Looking inside next year’s US election (WBC, CBA, BOQ, TNE, SSM)

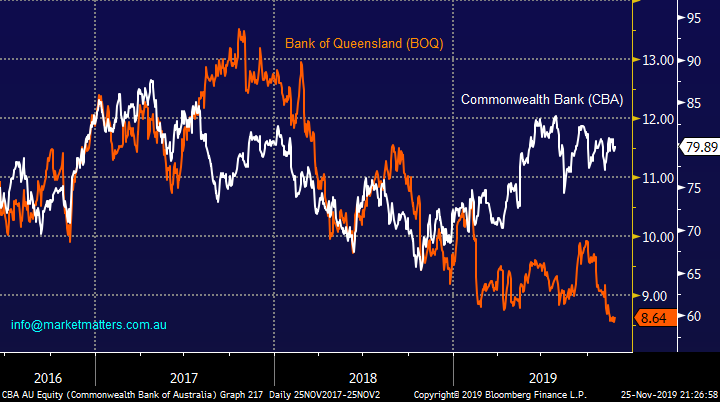

The ASX200 enjoyed a nice bump to start the last week of November, it’s now only a month until Christmas and counting – the tree has even gone up at home (yes, I know a week early but why not!). Yesterday’s 22-point rally was aided by some strong performances from the likes of BHP Group (BHP) and RIO Tinto (RIO) while the banks continued to weigh on the index after the Bank of Queensland’s (BOQ) announced a $275m capital raise at a ~11% discount to Fridays close – the sector is certainly on the nose this month! On the stock level losers actually nudged the winners but the strong performance by the heavyweight resources was enough to pick up the slack.

Local stocks were also supported by a combination of strong US futures and Asian Indices – as expected equities embraced Chinas decision to increase penalties on Intellectual Property (IP) theft, a big step towards a US – China trade resolution. MM anticipates a satisfactory agreement between the world’s two economic superpowers which if yesterday was anything to go on should be supportive of our region. After all Trump has an election to win next year and bickering with Xi Jinping is unlikely to be a vote grabber in 2020.

While yesterday was mainly about “risk on” the defensives / classic yield play stocks didn’t particularly experience much selling, if our banks could vaguely match the performance from their US counterparts the ASX200 would undoubtedly be knocking on the 7000 door but while Trump has deregulated the US banks the Australian sector has been hammered by the likes of a Banking Royal Commission, APRA and now AUSTRAC – one very good reason for MM to start focusing on the US election.

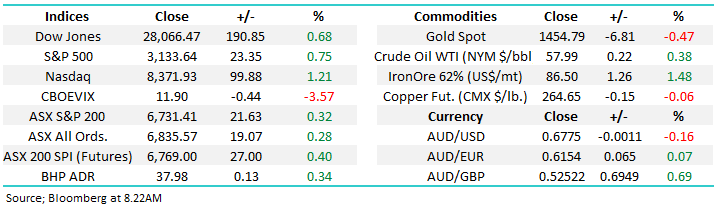

Short-term MM remains neutral the ASX200 with an upside bias.

Overnight global stocks were again strong with the S&P500 making new all-time highs, up +0.66%, futures are pointing to a 30-point gain for the ASX200. Thursday is Thanksgiving in the US and Friday a half day hence traders are likely to “square up” over the next few days, a net positive in our opinion.

This morning MM has commenced its evaluation / commentary of the both fascinating and critical for equities looming US election, now around 11-months away.

ASX200 Chart

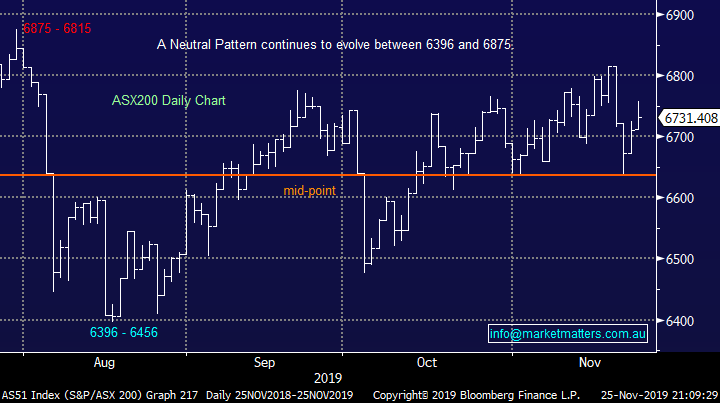

Subscribers who want to see the pain our Banking Sector has experienced compared to the US only have to look at the below chart – the Australian Banking Sector is down ~25% since 2015 while the US has rallied ~50%.

