If reflation does unfold should we be buying food producers? (OZL, WBC, A2M, ING, ELD, CGC, BGA, AAC, RIC)

The ASX200 had its second rest day for the week finally closing up less than +0.1% with Christmas rapidly approaching – only 6-sleeps to go so Indy my five-year-old yelled in my ear this morning! The market traded sideways for 6-days last week and more of the same feels a strong possibility moving into Christmas, the bulls shouldn’t get too disappointed, remember the rally up from this month’s low at 6590 is already above the average of the last decade. At MM we remain bullish but the “easy money” for December now feels behind us.

This morning I spent almost an hour listening to the below interview on Bloomberg of billionaire investor Stanley Druckenmiller, I strongly recommend it to subscribers. It’s a solid and interesting outlook piece for 2020 and not just because he has views largely aligned with us on both market and social levels:

For those with not enough time or the inclination to listen to the famous US investor the 3 standout points to us are as follows:

1 – Equities and risk assets are still enjoying the amazing tailwind of ultra-low interest rates compared to the strength of the global economy, but the Trump administration remains a scary wildcard.

2 – Bond yields are too low, and all the risk is on the upside into 2020 / 2021 i.e. Value Stocks are becoming more attractive.

3 – Reflation is set to unfold with the likes of copper and commodity currencies like the Aussie a relatively “good bet” i.e. the global economy is better positioned that many believe.

In addition to that, BHP have announced their plans to go back into commodity trading, while Morgan Stanley are reopening their base metals trading business, 2 separate pieces of news that is implies a positive view of commodities into 2020.

MM continues to believe the ASX200 will again test 6900 this month. – not a big call now!

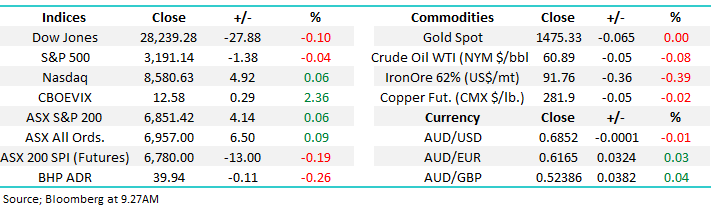

Overnight US stocks were very quiet closing basically unchanged; the SPI futures are pointing to a small decline early on locally for the ASX200.

Today we’ve have looked the Australian food producers as we feel the Agricultural Complex looks poised to appreciate.

ASX200 Chart

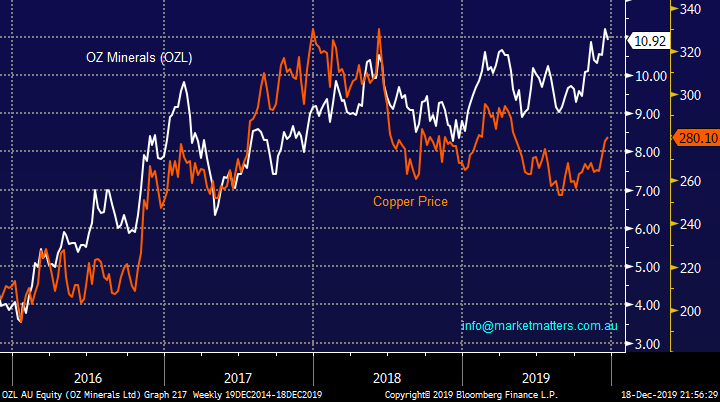

Yesterday OZ Minerals (OZL) was the worst performing stock in the ASX200 as it tumbled more than 5% on a quiet day for the bourse courtesy of a “Sell” call by influential broker Goldman Sachs – a fall that caught our eye as we hold OZL in our Growth Portfolio.

We remain bullish OZL primarily because we remain positive copper in line with our reflation view towards the global economy. However, the chart below does illustrate that OZL has got ahead of the underlying copper price, we would remind subscribers that our initial target for OZL is the $12 area which was in touching distance on Tuesday.

MM remains bullish OZL with an initial upside target still ~$12.

OZ Minerals (OZL) v Copper Chart

WBC and NAB have been swamped in bad news in the last 48-hours but both banks have been resilient implying to us that they have reached an area where value is presenting itself – at MM we like to buy stocks that don’t fall on bad news.

MM believes the next 20% for banking sector is up, not down.

Westpac Bank (WBC) Chart

Should we be buying the food producers?

Yesterday morning we said the “Agricultural complex was forming a base” and the below chart illustrates this view perfectly – the BBG Agricultural Index comprises mainstream commodities like coffee, corn, cotton, soybeans, sugar and wheat. This is an index that has more than halved since 2012 but if we are correct and its poised to rally then reflation is indeed very much back on the table.

MM is bullish the Agricultural index initially targeting over 20% upside.

