Does Bingo’s update yesterday imply the Building Sector is set for a recovery? (RIO, BIN, BLD, CSR, FBU, BKW, JHX, ABC)

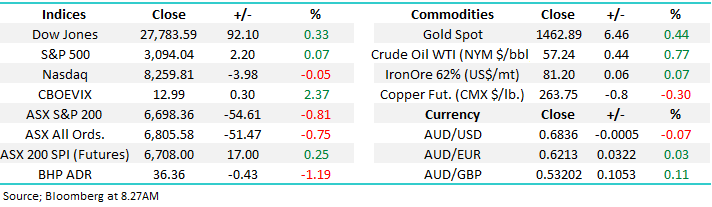

The ASX200 continues to rotate with the traders who sell strength and buy weakness having a field day - a game for the brave who have psychological metal to go against the markets short-term mood. The selling on Wednesday was steady throughout the day as opposed to aggressive at any point in time, we actually reached our highest level since early August on Tuesday only for the sellers to step back in yesterday, now a pullback towards 6600 wouldn’t surprise. MM will simply focus on stocks and sectors until further notice as the index has no clear direction.

Under-the-hood 10 out of the 11 sectors closed in the red with the Financials and Utilities the worst of a bad bunch, the one glimmer of optimism was from the IT sector where we saw Appen Ltd (APX) the best performer rallying almost 6%. We’re not keen on the IT end of town into 2020 but recently a number of stocks in the sector have endured large corrections and the risk / reward into Christmas is looking interesting – MM may consider a cheeky short-term opportunity in the likes of Appen (APX) or Altium (ALU).

Another sector which caught our eye amongst the selling yesterday was the iron ore stocks who as a bunch underperformed the ASX with Fortescue (FMG) -2.1%, RIO Tinto (RIO) -1.7%, BHP Group (BHP) –0.8% but interestingly the bulk commodity managed to rally +1.2% - it feels to us that the gloss has gone off the group for now and we wouldn’t be surprised to see further declines in the coming weeks. After taking a good profit on our FMG position earlier in the week MM is hoping for lower levels from these 3 to” beef up” our net exposure.

Short-term MM remains neutral the ASX200 with an upside bias.

Overnight global stocks were again firm with the Dow up 100-points at 7.30am, the SPI is calling the ASX to open up ~20-points but again the resources look vulnerable with BHP marked down over 1% in the US.

This morning MM has revisited at the Australian Building Sector following positive news from Bingo yesterday as they offered more upbeat guidance at their AGM which sent its stock soaring and appeared to help stocks like Boral (BLD) and CSR Ltd (CSR) rally on a weak day.

ASX200 Chart

The social unrest in Hong Kong unfortunately appears to be gathering momentum with some horrendous scenes being shown on social media. Not surprisingly a very different story is being reported in China with fears growing daily around what comes next.

Technically we can easily see fresh 2019 lows, around 10% lower which may just coincide with an excellent buyer opportunity into China influenced stocks / sectors e.g. the resources.

The Hang Seng is threatening to unravel 10% from current levels.

Hang Seng Index Chart

Interestingly the chart pattern for RIO Tinto (RIO) is very similar to the embattled index in 2019, if the Hang Seng does test fresh 2019 lows then we should be prepared for RIO to test sub $80 – we are happy to have the Fortescue (FMG) in the bank for now.

MM intends to remain patient before adding to our resources position.

RIO Tinto (RIO) Chart

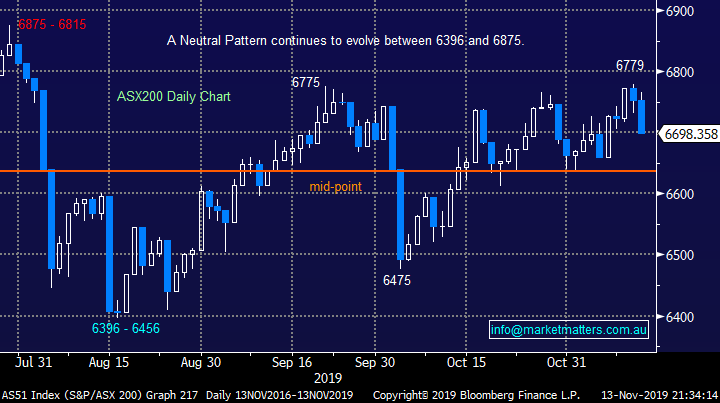

US bond yields are threatening to generate important sell signals by cracking clearly below the important 1.9% area. Our opinion is if they fail at current levels, we will see strong rotation back from the likes of resources into defensives, a move that equities appear to have pre-empted over the last few days. Further escalation in Hong Kong tensions & / or some hiccups with US – China trade may be the catalyst to set these wheels in full motion.

In the US overnight we saw Real Estate and Utilities lead the gains rallying over 1% while Financials and Resources all declined – on balance we believe this has further to unfold before providing an excellent reversion opportunity.

MM expects the defensives to benefit if US bond yields take another leg lower.

