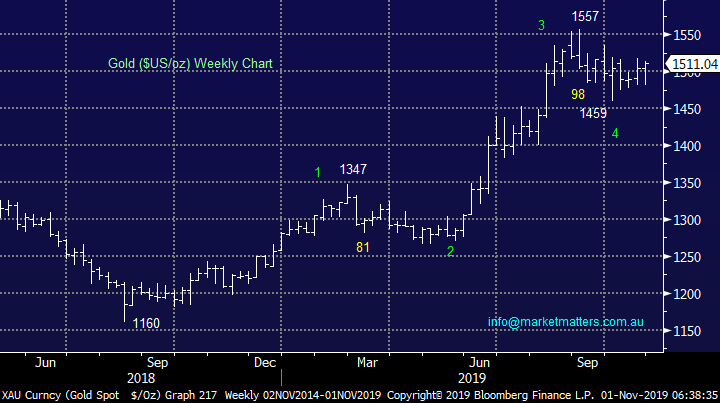

MM – Boris to win BREXIT but trade war volatility will persist (CGC, ANZ)

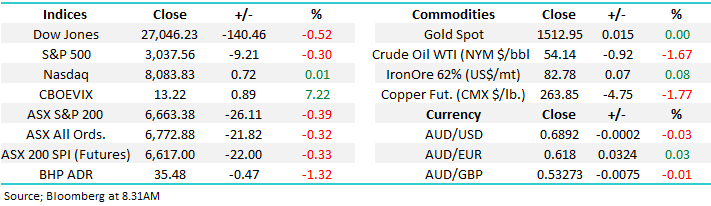

The ASX200 endured another tough day at the office although after being down 50-points at lunchtime a bounce to recoup half of the losses must have been encouraging for the bulls. The banks weighed heavily on the index following ANZ’s poor result which saw the stock fall -3.3%, the sector was dragged down by the result which saw an average decline for the “Big 4” of -1.7%. This was always going to create a huge headwind for the local index when we consider that the banks make up almost a quarter of the ASX200. We actually saw more stocks close up on the day but as we said the banks influence is significant.

Yesterday we stated that “our view at MM is the RBA wont cut rates again until at least a few months into 2020," on the surface the market’s reaction the day after the in-line CPI inflation print agreed with this view as the $A popped above 69c reaching its highest level since late July potentially implying no further cuts by the RBA but we feel the strength in the “little Aussie battler” was fuelled almost entirely by a weak $US. This looked on the money later in the evening as the $A fell following some confrontational comments out of China but the $US didn’t recover after weak manufacturing and employment data in the States.

Overnight China put a huge dampener on stocks when they cast doubt on the possibilities of a long term trade deal with Trump, strange timing as they’re about to sign the “phase 1” agreement – perhaps they have gone short stocks! Importantly Chinese officials have warned they wont budge on a number of key issues. Hong Kong has already slid into recession courtesy of the ongoing riots and trade issues between the world’s largest 2 superpowers. The global economy is walking a tricky path to avoid a recession, a battle which will more than likely go pear shaped if the US & China continue to squabble over trade.

Short-term MM remains bearish the ASX200 targeting the 6600 area – will potentially be tested today.

Overnight global stocks retreated on the weak economic data and comments out of China but all things considered it was a very measured move. Fortunately for the US index major index influencers Apple (AAPL) and Facebook (FB US) both rallied after strong earnings with Apple which resides in our international equities portfolio the standout gaining over 2%. – the tech based NASDAQ even managed to close up on the day when the Dow fell -0.5%. The SPI futures are calling the market to open down around 20-points with the resources likely to be the main causalities early on.

This morning MM has taken another quick look at the macroeconomic picture as it continues to evolve almost daily and of course happy Friday! For the first time in a while it’s actually felt like a long week in markets although no doubt I feel better than the vast majority of kids out there nursing serious chocolate hangovers. Each year it surprises me just how big Halloween has become.

ASX200 Chart

The more I sift through the ANZ result there’s less that it unveils to like! I had a chat this morning with our Analyst in the sector – he’s good, and while the franking cut did not come as a huge surprise to him, it wasn’t baked into his numbers. Equally, the institutional traders we deal with daily that have internal analysts generally did not have a cut to franking priced in, so it was surprise to us and the majority in the market plus of course it was also a weak result.

It’s easy to go back and look across the 3 heavyweight banks who trade ex-dividend this month and conclude they’re all pretty much the same but it doesn’t mean they will remain so – ANZ is now the only one of the “Big 4” not paying a 100% franked dividend and although it’s still at 70% and will likely settle somewhere around the 80% mark next year, it’s easy to foresee the influential retail investor starting to look elsewhere within the sector moving forward.

The announced 80cps dividend from ANZ yesterday is worth $1.14 when fully franked, at 70% franking this equates to $1.04 or a ~9% reduction. As banks are struggling to grow the top line, yield is very important - a ~9% drop in effective yield is meaningful.

