A break out for the index, other’s didn’t fare so well (AZJ, RFG)

WHAT MATTERED TODAY

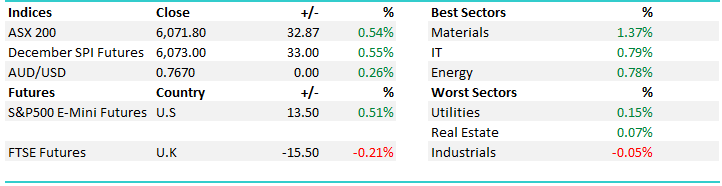

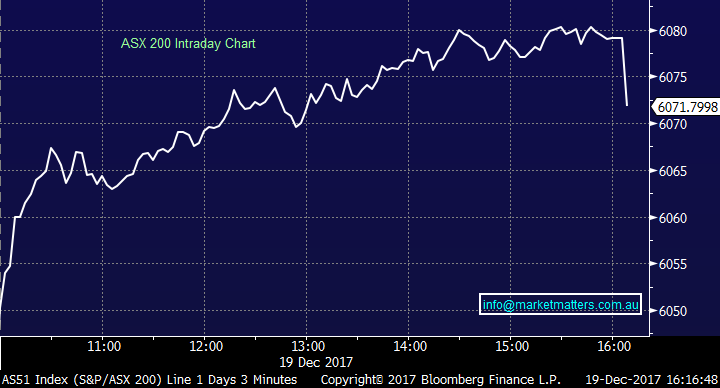

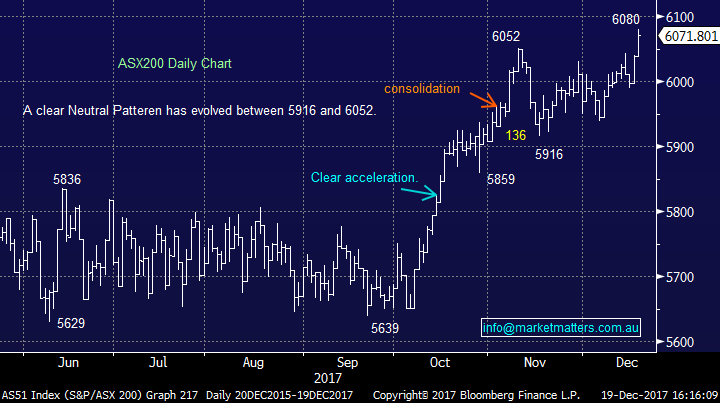

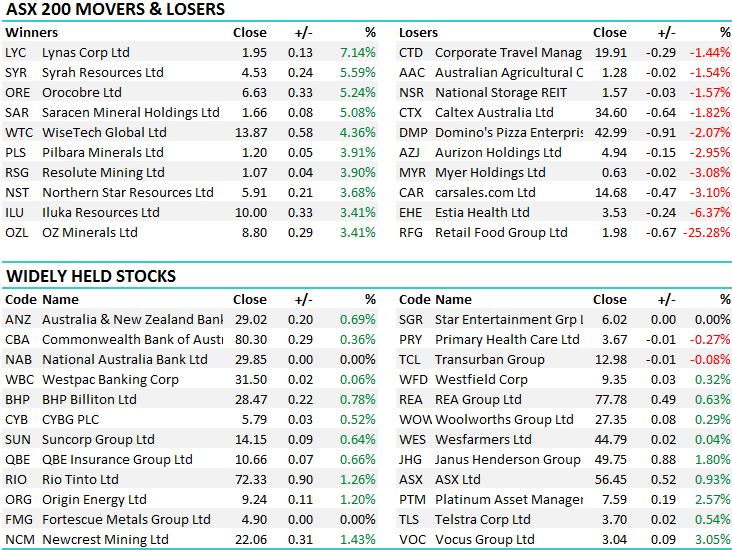

The Aussie market followed positive overnight leads to break into fresh levels not seen in over 9 years. Continuing progress in US tax reform, strong commodities markets and cashed up investors pushed the market in to unfamiliar territory. It wasn’t until the end of the session that any substantial selling eventuated, knocking 6 points off the index at the close of a strong day. As the tech heavy NASDAQ continued into record levels, the Aussie tech stocks were supported. Wisetech (WTC) shareholders also welcomed the end of the CEO selling stock, continuing it's amrch higher to put on 4.4% and helping move the dial for IT shares.

Despite reports NAB had been overcharging interest on home loans, it followed all banks higher, however it was the mining sector that was most loved today, supported by the heavy weights BHP and RIO – iron ore and oil futures were both higher in Asian trade. The industrial sector was the only one to finish in the red, dragged by Aurizon who were weak again today, reasons why later on. Overall, a range today of +/- 41 points, a high of 6080, a low of 6038 and a close of 6071, up 32pts or 0.54%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

1. Retail Food Group (RFG) $1.98 / -25.28% - Was belted again today, falling to levels not seen since 2009, and rightly so after downgrading earnings guidance by ~30% with the timing highly questionable. Just 6 days ago the company announced that…In line with its continuous disclosure obligations, RFG has made considerable disclosure in relation to its financial performance, business operations, prospects and trading conditions in recent months. These disclosures provide an evidence-based overview of RFG’s franchise operations. In that announcement, there was no downgrade with all parts of the business operating ‘inline’. Today the company provided an update on the expected impact of persistent challenging domestic retail conditions and other factors on its 1H18 statutory business performance. They went onto say… Consistent with recent trading updates of other retailers, particularly those retailers with shopping centre exposures, RFG’s domestic franchise revenues continue to track lower than expected. Of the major Brand Systems, Crust and Donut King have continued to perform to expectation, whereas Michel’s Patisserie, Brumby’s and Gloria Jean’s are trading below expectations. Recent negative media coverage about franchising, retail and RFG in particular has also contributed to a noticeable decline in momentum in new and renewing franchise sales. Associated revenues are now forecast to be below prior expectations and future franchise trading revenues are also likely to be impacted.

We don’t own RFG, never have however the big about turn on guidance in such a short period of time will rightly garner some negative attention. The stock closed today at $1.98 down more than 50% in just over a week. Although the disclosers are poor, and the company clearly has underlying issues with Franchisee’s and will find it very difficult in the short term to attract new buyers, the pragmatist in me would think that an external audit, a review of all franchise systems / operations, a concession that current systems are inadequate and an about turn will go a long way to re-direct fate of the business. Big downgrades will happen tonight and interestingly enough, this is the sort of business that private equity tends to be attracted to. Clearly this is a high risk proposition however one that we’ll certainly keep on the radar in the coming days.

Retail Food Group (RFG) Daily Chart

2. Aurizon Holdings (AZJ) $4.94 / -2.95% - struggled again today after the Queensland Competition Authority published draft decisions to regulate the freight rail operator’s coal network. The report was pushing for a revenue cap of around $4bil over a four year period, 25% lower than Aurizon’s estimates and could impact the group’s earnings by 8% next financial year and beyond. AZJ has performed strongly over the past 18 months, buoyed by increasing mining activity in the north east state and a number of hauling contracts held by rival Pacific National becoming available, despite haulage interruptions caused by the cyclone season continuing to impact delivery to the Dalrymple Bay Coal Terminal. A different play on a sector we like at MM, however the gearing levels put margins at risk as rates rise so one we will likely steer clear of.

Aurizon Holdings (AZJ) Daily Chart

Our Calls

No changes to either portfolio today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here