Overseas Wednesday – International Equities & ETF Portfolios (CCI, BHP, COPX US, IEM)

The ASX200 continues to rotate in a tight range while the major sectors / themes within global equity markets jostle for favour into Christmas, and beyond. At MM we have some strong views around what’s on the menu moving forward hence today we’ve written a concise report outlining these often contrarian thoughts and most importantly how we intend to position the MM portfolios to benefit accordingly, assuming of course we are correct! :

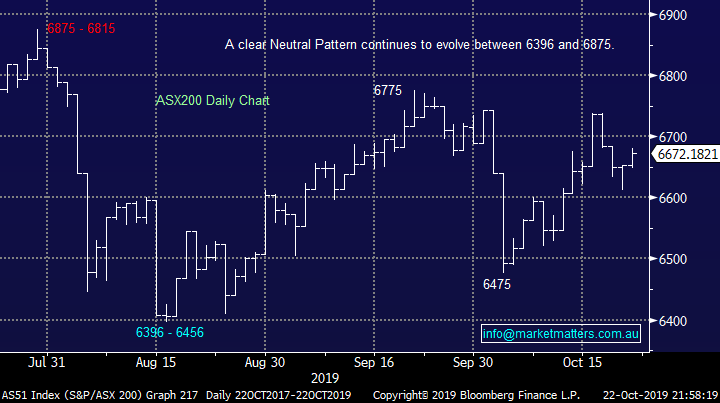

1 – Sell $US: MM believes the $US is commencing a major move to the downside which importantly has reflationary implications – its bullish for commodities and emerging markets (EM).

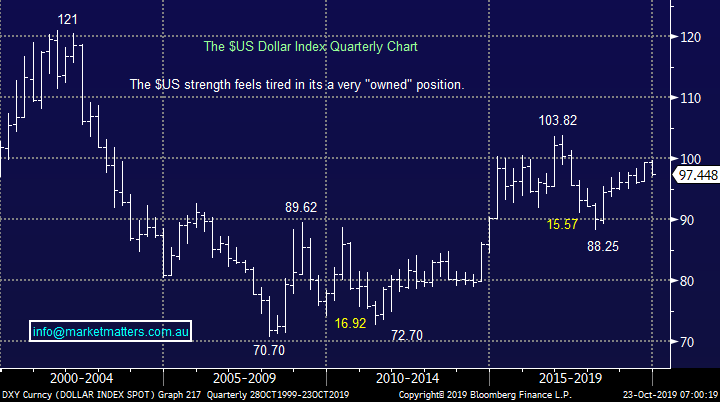

2 – Interest rates bottoming: We believe the risk / reward has tipped in favour of a low being in place for bond yields i.e. interest rates have bottomed. A bullish move for bank earnings.

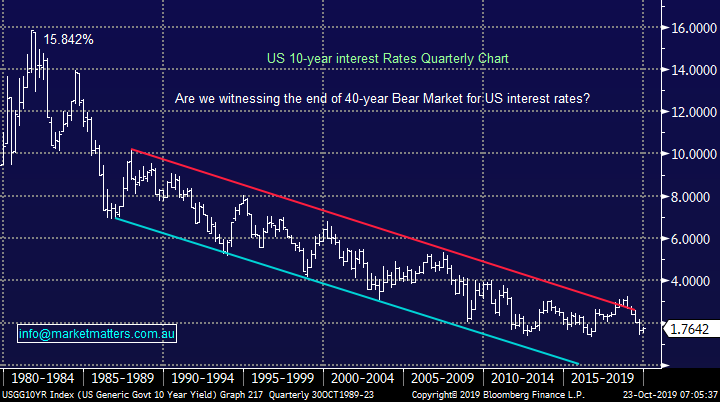

3 – Major stock indices neutral: Underlying equity indices remain neutral with sentiment indicators like the put / call ratio implying a meaningful move to the downside is unlikely i.e. investors are already scarred / bearish.

4 – Buy cyclicals over growth: MM is bullish cyclicals over defensive stocks especially those on the ASX who have enjoyed the strong $US tailwind.

We have touched on these points a few times over recent weeks but they have huge ramifications on how portfolios should be structured hence today when we look at our plans for the International Equity and Global Macro Portfolios both are eyes firmly fixed on these huge market influences on the road ahead.

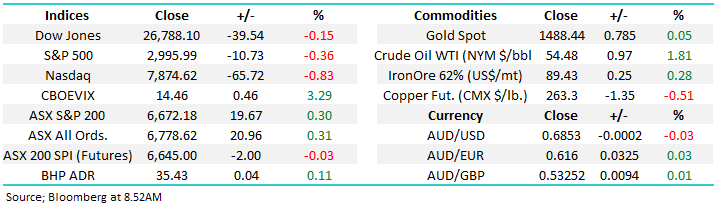

Overnight US stocks again drifted into the close with the tech based NASDAQ the main culprit falling -0.8%, the SPI futures are suggesting the ASX200 is set to open down less than 10-points with again no clear lead.