US 10-year Bond Yields Chart

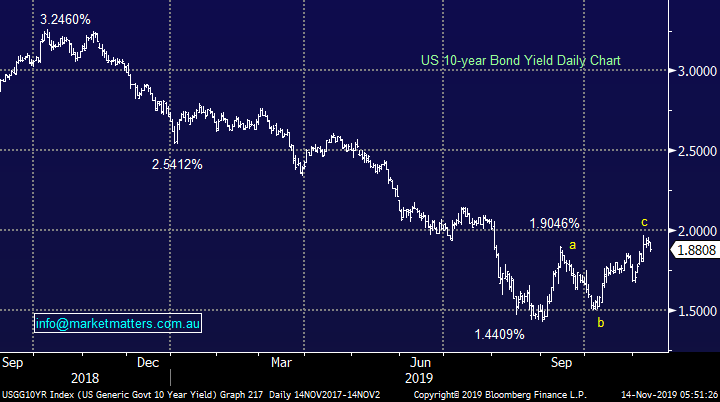

Did Bingo (BIN) give a clue for the Building Sector?

Yesterday at Bingo’s much anticipated AGM we saw no negative surprises, a big positive in today’s environment e.g. residential volumes were “soft” but within expectations. As I mentioned BIN has 10% of the company sold short because of the belief that amongst other things weakness in residential construction will hurt the waste management and recycling business, clearly not on the money at present.

I would definitely not want to be sitting on a large short position in BIN but after the stocks impressive rally yesterday today I look at if better risk / reward opportunities lie with the building related stocks as opposed to the already recovered BIN.

Today I have briefly revisited 5 major building stocks all of whom outperformed the market yesterday.

Bingo Industries (BIN) Chart

1 Boral Ltd (BLD) $4.98

Building products business BLD is trading on a conservative Est P/E for 2020 of 14.3x while its forecasted yield is a healthy 5.5% part franked. Even in a tough 2019 financial year the company managed to deliver 4% growth in sales suggesting it’s on a solid footing when the industry picks up – some fiscal stimulus would be an ideal catalyst. As the business enjoys solid positive cash flow, we perceive it to be an excellent turnaround story when the residential housing headwind diminishes.

MM owns BLD in its Growth Portfolio looking for ~10% further upside.

MM is bullish BLD initially targeting the $5.50 area.

Boral (BLD) Chart

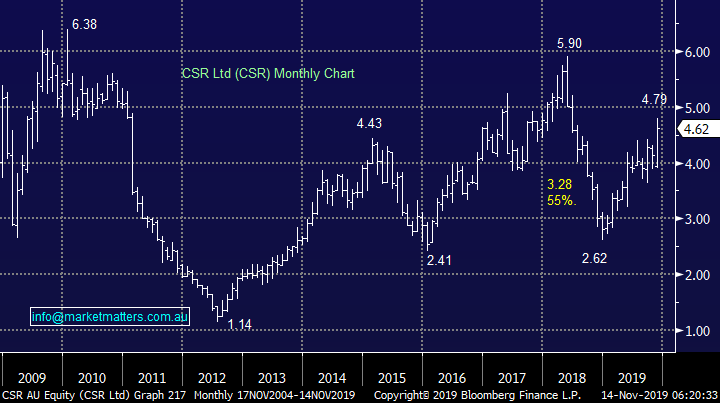

2 CSR Ltd (CSR) $4.62

Sydney based CSR manufactures the likes of plasterboard, glass, fibre cement, bricks and roof tiles for the commercial and residential market, a recently tough environment which the business has negotiated admirably. The shares are now trading on an Est P/E for 2020 of 18.3x while it generates an estimated ~6% part franked yield.

This week MM took a nice 46% profit from CSR for our Income Portfolio, a tough yield to walk away from but we feel at this stage the share price has got a touch ahead of itself, especially following rumours of a potential takeover by GFG Alliance. We remain buyers of cyclicals into weakness and sellers of strength hence we still might again pop up on the register in the year ahead.

We took advantage of the large short position in CSR when the needle moved a characteristic MM is always on the lookout for – just like BIN!

MM is now neutral CSR.

CSR Ltd (CSR) Chart

3 Fletcher Building (FBU) $4.82

FBU has struggled compared to both the market and its peers over the last 3-years but potentially some value is finally emerging with the shares trading on an Est P/E for 2020 of 14.2x while the NZ based building stock is paying a projected 5.8% unfranked yield.

They generate more than +60% of their earnings from New Zealand who yesterday surprised the market by keeping interest rates unchanged – a cut of 25bp had been forecast. This implies the central bank has started to see some green shoots in the economy following the 50bp cut to rates in August.

Unfortunately, the short position is small so no forced buying to support the stock is likely.

MM is neutral / positive FBU.

