Do we like the 5 standout performers into 2020? (A2M, BPT, AVH, PNV, FMG, APT, JIN)

The ASX200 firmed yesterday but it was a relatively lacklustre performance considering the Dow rallied more than 300-points on Friday night. Sector rotation was the main game as we saw 5 of the major 11 sectors close down on the day while the Resources and Energy Sectors lead the gains which is a thematic MM believes will unfold further in 2020 – time will tell if we are right but rotation definitely seems likely to persist for months to come.

We continue to believe, as do many market players, bond yields are the key for stock, sector and market performance in 2020, below is a brief 10-minute video on a few topical issues into next year including sector preferences around bond yields:

Market Matters Video – James Gerrish & Harrison Watt – Click here

As everyone is aware its December and a Christmas rally is expected by many, we reiterate our early message to the bulls - be patient, the last 7-10 days are usually the strongest part of the month as Fund Managers appear to “go on strike” with their sell fingers i.e. why would anyone make their returns look poorer than need be. Hence a few choppy fairly quiet days this week would not surprise MM.

MM is bullish the ASX200 while it can hold above 6650.

Overnight global markets drifted lower with the Dow closing down almost -0.4% and the SPI futures pointing to an early 15-point drop while BHP rallied 20c in the US implying another strong day for our resource stocks.

Interestingly North Korea calling President Trump a “Heedless and erratic old man” was basically ignored, a while ago it would have sent stocks plunging lower illustrating how markets change their focus, today it’s all about trade – in our opinion trade will see a short-term resolution but medium / longer term the risks of de-globalisation are rising, something not yet being considered by markets.

Today we have looked at 5 standout performing companies of the last 12-months as the stocks would be prime candidates for fund managers to refrain from selling, to ensure preservation of performance and in some cases their bonuses.

ASX200 Index Chart

Yesterday a2 Milk (A2M) was sold-off almost 4% on the news that CEO Jayne Hrdlicka had resigned / been pushed from the board. In our opinion this a clear case of simple risk / reward, the stocks trading on an Est. P/E of over 30x for 2020 which leaves little room for error while many would quote “there’s no smoke without fire“ with regard to the disruption at management level for A2M - for MM its easy if in doubt stay out of a2 Milk.

MM is neutral A2M at present.

A2 Milk Co Ltd (A2M) Chart

The best performing stock yesterday was Beach Petroleum which we believe is excellently positioned for an end of year run at $3, not great risk / reward but encouraging for our BHP Group (BHP) position.

MM is bullish BPT targeting fresh highs.

Beach Energy Ltd (BPT) Chart

Overnight copper rallied another +1.25% taking it to its highest level since mid-July, we are looking for at least another 10% upside.

MM remains bullish Copper.

Copper Futures ($US/lb) Chart

Today we have looked at the top 5 performers in the ASX200 ranked in order with the exception of number 5 where we have considered Jumbo Interactive (JIN) as opposed to Silver Lake Resources (SLR) using a little poetic licence around the 1% difference in relative performance. Most of these names have probably slipped under the radar of most Australian investors.

1 Avita Medical (AVH) 57c

Biotech AVH has soared over +600% over the last year taking the companies market cap up to $1.2bn. The global regenerative stock has enjoyed strong sales growth of its RECELL system which received US FDA approval last year – in simple terms a skin samples the size of your mobile phone can be used to treat the whole torso for major burns.

Sales growth has been huge allowing the company to raise $120m from institutions to fund expansion at 59c a share, slightly higher than yesterdays close. Their product is clearly excellent, the main query is around what’s the business worth, a very tricky question to answer in our opinion at the stage of the company’s evolution hence we would be using technicals to quantify risk / reward.

MM likes AVH as an aggressive play ~56c with stops below 50c.