BBG Agricultural Index Chart

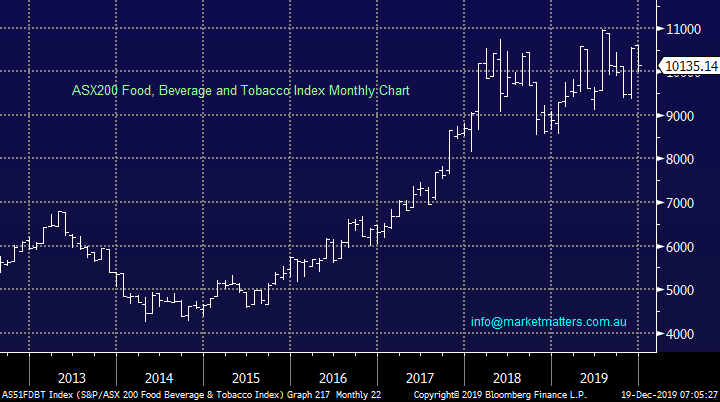

My first thought was to have a look at the Australian Food, Beverage and Tobacco index but this proved messy at best - of the 9 stocks in the sector 4 are down by more than 10% for the year while 2 are up by more than 30%, in other words todays exercise is one to be performed under the hood not on a sector level

MM is neutral the ASX200 Food, Beverage & Tobacco Index.

Hence today MM has briefly looked at 7 specific food producers who might benefit from a solid increase in agricultural prices however this is a tricky game with unprecedented weather conditions / draught pressuring the Australian farmers.

ASX200 Food, Beverage & Tobacco Index Chart

1 a2 Milk Co Ltd (A2M) $14.77.

A2M has been volatile in 2019 falling 35% from its August high however the milk and infant formula company is still up over 40% for the year. Recently we’ve seen their CEO Jayne Hrdlicka fairly unceremoniously replaced but the markets taken this board volatility in its stride. The company’s most recent trading update again showed China as the company’s area of growth which bodes well in our opinion moving forward as the Phase 1 trade deal should help their expansion into 2020.

Technically A2M looks bullish targeting new all-time highs while stops can be run below $13 i.e. 12% risk.

MM is now bullish A2M liking the better than 2:1 risk / reward profile.

A2 Milk (A2M) Chart

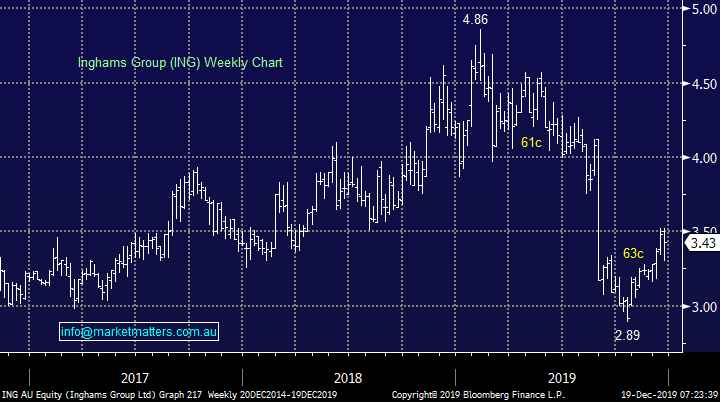

2 Ingham’s Group (ING) $3.43.

ING is very much a 2-edged sword as the price of chicken may be set to increase but so might the cost of the birds feed, this feels a touch too hard at present. The stocks more than 5% fully franked yield is definitely attractive in today’s environment making this an ideal stock to accumulate in the correct value area.

Technically ING would be great buying into fresh 2019 lows.

MM is neutral ING just here.

Ingham’s Group (ING) Chart

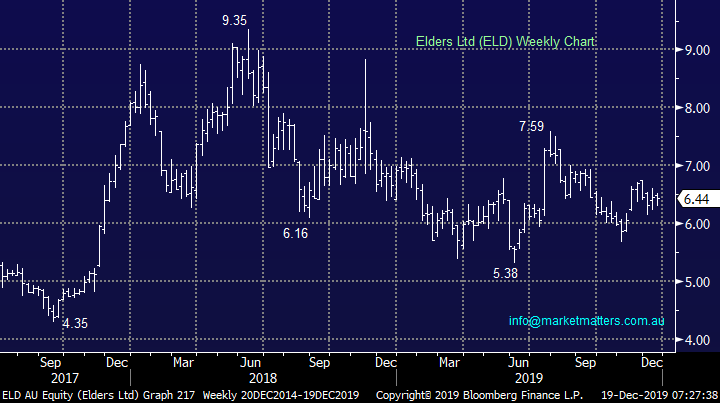

3 Elders Ltd (ELD) $6.44.

Agri-business ELD remains a billion-dollar business even while it has endured the kitchen sink being thrown at it by the environment. The different rural services where ELD operates enjoys one common factor, a healthy Australian farming environment which unfortunately has been extremely tough over recent years. This would be a great play in our opinion if it wasn’t for the weather-related risks making this not surprisingly a high-risk investment.

