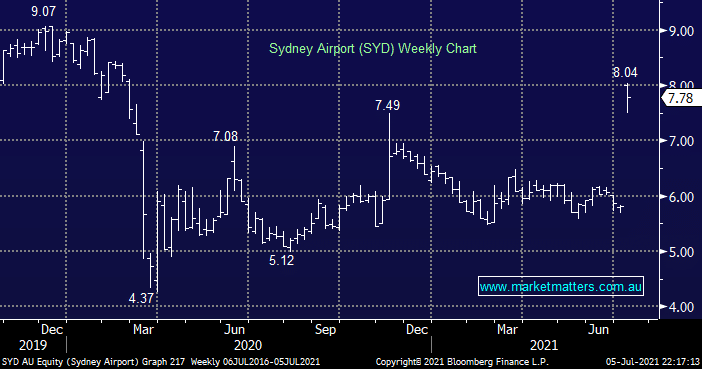

As we mentioned earlier Sydney Airports (SYD) received a surprising and attractive $22.6bn bid yesterday at a 42% premium to Fridays close. In some regards it may feel opportunistic under the current COVID induced travel cloud but I know if MM were long we would be extremely happy. The bottom line is the combination of private equity, infrastructure funds and large super are literally sitting on trillions of dollars looking for opportunities to put their war chests to work, it’s a tough gig to add alpha when asset prices have already run extremely hard. We’ve already seen plenty of M&A news in 2021 with more appearing likely into Christmas, and beyond e.g. Altium (ALU), Bingo (BIN), Vocus (VOC), Boral (BLD) and Crown Resorts (CWN) are all in play.

- The pent up demand / attraction for depressed stocks who have taken a short-term hit to earnings but have solid asset base is huge.

With regards to SYD it’s hard to imagine a higher bid at this stage, with only a few airports now listed on stock exchanges its not like their reinventing the wheel at this stage – Auckland Airport (AIA) and Germanys Frankfurt Airport (FRA GR) are 2 remaining ones that spring to mind. The stock trading fairly close to the bid price implies initial “bets” are the consortium will get this one over the line. NB: A bid requires FIRB and ACCC approval to succeed while an international buyer cannot own more than 49% of SYD.