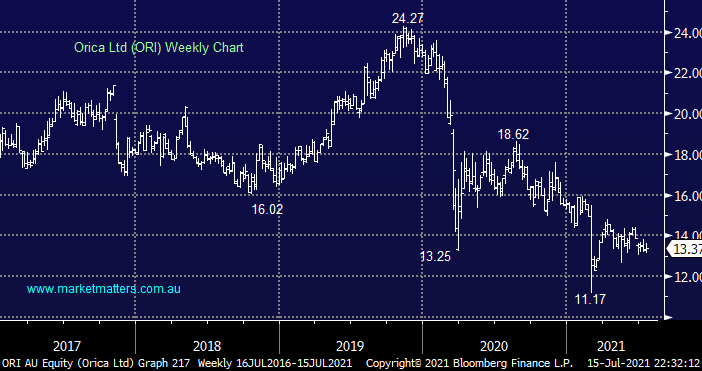

Chemical and explosive business ORI has not recovered from its COVID sell-off although we should note the stock started turning lower back in 2019. Mays half-year results had no major hidden surprises although it did disappoint delivering a 9% drop in revenue and a 25% decline in earnings, this could become a classic case of the worst is behind us. Hence MM feels this is a prime candidate for a recovery play which has been a theme over recent months with a number of underperformers rallying strongly.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

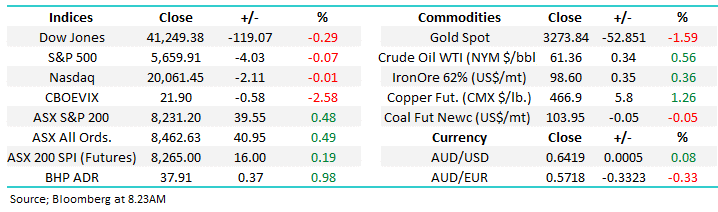

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

MM likes ORI as an aggressive play

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.