MM now prefers WBC & NAB over ANZ – we’ll likely switch

Watch for alerts.

ANZ, Westpac (WBC) and NAB Banks Chart

Yesterday we talked about the phoenix rising from the ashes and ironically the position MM was the most concerned about over the weekend is performing ok having rallied 20% from its initial low on Wednesday morning. While the bounce in Costa Group (CGC) is likely to be aided by the major short position in the stock there does appear to be some legitimate buy side institutional interest coming through – which makes sense with CGC’s largest holders (on the register recently) are value oriented funds like Schroders.

The encouraging factor for CGC is they have to a large degree control over the very issues the hurt the stock in recent times – they produced more blueberries when CGC already had 70% of the market, supply and demand did the rest pushing prices lower i.e. dial down production and prices should rise – sounds like Saudi Arabia and the oil price!

MM can see another 20% upside for CGC at this point in time.

Costa Group (CGC) Chart

Reviewing the macro-economic picture

Following the comments out of China overnight plus the weak US manufacturing / employment data we felt it was an optimum time to review our stance on the bigger global-macroeconomic picture especially as it impacts a number of our positions in the MM Growth Portfolio. Fortunately things are evolving according to the MM script so todays report is more of an update on our thoughts and most importantly plans through November, assuming of course markets don’t deviate from the MM path.

As we’ve alluded to in recent reports we don’t expect the multi-decade old trends, like the current bear market for bond yields / interest rates, to roll over without a fight and after all at this stage we’re just looking for an end to the bond yield declines as opposed to a “V-shaped” recovery – in other words bond yields / interest rates will plateau around current levels until central banks can reignite inflation and this might take years!

The current sabre rattling between the US and China is likely to be ongoing but it should not be underestimated how much they both want and need the same result in the years ahead i.e. neither party wants a full scale trade war.

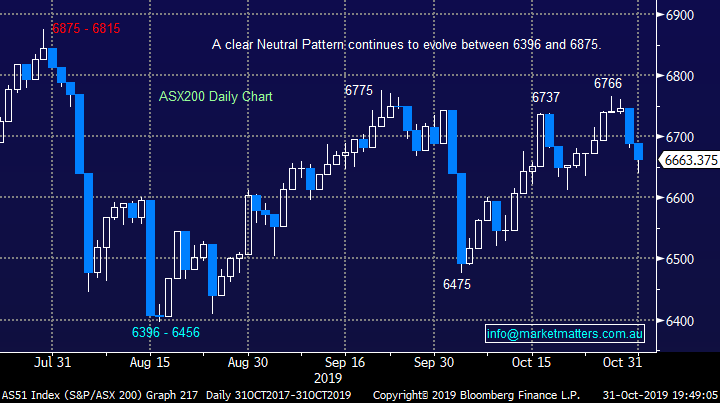

Bond yields / interest rates

The classic “one-two” of bad economic news overnight sent bond yields lower as would be expected. We still anticipate a test and probably break of the 2019 lows for bond yields e.g. the US 10-years will break under 1.44%. Importantly from a stock market perspective this means another period of strength for the yield sensitive stocks like Utilities, Real Estate and gold and conversely weakness in sectors like the banks.

MM expects the influential US 10-year bond yield to rotate between 1.25% and 2.25% through 2020.

US 10-year Bond Yield Chart

Importantly MM believes short-term rotation from the likes of banks into say Utilities and Real Estate is one to fade not embrace. i.e. we are buyers of banks and other stocks / sectors that experience short-term weakness as markets again become concerned around the health of the global economy.