As we alluded to earlier the huge performance differential is primarily around regulatory issues but as AUSTRAC smashes Westpac (WBC) we must stand back and question whether things are reaching an extreme – Australian banks have undoubtedly let down their public on numerous levels but looking forward have they now passed through the eye of the storm?

US S&P500 & ASX200 banking Sector Chart

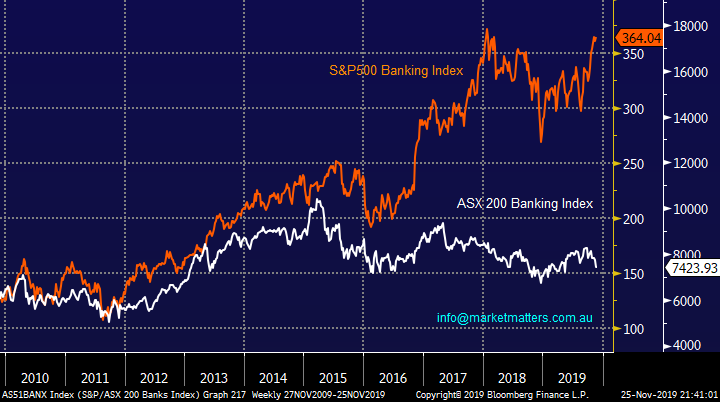

Today I thought it might be simpler to look at the topical Westpac (WBC) and the Bank of Queensland (BOQ) separately:

1 Westpac (WBC) $24.44 – MM will not consider averaging our WBC position at this stage, and would only have interest up weighting if the stock fell to the $22 area where the bank will be yielding well over 7% fully franked.

**This morning we have just seen sweeping changes through Westpac management and at Board level – The CEO Brian Hartzer has resigned, The Chairman will go in early 2020 and long-standing Director Ewen Crouch will not stand for re-election. This does not come as a surprise. The current CFO Peter King will take over as interim CEO while a global search takes place**

2 Bank of Queensland (BOQ), best guess is a reopen ~$7.70 – no change, it would be easy to say sell CBA and buy BOQ but to MM the regional banks are in the worst position in terms of funding a higher regulatory burden going forward.

Westpac (WBC) Chart

Commonwealth Bank (CBA) & Bank of Queensland (BOQ) Chart

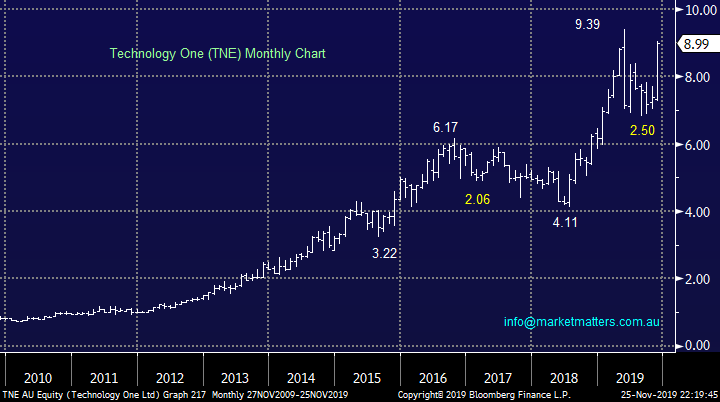

Last night UBS were trying to place 8 million Technology One (TNE) shares at $8.50 as 2 directors look to reduce their exposure into this month’s strength. Last week the shares surged after the release of its full year result which demonstrated strong 13% growth of revenue to $286m.

At MM we never enjoy directors selling their own stock, we are now neutral TNE.

Hence if the shares fall ~5% tomorrow, as expected, we will sit back and observe.

Technology One (TNE) Chart

An unfortunate but perfect example of what can unfold when directors sell stock was illustrated by one of our holdings, Service Stream (SSM) yesterday. We bought SSM last month only for it to drop following its AGM, the sale of 1 million shares by MD Leigh Mackender the reason. It’s never great news seeing insider selling in a stock but it’s not always bad news, in the case of SSM the companies financials and outlook appear solid but investors are like elephants when it comes to directors selling – they take a long time to forget.

MM remains cautiously bullish SSM.