Avita Medical (AVH) Chart

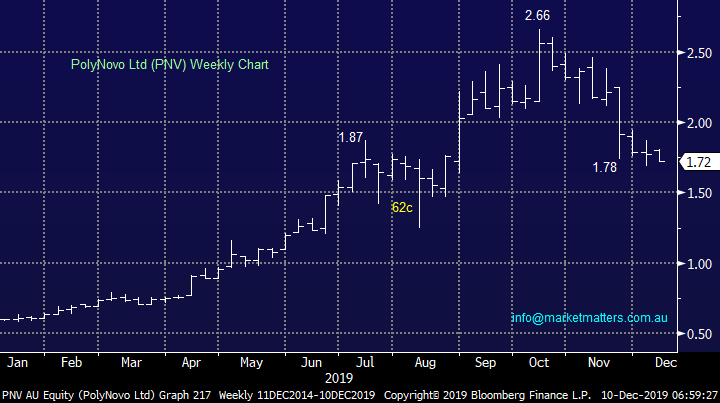

2 PolyNovo Ltd (PNV) $1.72

Another biotech stock PNV which has rallied almost 200% over the last 12-months although it’s now corrected 35% from its October high taking its market cap back towards $1.1bn. This is another wonderful Australian company that has pioneered burns treatment. Sales were over $9m in FY 2019 up more than 4x during the year, although clearly a small umber relative to its market cap. At its recent AGM the Chairman refrained from making forecasts moving forward, not ideal in our opinion however tricky the task.

We are confident the business will again grow strongly this year, but again does it make the business worth well over $1bn?

MM is neutral PNV at present.

PolyNovo Ltd (PNV) Chart

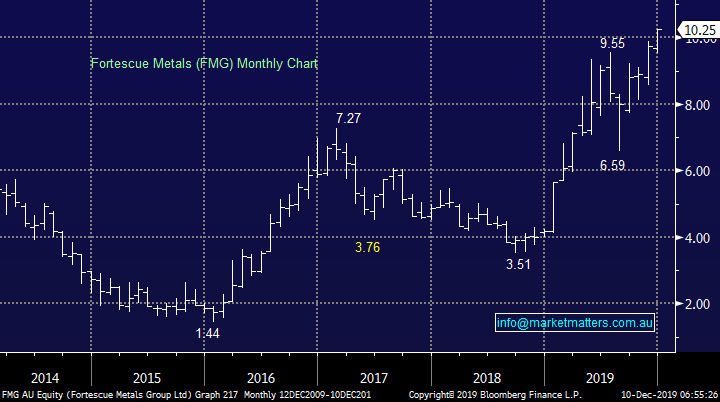

3 Fortescue Metals (FMG) $10.25

Iron ore miner FMG need no introduction and its roared up +175% over the last 12-months, while also paying some healthy dividends. To put things in perspective its trounced market darling CSL by well over 3x, fortunately MM has enjoyed a nice chunk of the gains although this morning its feeling like we got off the train too soon.

The miner continues to shrug off a relatively lacklustre iron ore price in 2019 which has surprised us but it’s a great sign of the underlying strength of the stock moving into 2020 – we are looking to re-enter FMG probably now at higher levels than we recently sold but remember ego is not the friend of the successful investor.

MM is bullish FMG looking for entry opportunities.

Fortescue Metals (FMG) Chart

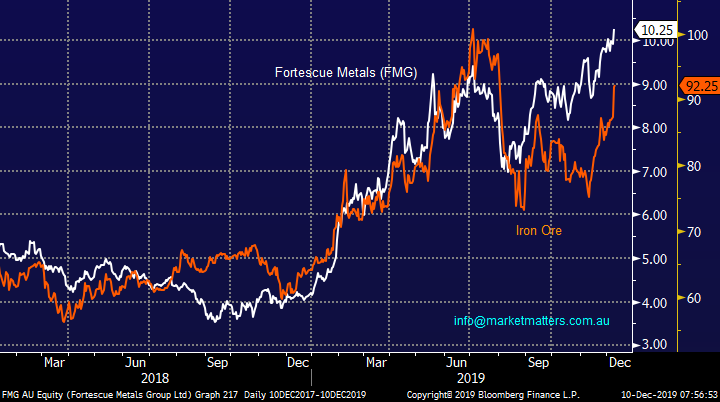

FMG didn’t correct with the iron ore price this year, time to remember one of MM’s favourite sayings “A stock that doesn’t fall on bad news is a strong stock”.

