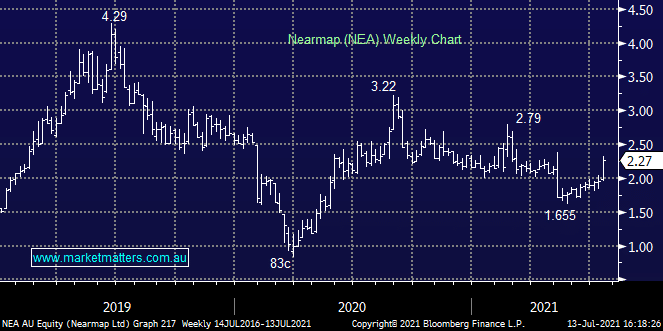

NEA 14.36%: the mapping tech business now expects Annual Contract Value (ACV) to come in at $133.8m after upping guidance only 10 weeks ago to $128-132m. The unaudited figure would see ACV growth of 26% for the year coming on the back of strong North American sales after a rethink of the process. The May upgrade came just a day before it was announced US competitor Eagle View was looking to sue Nearmap for patent breaches. Nearmap continue to deny the claims, however it has caused some pressure on the share price in recent times. They also announced a technological breakthrough today with testing underway for a new product set to hit the market later this financial year.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral NEA

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.