ASX200 Chart

The $US is looking “cooked”

The chart below illustrates that any depreciation in the $US is in its infancy and markets are unlikely to have embraced this potentially seismic change in trend. At the very least the risk / reward for investors positioned for an ongoing rally in the $US is very unappealing to MM.

Importantly a weaker $US is reflationary by definition, exactly what central banks are striving for.

$US Index Chart

Bond yields are leading sector rotation

We believe its way too early to be talking about an end to the multi-decade bear market for interest rates but we do believe they are reaching, or already have reached, the nadir of the descent.

At MM our strong opinion is central banks are going to implement aggressive fiscal stimulus in 2020 to maintain post GFC economic activity, a move that is both potentially inflationary and an acknowledgement that further rate cuts are pretty much a waste of time.

US 10-year bond yield Chart

Stock markets remain neutral

This churning share market should not be fought with the ASX200 trading at the same level as it was in June.

We believe investors should focus on the correct stocks / sectors as opposed to the underlying index itself – not always the case.

ASX200 Index Chart

Buy Cyclicals over Growth / Defensives

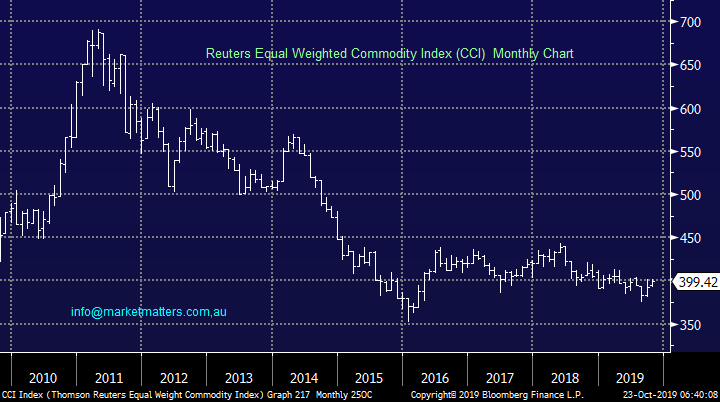

Copper has a record high speculative short position which is a huge contrarian flashing light that a major low is close to hand. As we’ve stated a number of times we’re bullish commodities and the below chart illustrates the obvious room to at least bounce for the equally weighted basket – a huge reflationary warning signal that says to MM avoid defensive and yield play stocks.

MM has an initial target over 15% higher for the Commodity Index (CCI).

Equal weighted Commodity Index (CCI) Chart

International Equites Portfolio

We have recently added Bank of America (BAC), Janus Henderson (JHG US) and United Health (UNH US) to our International Portfolio reducing our cash position to 59% : https://www.marketmatters.com.au/new-international-portfolio/

There are a number of stocks / sectors MM is keen to buy to skew this portfolio very much in-line with our economic views into 2020, some close to home and some far away.

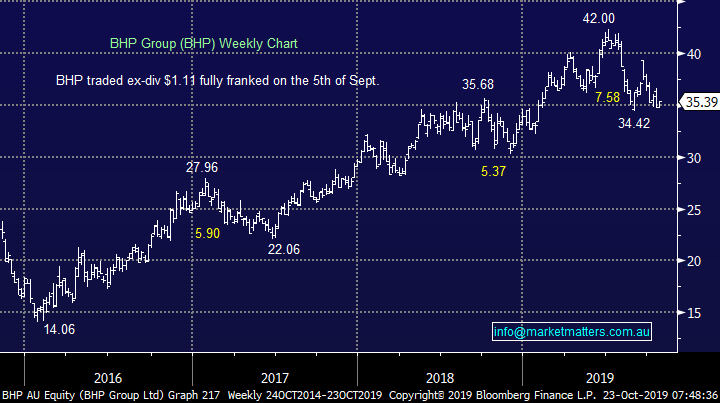

1 – BHP Group (BHP) $35.39 – why get too fancy, BHP is a top international resources business which is only trading on a P/E of 12x for 2020 while it yields 5.8% fully franked, that ticks our boxes.

BHP Group (BHP) Chart

2 – Our favourite banking position to dovetail with our new Bank of America (BAC US) position is JP Morgan (JPM US) where a conservative 5% stop can be adopted. We do ponder long and hard a banking ETF here as well.