Fortescue Metals (FMG) v Iron Ore Chart

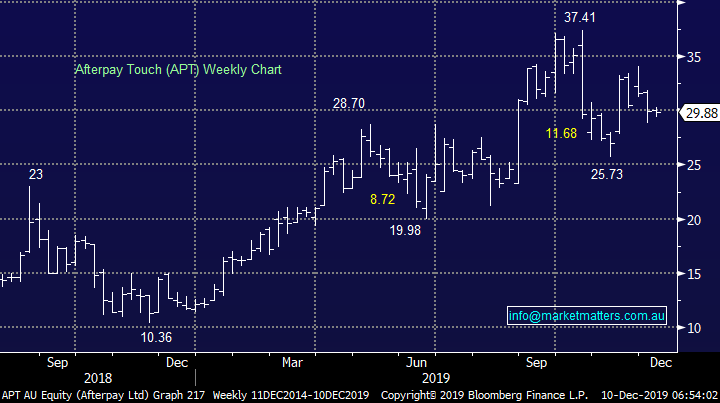

4 Afterpay Touch (APT) $29.88

Buy now pay later business APT is up almost +150% over the last year putting it in 4th place on the performance table even though its 20% below its years high. We’ve been concerned around the competition and regulatory issues moving forward but APT have certainly kept delivering.

The stock is trading on a huge multiple which has taken the companies valuation over $7.7bn, clearly a huge success story of the last 2-years. Technically we can buy APT with stops below $27.80, or 7% risk looking for a Christmas rally.

MM is neutral / bullish APT.

Afterpay Touch (APT) Chart

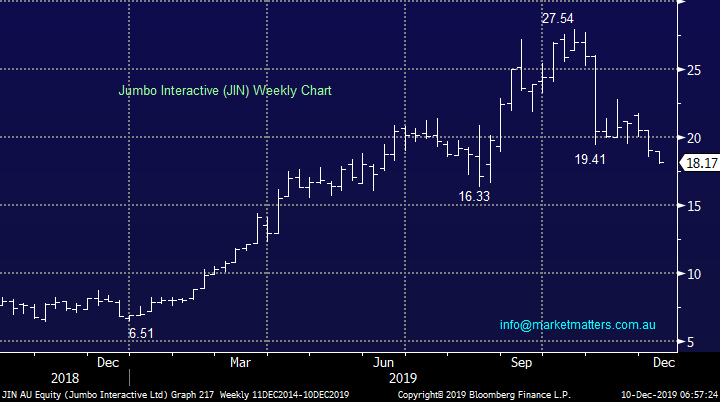

5 Jumbo Interactive (JIN) $18.17

e-commerce and on-line lotteries business JIN have rallied almost +130% over the last 12-months although like 4 of the 5 in today’s list it has pulled back from its 2019 highs, in this case well over 30%. The stock previously rallied hard on the news it had entered the UK’s on-line lottery market via the 3-million-pound acquisition of UK merchant Gatherwell.

The stocks Est P/E of 32.2x for 2020 and yield of 2.45% fully franked is attractive for a growth stock.

JIN is interesting into current weakness although it’s hard to quantify the risk / reward here.

Jumbo Interactive (JIN) Chart

Conclusion

Surprisingly not one of the 5 stocks are clear obvious buys for a Christmas rally but as a group we feel there’s a very good chance they will outperform into January, especially as 4 have corrected significantly over recent months.

Overnight Market Matters Wrap

- A quiet session in the US saw equities start the week on a soft note as investors stayed alert ahead of a busy week of catalysts, particularly the US-China trade deadline.

- Crude oil lost some ground, off 0.37% and the most in a week despite still trading at higher levels, while gold was little changed.

- Data to watch this week includes:

- Today – China inflation data

- Wednesday – US rate decision (no change expected)

- Thursday – ECB rate decision and UK election

- The December SPI Futures is indicating the ASX 200 to open 15 points lower, testing the 6715 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.