MM likes banks and resources into weakness

US S&P500 Banking Index

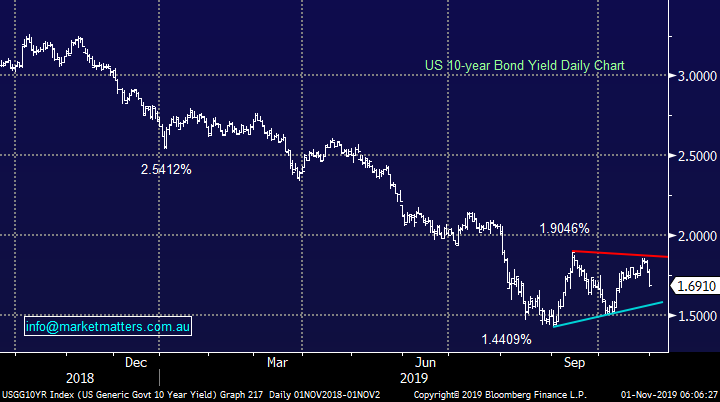

Gold

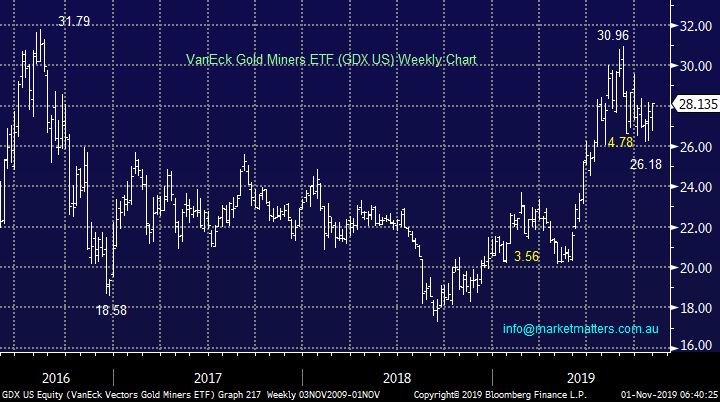

We feel like it’s now or never for gold to challenge $US1600/oz in 2019, the overnight chain of events led to gold rallying almost $US20/oz as it appeared to regain its mojo in the process, suddenly golds only 3% below its 2019 high although the gold miners aren’t convinced, they’re languishing nearer to 10% below their same milestone. The GDX gold miners ETF bounced 2.5% following golds advance which should theoretically see some lift today in MM’s sector exposure via Newcrest (NCM) and Evolution Mining (EVN).

We still feel that the gold price is on target to scale fresh heights in 2019 but the gold stocks at this stage feel likely to struggle to make the same degree of gains.

MM is looking to close our EVN and NCM positions into a bounce, ideally when gold is ~5% higher.

If this move unfolds as expected expect MM to switch our gold position into a more cyclical based exposure.

Gold ($US/oz) Chart

VanEck Gold Miners ETF (GDX US) Chart

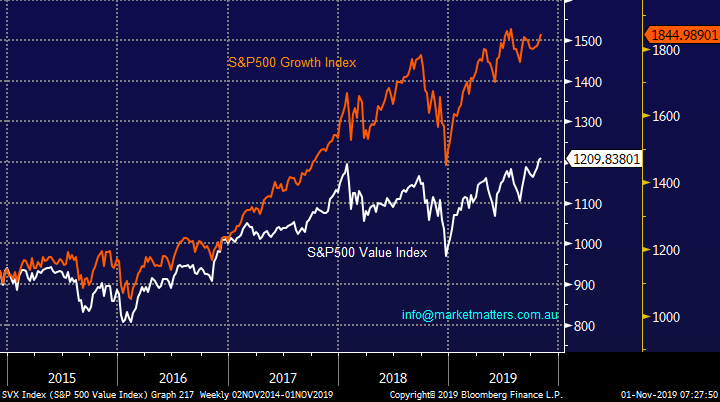

We’re sticking with Value over Growth

We remain comfortable with our view that its time to be rotating from Growth to Value stocks but just like with bond yields significant long-term trends do not fade overnight, they fight kicking and screaming before giving up the ghost.

MM continues to prefer Value over Growth stocks at this stage of the cycle.

S&P500 Growth & Value Indices Chart

BREXIT almost history

At MM we continue to believe Boris Johnson will win the UK election and BREXIT will finally become tomorrows fish and chip paper, although I have a vivid memory of writing this a while ago. If this happens, it will be supportive in the short-term for UK facing stocks like Janus Henderson (JHG) which we hold in the Growth Portfolio. The longer term ramifications for the region is harder to foresee but its in everyone’s interest to make it work so they probably / hopefully will.

MM remains bullish UK facing stocks.

British Pound vs USD (GBP/USD) Chart

Conclusion (s)

MM is expecting a bounce in stocks / sectors that enjoy low interest rates at the expense of cyclical stocks like banks and resources. This is a move we intend to fade in the weeks ahead.

Global Indices

No change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated but major resistance is now less than 1% away reverting us to a neutral stance. However a break back under 3000 is required to switch us to a bearish short-term stance, still over 1% away.

MM is now neutral US stocks.

US S&P500 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

· Looks like we will be starting our Friday with the Australian market opening down. The XJO futures are currently 22 points in the red. We had weak leads from offshore with the DOW down 0.52%, S&P 500 down 0.40% and the NASDAQ being the most resilient of the indices only down 0.14%

· The US markets were rattled by weak manufacturing data and renewed concern on trade. Apple and Facebook both had great results which prevented steeper declines in the indexes. Looks like the trouble in Hong Kong has caused a recession, with the economy contracting in the third quarter, its largest decline since 2009.

· Metals on the LME didn’t have a great night copper bared the brunt of the selloff closing down 1.92%. Nickel was also weak closing down 0.83%. Iron ore was -1.3% to $US85.97 a tonne. Oil was off almost 2% but Gold had a better night with spot gold currently trading at US$1515/oz. AUD/USD cross is currently 68.94c

· Today we have earnings from CSR, MQG and ORI.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.