Service Stream (SSM) Chart

Delving into the US Election

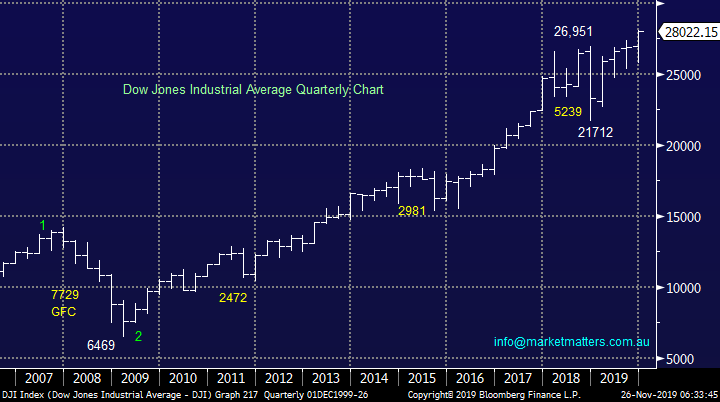

On November 3rd, 2020 we will learn if Donald Trump has pulled off the double whammy and retained the White House for a 2nd term, who would have thought it possible back in 2016. Since that memorable day when stocks initially plunged as it became apparent that Trump was winning the election the S&P500 has soared around 50% in just 3-years illustrating the power of some huge stock market tailwinds like tax cuts, deregulation and of course historically low interest rates. If Trump wins I cannot see equities matching the last 3-years when he looks to have already fired the policy bazooka’s but his direction has clearly been pro-markets.

However, there’s clearly a lot of water to go under the bridge in the next 11-months, the odds of the main candidates today are:

Trump $2.30, Joe Biden $7.00, Elizabeth Warren $8.00, Bernie Sanders $10.00 and Michael Blomberg $13.

Clearly at this stage the incumbent President is the strong favourite but until the Democrats distil their significant volume of candidates down to one this is inevitable. In today’s report we will try to succinctly illustrate the implications of different parties / candidates winning next year.

US S&P500 Index Chart

1 Republican -Trump

Historically the US market performs well in the year when a first term President is up for re-election although on average the best year is their 3rd year, in Trumps case the one just finished. The year leading up to the election is usually below average for equities, but they still rally 87% of the time running into the election, clearly a bullish number.

Donald Trump’s path to re-election revolves around economic strength and asset prices, essentially playing on voters’ self-interest rather than on any big-ticket social policy – it reminds me of the saying, if you find a horse called self-interest, back it!

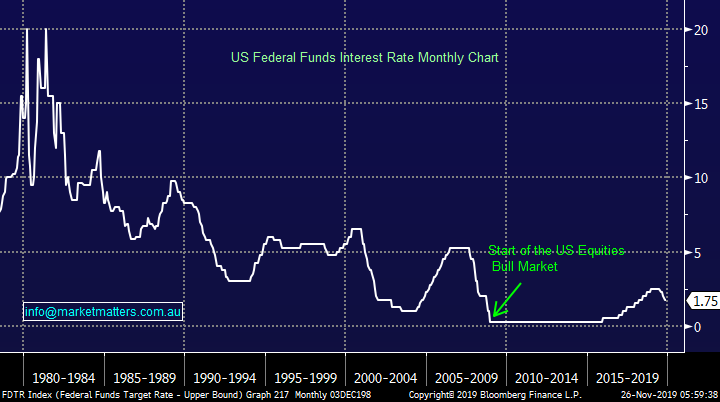

When thinking about Trumps potential strategy for re-election, the path seems to be fairly straight forward – although I say that with some trepidation given Trump & straight forward seem like polar opposites. Apply maximum pressure on the US Federal Reserve to cut interest rates, to date he’s managed to extract 3 cuts from Jay Powell and Co, more next year would help his cause. The next catalyst is a trade deal - he needs to complete a trade deal with China providing enough time for it to have positive ramifications on economic indicators.

Targeted domestic spending programs would likely follow, the military typically get a good run here. By this time, economic activity will have bounced back thanks to an improved global trading environment, he’ll be able to point to strong growth figures (coming off a low base), interest rates will still be low, hopefully lower than where they are today if he gets his way, employment strong thanks to an increase in government spending and ultimately, this should coincide with a strong stock market. He will be very mindful that no US President has been re-elected during a recession hence I cannot imagine even his ego would attempt a re-election campaign during a US – China “trade war” which would in all probability result in the big “R” word.

The US Official interest rate is sitting at 1.75%, well above our own and especially those in Europe. A cut by the ‘independent’ Fed next year would undoubtedly be a nice shot in the arm for Trumps campaign. He’s certainly been very vocal about rates being too high in the US, leading to a higher $US making the country less competitive, not as daft as some of his tweets / comments. We believe the gap between global interest rates and those in the US has probably peaked but whether he can put enough pressure on the Fed to get cuts in an election year is certainly open for debate.