US S&P500 Banking Index Chart

Conclusion (s)

Of the 3 stocks / ETF’s MM looked at today we like all 3, especially as we hold a short S&P500 position which is where we see major underperformance moving forward.

MM Global Macro ETF Portfolio

The MM Global Macro Portfolio is in need of tweaking to fully align with our views outlined earlier, expect some action this week. : https://www.marketmatters.com.au/new-global-portfolio/

1 – The same as the International Portfolios we are looking to buy the iShares Emerging Markets ETF (IEM).

iShares Emerging Markets ETF (IEM) Chart

2 – We are especially bullish copper into 2020 with our preferred way of investing around this view is via the Global X Copper Miners ETF (COPX US) at today’s level.

For more information on this ETF go to: https://www.globalxetfs.com/funds/copx/

Global X Copper Miners ETF (COPX US) Chart

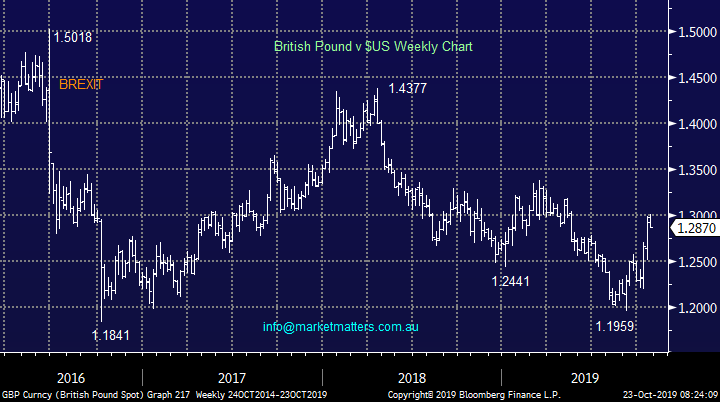

3 – Our thoughts around BREXIT remain positive hence our recent comfort in buying JHG for the International Equities Portfolio, following last night’s pullback after yet more voting in the UK, we like the Pound from a risk / reward perspective.

Our preferred ETF to invest in the Pound is the Invesco ETF: https://www.invesco.com/portal/site/us/investors/etfs/product-detail?productId=FXB

British Pound v $US Chart

4 – Again as discussed previously we are keen on the banking sector into 2020, a sector which enjoys rising margins as interest rates and reflation rise.

Our preferred ETF for global banks’ exposure is the BetaShares Global banks ETF (BNKS) which is listed in Australia and is currency hedged : https://www.betashares.com.au/fund/global-banks-etf-currency-hedged/

MSCI World Bank Index Chart

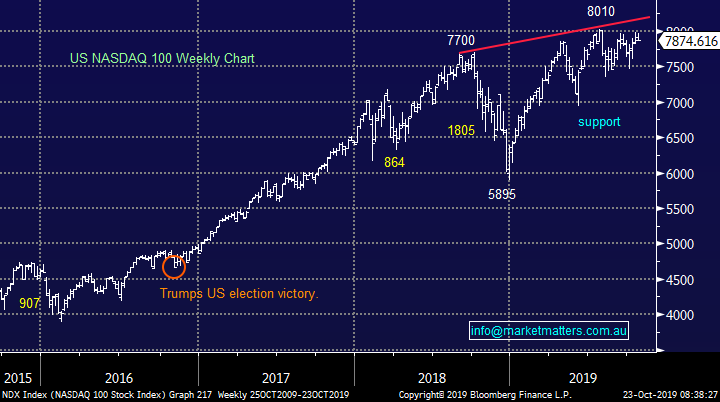

5 – lastly we feel our “anti” growth opinion can be best played through going short the US NASDAQ.

Our preferred ETF for a short exposure to the NASDAQ is the ProShares short QQQ ETF (PSQ US) : https://www.etf.com/PSQ

US NASDAQ Index Chart

Conclusion (s)

Of the 5 ETF’s MM looked at today we like all 5 to “fit” our global macro view on markets.

Watch the pm reports for alerts.

Overnight Market Matters Wrap

· The US equities closed weaker overnight led by the tech. heavy Nasdaq 100 ending its session down 0.83%.

· Netflix was the main driver of the weakness seen in the Nasdaq 100 after Verizon communications announced a partnership with Walt Disney Co., while Facebook sank on anti trust woes and concerns on its business practices.

· On the commodities front, crude oil gained following a report that OPEC and its partnered crude producers discuss deepening supply cuts next month. Nickel rallied nearly 3% on the LME and iron ore rose 1.5% to $US86.68/t after Vale reported another problem at one of its dams.

· The December SPI Futures is indicating the ASX 200 to open with little change this morning, hovering around the 6670 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.