Fletcher Building (FBU) Chart

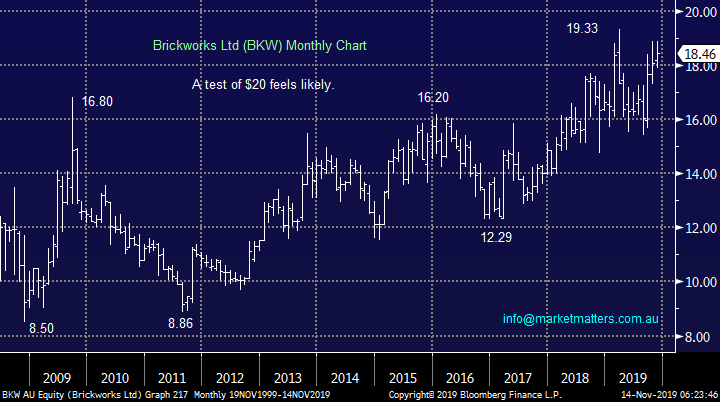

4 Brickworks (BKW) $18.46

BKW has shrugged off sector weakness and it delivered a record full year profit in September; it actually remains a growth story with the US its current focus - businesses who perform in a space where many have their backs against the wall should be admired. However, its often a volatile stock and one where we don’t feel chasing strength offers exciting risk / reward, that boring cliché.

MM likes BKW but cannot see us buying the brick maker in 2020 after its recent run. We touched on SOL earlier in the week, BKW’s largest shareholder, perhaps a better way to play this theme.

MM remains bullish BKW targeting 8-10% upside.

Brickworks (BKW) Chart

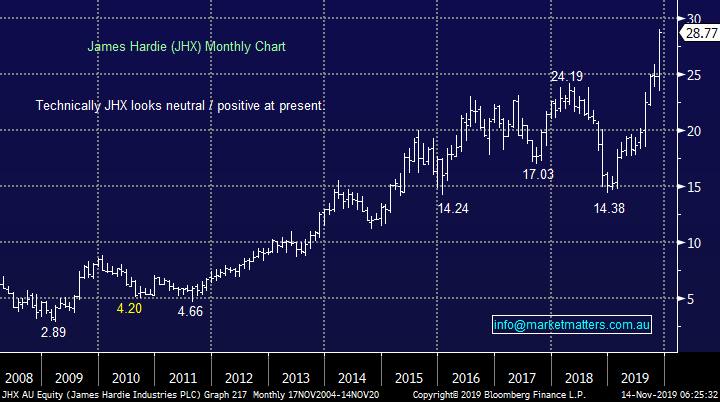

5 James Hardie (JHX) $28.77

JHX has even outperformed BKW over recent years illustrating there can be diamonds in rough sectors although a 40% correction in 2018 would have tested many investors resolve. The company has continued to deliver big increases earnings, their last ¼’ly profit was up 22% on the previous year plus they are delivering increasing margins, an exciting combination.

Its hard to find enticing risk / reward at present but we will be watching pullbacks moving forward as the business is ticking all the right boxes.

MM is bullish JHX with stops under $25.90.

James Hardie (JHX) Chart

6 Adelaide Brighton (ABC) $3.25

Lastly ABC which caused us some angst this year as we tried to pick a bottom in a hugely out of favour stock. After their latest downgrade we are more comfortable being observers for now.

MM is neutral ABC.

Adelaide Brighton (ABC) Chart

Conclusion (s)

MM is happy with our BLD exposure at this point in time and while we like cyclicals moving into 2020 interestingly none of the other 5 stocks, we looked at today having us chomping at the bit to buy / accumulate just yet.

We will consider into a pullback if the risk off theme gathers momentum with CSR, BKW and JHX are preferred stocks.

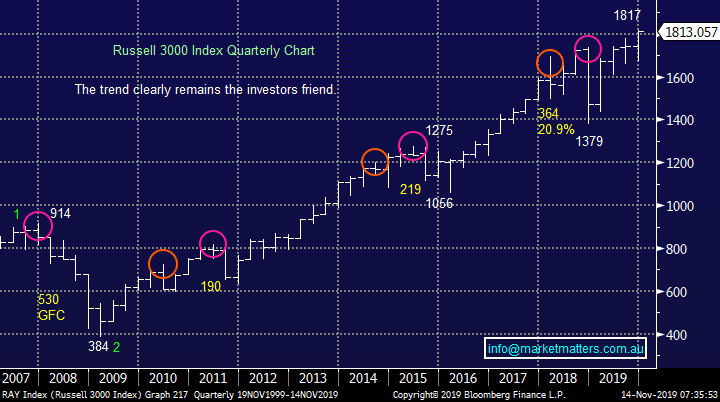

Global Indices

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 1750 for the Russell 3000 is required to switch us to a bearish short-term stance.

MM is now neutral / positive US stocks.

US Russell 3000 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~10% higher looking realistic.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US equity markets set new records once again overnight, shrugging off reports that the US-China trade talks still face a number of hurdles.

- A mixed session on the commodities front, with oil and gold edging higher, while base metals edged lower

- BHP is expected to continue its underperformance, after ending its US session off an equivalent of 1.19% from Australia’s previous close and currently off 1.37% for the week.

- The December SPI Futures is indicating the ASX 200 to open marginally higher, above the 6700 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.