Hence our simple conclusion is equities should enjoy an ongoing tailwind while Trump looks likely to be positioned to return to the Whitehouse.

MM is net bullish equities while Trump looks likely to win next year.

US Fed Funds Rate Chart

2 Democrat – Joe Biden

Joe Biden is probably best described as the neutral of the three leading candidates although if stocks are still trading around current levels into the election a win for this moderate Democrat in our opinion is still likely to be market negative. However, a recent survey of US investors not surprisingly has this candidate as the most market friendly Democrat candidate that could take office.

Between February and June, the Democrat’s will pick their candidate to take on President Trump through a number of votes across the whole of the US, we believe if this current favourite gets up the market’s reaction will be fairly muted at the time. I would normally say that polling leading into the election will be a lot more important than the Democrats decision on their candidate however we’re going into an election where the credibility of the pollsters is at record lows, much like the rating agencies post the GFC!

Focussing on Biden’s polices, the majority are more socially focused:

From a markets perspective he advocates raising the minimum wage to $15 /hour, he is a supporter of nuclear power, he would end new oil & gas drilling on federal land, reduce carbon emissions, boost defence spending, increase capital gains tax, increase corporate tax, drop tariffs to pressure countries and Medicare for all. Clearly very different to Trump, reminding me of Obama, but that’s Democrat’s policies.

The most notable is around oil and gas drilling. If US energy production is reduced this could put upward pressure on energy prices which is ultimately inflationary. Inflation above 2% for sustained periods should see interest rates go higher – a clear negative headwind for the market although there would be a big legal stoush to actually get this policy enacted.

More detail can be found here: https://www.politico.com/2020-election/candidates-views-on-the-issues/joe-biden/

3 Democrat – Elizabeth Warren

Ex-Republican Elizabeth Warren is the undoubted “canary in the coal mine” with her Democratic policies coming in very much at an extreme with some huge social plans:

In Healthcare, her policy is Medicare for all including limiting profitability for insurance companies and government run pharmaceutical operations to drop drug prices – some huge ramifications for global health stocks. The wealthy are also in the cross hairs (which is fairly typical) with the introduction of a billionaire’s tax to fund her social ideas, likely to appeal to the masses but the rich are historically brilliant at avoiding tax! It amounts to $US20.5 trillion tax on the ultra-rich but there are no plans to raise taxes on the middle class. This is unlikely to work given capital flows & investment will go elsewhere however a clear negative for the economy and stocks none-the-less.

She also advocates breaking up big tech, which although is less likely to be a short term negative for them, it may actually be a positive for some, the longer term ramifications around data sharing and leverage across platforms could have implications for the returns of those businesses, while in the banking space, she would reregulate banks, a massive turnaround on Trumps policies that would probably weigh heavily on the sector.

More detail can be found here:https://www.politico.com/2020-election/candidates-views-on-the-issues/elizabeth-warren/

If Elizabeth Warren is the Democratic Candidate, I doubt she will beat Trump. The one caveat to that is if Trump takes somebody blows during impeachment proceedings. If Warren gets the nomination the market’s reaction to any impeachment ‘landmines’ will be a clear negative one – and a lot of volatility would play out.

Further still, if she was to win the race to the Whitehouse, we can see at least a 20% correction for US stocks i.e. eradicating all of 2019’s gains.

Dow Jones Industrial Average Chart

Conclusion (s)

A Trump victory should be supportive of stocks whereas Biden is more neutral but Elizabeth Warren would be very negative in our opinion - time to watch the popularity tape.

At MM we believe Trump will be re-elected but the polls have thrown up some huge surprises in the last few years hence investors should be prepared for different eventualities as outlined above

Global Indices

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 8000 for the tech-based NASDAQ is required to switch us to a bearish short-term stance.

MM is now neutral / positive US stocks.

US NASDAQ Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~8% higher looking realistic.

German DAX Chart

Overnight Market Matters Wrap

· The US equities started the week on a positive note as investors welcomed the comments from US National Security advisor Robert O’Brien that a phase one US-China trade deal could still happen before the end of the year, along with moves by China to raise penalties for companies violating US intellectual property rules.

· Iron ore once again led the commodities market, hitting US$90/tonne for the first time in over a month, base metals were also broadly firmer led by copper, while gold eased back to US$1454.79/oz.

· Locally, changes were made in the Westpac (WBC) team, with both the CEO and Chairman stepping down following the money-laundering scandal. – we expect a short-term uplift in this name and across the big four banks in general.

- The December SPI Futures is indicating the ASX 200 to open 36 points higher, testing the 6770 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.