Britain goes to the polls, how will it affect the ASX? (S32, EML, PDL, IRE, JHG, XRO, SGM)

The ASX200 roared back to life yesterday afternoon following a choppy lacklustre morning, the positive close up +45-points felt like a Christmas rally had commenced. The buying was fairly broad-based with winners outnumbering losers 2:1 while on the sector level only the IT stocks were a drag on the index. Overnight in the US the resources were the strongest sector while Real Estate fell almost -1%, an almost +1% rally in copper is likely to support the local miners again today.

If a classic “Santa Rally” has commenced the local index should shake off the likely early weakness this morning and close higher, the perfect test in our opinion.

The Poms go to the polls when they wake up and we might see some major overnight volatility if Jeremy Corbin looks in with a chance of a surprise Labor victory – the bookmakers odds show the UK and European markets are discounting any real chance that the almost communist UK Labor Party will come into power. Remember back in November 2016, the ASX200 swung madly in a huge 5% range as results showed Trump was set to become US President, never say never!

MM believes the ASX200 will again test 6900 this month.

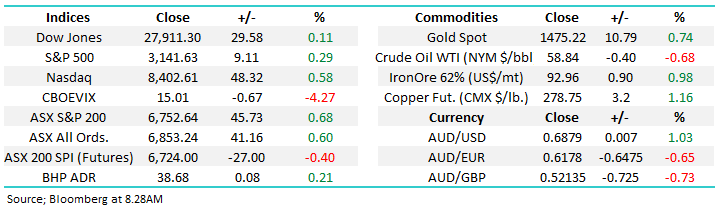

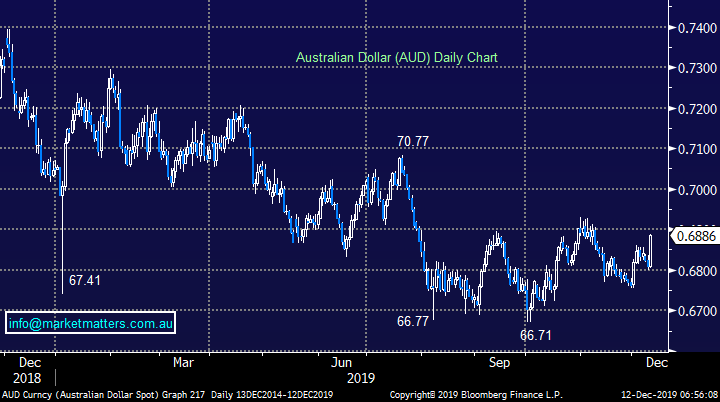

Overnight US stocks closed marginally higher led by the tech based NASDAQ but the SPI is calling the ASX200 to fall almost -0.5% on the opening as the $A rallied towards 69c the obvious negative influence, the miners should remain firm.

Today we’ve have looked at 5 UK facing stocks as Britain goes to the polls in a vote which will also dictate how cleanly BREXIT is resolved.

ASX200 Chart

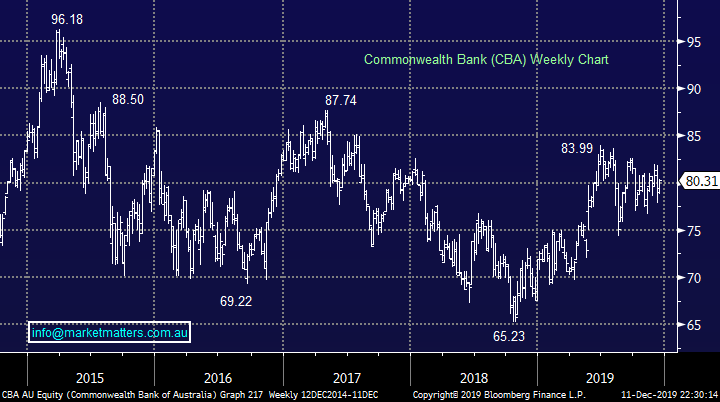

Commonwealth Bank (CBA) is grabbing the headlines today as APRA looks set to punish Australia’s largest bank and company for charging the dead – CBA self-reported this matter to APRA in 2018 and have already repaid over 95% of the incorrect fees but bad news sells newspapers!

MM remains bullish initially targeting the $85-6 area.

Commonwealth Bank (CBA) Chart

Australian miner South32 (S32) is enjoying a strong week and we still believe its offering investors good value trading on an Est P/E for 2020 of 15.6x while yielding ~5% fully franked. As investors panic around tumbling returns from Term Deposits and classic “Yield Play” stocks like Sydney Airports (SYD) are seeing their yield fall towards 4% unfranked, the miners are looking attractive to anyone with a greater risk profile and a more active open mind set.

MM is bullish S32 with stops below $2.60 – 7% risk.

South32 (S32) Chart

The IT Sector performed poorly yesterday dragged lower by the likes of Altium (ALU), Appen Ltd (APX) and Nearmap (NEA) who all fell well over -2%. We’re not keen on the high valuation sector at current levels but into weakness 1 or 2 might become prime candidates for a sharp bounce into January.

One stock that caught my eye is payment car solutions business EML Payments (EML) which is a new addition to the ASX200, this $1.4bn stock looks poised to correct back under $4 as much of the “forced” institutional / index tracking buying is probably complete.

MM will consider EML around 10% lower.

