asian business, the Americas and Europe. Despite many headwinds to consumer facing products ahead, we like a2 milks ability to grow sales through market share to more than offset any headwinds the consumer market may face.

a2 Milk Co. (A2M) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.