Technically MM likes ELD with stops below $6.10 i.e. around 5% risk.

MM is neutral to bullish ELD.

Elders Ltd (ELD) Chart

4 Costa Group (CGC) $2.39.

CGC has been our nemesis in 2019 and one that doesn’t need more mainline discussion by MM at this stage. However, if the company stops flooding their own market with product and we see general agriculture price appreciation it should represent a solid platform for some recovery in CGC. Back in November we reduced our position ~$2.70 and it’s tempting to increase around current levels but on balance we believe prudence is a better form of valour with regard to CGC – we will maintain our existing weighting to CGC.

MM is bullish CGC at current levels.

Costa Group (CGC) Chart

5 Bega Cheese (BGA) $4.05.

BGA has endured an awful 2-years like much of the dairy industry as the stock basically halved in price but its product mix is becoming more diverse and interesting to MM. Cash flow has remained strong with FY19 breaking above $100m, double that of 2018.

This is a stock where the next 25% looks far more likely to be up as opposed to down given a weak FY20 is already being factored in by the market, while a strong bounce back in FY21 is being forecast

MM is neutral / positive BGA.

Bega Cheese (BGA) Chart

6 Australian Agricultural Co (AAC) $1.105.

Integrated cattle and beef producer AAC now run Australia’s largest herd of wagyu cattle marketing / selling its produce both locally and overseas. The stocks been hammered by the combination of draught and floods and while we remain cognisant that weather conditions continue to scale new extremes panic selling does present opportunities – the growing Chinese middle class wants quality produce.

Technically AAC looks excellent with stops below 98c.

MM is bullish AAC.

Australian Agricultural Co (AAC) Chart

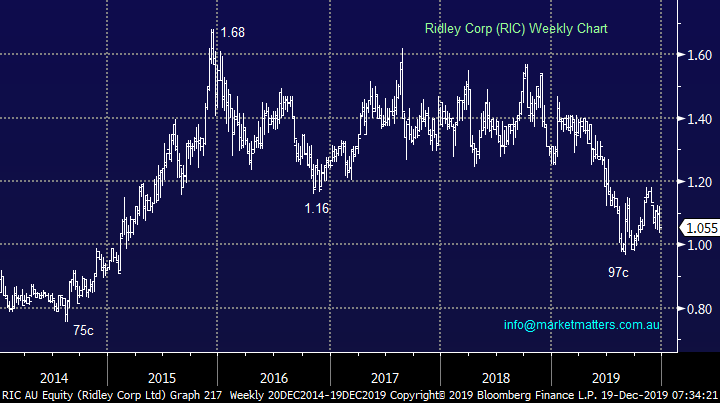

7 Ridley Corp (RIC) $1.05.

Stockfeed mill operator RIC has struggled in 2018 /9 but we feel this relatively small operator is slowly presenting some value, the stocks trading on an Est P/E for 2020 of 16.2x while its yielding ~4% fully franked. This $328m market cap business maybe too small for MM but into fresh lows its will be interesting for aggressive players.

Technically RIC is a sell targeting sub 97c, or ~10% lower.

MM would consider RIC into fresh lows.

Ridley Corp (RIC) Chart

Conclusion (s)

Of the 7 stocks we looked at today our favourites at today’s prices are AAC, A2M, CGC, BGA and ELD - interesting a large % are looking interesting from a risk / reward perspective, i.e. forming decent basing patterns.

Overseas Equities.

No change, US stocks again made fresh all-time highs this morning as they continue to embrace positive macro themes – we remain bullish the S&P500 while its trading above 3025.

MM remains bullish but cautious US stocks.

US S&P500 Chart

Overnight Market Matters Wrap

· The US closed with little change overnight, as the House is debating whether to impeach Trump around his efforts to coerce Ukraine to provide information on Joe Biden and his son, Hunter. The Democrats look to have enough votes to approve impeachment, which would then lead to a trial in the Senate, where a two-thirds majority would be required to remove the President.

· The Australian unemployment rate and employment change will be released at 11.30am today (AEDT), while US initial jobless claims will hit the screens overnight. Both will have implications for monetary policy in their respective countries. As we saw with Monday’s huge rally, any sign of lower rates has positive implications for equities.

· On the commodities front, nickel and copper fell on the LME, while iron ore declined nearly 1%. Oil and gold held steady, while US 10-year government bonds are yielding 1.92%.

· A volatile open is expected to be seen this morning with the December SPI Futures expiring this morning and the March SPI future indicating the ASX 200 to open marginally higher, testing the 6885 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.