EML Payments (EML) Chart

The noticeable underperformance from the SPI Futures this morning is probably down to the very strong Aussie which surged +1.1% overnight. Our contrarian bullish $A target remains up around the 80c area, if this proves correct some of the in favour ASX $US earners are likely to suffer a new significant headwind e.g. highflyers like CSL could suddenly become a drag on the local index.

MM remains bullish the $A.

Australian Dollar ($A) Chart

The UK goes to the polls.

While I’m typing this mornings report the odds of a Labor victory in the UK election sit at 6-1 against Jeremy Corbyn, he has very few believers at both the bookmakers or polls – this feels correct to MM, we feel the British people are scarred of his policies just as they were back in 1983 when Maggie smashed the ultra-left wing Michael Foot 397-209, a phenomenal landslide from any perspective.

MM believes Boris Johnson will win the UK election, BREXIT will get sorted and the Pound rallies.

This should be good news for the 5 stocks I have touched on today who enjoy revenue of between 18% and 70% from the UK BUT if Labor does pull off a surprise its likely to be a very tough week on these stocks and MM holds 3 of them!

British Pound Chart

1 Pendal Group (PDL) $8.26.

PDL earns a lofty 70% of its revenue from the UK, certainly not one for the faint hearted if you are concerned with the outcome of the British election. After a tough few years which saw them deliver a net profit for FY19 down 19% to $163.5m, the fall was mainly due to a decrease in performance fees which has been witnessed across many active fund managers however this is a trend we can see improving into 2020 /21.

We believe PDL, like a number of the Fund / Asset Mangers has become oversold in 2018/9, its simply good value in our opinion trading on an Est P/E for 2020 of 15.4x while it yields an attractive 5.45% part franked dividend. Priced off its historical multiple Pendal is worth $9.13 while a slight extension on the upside of this would have PDL over $10 in short order.

MM remains bullish and long PDL initially targeting the $9.50 area.

Pendal Group (PDL) Chart

2 IRESS Ltd (IRE) $13.25.

Data provider for the financial services industry IRE earns 32% of its revenue from the UK, higher than many imagine sitting in our Australian bubble. Impressively their software is enjoyed by ~9,000 users including our desk but the question is where’s the growth from here, will it be primarily through acquisition? For the first 6-months of 2019 the business grew revenue 5% to over $240m while delivering a net profit after tax (NPAT) above $30m – no disappointments always go down well.

We don’t believe the stock’s cheap at current levels and are happy sitting on the fence after taking a nice profit from the stock in 2018.

MM is neutral IRE at current levels.

IRESS Ltd (IRE) Chart

3 Janus Henderson (JHG) $35.91.

JHG earns 28% of its revenue from the UK and as we see the impact from BREXIT was huge hammering the stock ~40% in quick time – a Labor victory is likely to see a repeat performance.

Like PDL we also believe JHG has become oversold and is one of the cheapest global fund manages listed on an exchange trading on an Est P/E for 2020 of just 10.1x while it yields an attractive 5.8% unfranked dividend.

MM remains bullish and long JHG initially targeting the $40 area.

Janus Henderson (JHG) Chart

4 Xero (XRO) $80.11.

Cloud based accounting business XRO earns 21% of its revenue from the UK and along with the US this is a growth market for the company which will become more important over time. This is an impressive company and we’ve left some $$ on the table with this one but around the $80 region we believe the stocks upward trajectory will become more volatile as its valuation scales huge heights – now a stock almost suited to the trader with our buy area for active investors / traders around the $77 area.

The business is now valued at $11.3bn and has just become profitable – only just - that’s a huge amount of positive growth / performance built into the share price, its simply too rich for us.

MM is net bullish XRO but the “easy money” feels behind the stock.

Xero (XRO) Chart

5 Sims Metal (SGM) $10.97.

Scrap metal business SGM earns 18% of its revenue from the UK and just over 40% from the US, a healthy global mix in our opinion. Like unrelated PDL and JHG the Sims shares have experienced a tough year but we believe its now poised to rally strongly from current levels after suffering from a severe drop in the ferrous scrap price - remember commodity prices are cyclical.

The company announced a buyback program to commence on 22nd of November for up to 10% of the issued capital – a nice tailwind for their stock and main reason we increased our weighting yesterday.

MM remains bullish SGM initially targeting the $12.50 area.

Sims Metal (SGM) Chart

Conclusion (s)

Of the 5 stocks we looked at today we own our favourite 3 Janus Henderson (JHG), Pendal Group (PDL) and Sims Metal (SGM) – be a worry if we didn’t! We are neutral / bullish Xero (XRO) and neutral IRESS (IRE).

Overseas Equities.

US stocks remain within striking distance of their all-time highs this morning having regained all of the Trump inspired spike lower last week.

MM expects new all-time highs into Christmas for US stocks.

US S&P500 Chart

Overnight Market Matters Wrap

- The US equity markets had a soft start early in the session, only to recover from its intra-day lows and close in the green as the US Fed Reserve kept its key interest rates unchanged for the last meeting of the 2019.

- The so called “dot plot” of individual committee members’ forecast of future rate movements showed that 13/17 members expected no change in policy during 2020.

- On the commodities and treasury front, gold rallied to US$1475.22/oz., as did bonds (just below 1.8%), the US$ weakened however, with the Aussie battler A$ higher at US68.77c.

- Tonight, investors focus on the Eurozone with the UK election and ECB policy decision at hand, while the ‘world’ will then switch to the US-China trade deadline on 15th December.

- The December SPI Futures is indicating the ASX 200 to open 28 points lower, towards the 6724 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.