Updating our outlook for the Capital Goods Sector (SSM, NWH, SVW, RWC, GWA,ASB)

Our thoughts at MM this morning with those battling bush fires around the country, while most are thinking about last minute Christmas presents there are many doing it tough out there.

The ASX200 slipped lower yesterday due to the combination of general Christmas lethargy, a firming $A and some profit taking following the markets strong +4.3% rally from its low in the first week of December – with only 5 sleeps until Santa arrives people are talking more about holiday plans than markets. On Thursday the broad market was fairly evenly matched but with the banks, large cap miners and healthcare sectors all coming under slight pressure the index was always fighting an uphill battle to close in positive territory.

On the economic front we saw a solid improvement in the Australian employment data for November showing things aren’t as bad as many fear domestically reducing pressure on the RBA to cut rates in 2020 – bets are now down to 60% for a cut in February. The prospect that Official Rates might not imminently fall from 0.75% to 0.25% as previously expected pushed the $A back towards 69c creating the double negative impact on local stocks – this headwind is likely to last at least a few days.

Yesterday morning we heard that Donald Trump had become the 3rd US President to be impeached but financial markets seemed to shrug their shoulders in a combined Christmas carol of “Who Cares”. It appears to us that the whole process is a waste of time as the Republican based Senate are extremely likely to block any further escalation, remember no US President has ever been removed from office following an impeachment but also none have been re-elected.

I discussed the topic briefly on CBNC yesterday afternoon.

MM continues to believes the ASX200 will again test 6900 in the weeks ahead.

Overnight US stocks made fresh all-time highs with the broad based S&P500 adding +0.45% but the SPI Futures are calling the ASX200 to fall around 20-points early this morning with the reduced optimism of a February rate cut the likely reason.

Today we’ve looked at the Australian Capital Goods Sector following recent strong performances from relatively new purchases by MM of Service Stream (SSM) and NRW Holdings (NWH) – SSM was the top performer on the ASX200 yesterday rallying over 11%.

ASX200 Chart

When we stand back and look at the hugely influential Australian 3-year bond yield its clearly still tracking sideways as fund managers deliberate the strength of both the local economy and the RBA’s future policy decisions. However as the last 24-hours have illustrated the market is unlikely to embrace rising bond yields.

At MM we continue to believe bond yields are looking for a major low.

Ideally MM would buy a failed spike lower in local bond yields.

Australian 3-year Bond Yield Chart

Similarly the $A has been chopping around in a tight range over the same timeframe which makes sense. We remain bullish the $A into next year which implies bond yields will eventually turn higher.

MM remain bullish the $A into 2020 / 2021 eventually targeting the 80c area.

Australian Dollar ($A) Chart

The Capital Goods Sector

This is not a sector which regularly gets “Air Time” from many analysts but we’ve been watching it closely over recent months after it generated a major technical buy signal in September. There are only 8 stocks in the Australian group which are defined as below:

“A diverse sector, containing companies that manufacture machinery used to create capital goods, electrical equipment, aerospace and defence, engineering and construction projects”.

Post the GFC the sector has been a very poor battleground for investors however times are changing, many businesses have been recapitalised and / or are aggressively paying down debt as earnings improve- we continue to like the space moving into 2020. The +22% rally by NRW Holdings (NRW) over the last month illustrates there are some excellent profits to be enjoyed from this largely ignored group. **Importantly, a reminder that NWH has a share purchase plan under way that closes on the 2nd January. Up to $15,000 worth of shares available at $2.85, which is a 12.5% discount to yesterdays close**

MM remains bullish the Australian Capital Goods Sector.

ASX200 Capital Goods Index Chart

Firstly a quick update on our 2 existing holdings in the sector:

1 – Service Stream (SSM) $2.71: A wholly owned subsidiary of this network services business won a 10-year contract with Sydney water yesterday sending the stock sharply higher, we remain bullish with an initial target ~15% higher.

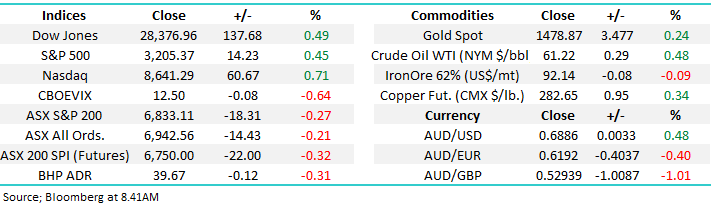

2 – NRW Holdings (NWH) $3.26: mining services provider NWH has enjoyed an excellent 2019 propelled higher by the prospect of the successful acquisition of BGC Contracting. MM remains bullish but the short-term easy money looks behind us.

Service Stream Limited (SSM) Chart

NRW Holdings (NRW) Chart

Today we have looked at 4 other stocks in the sector which MM are considering as we move towards 2020.

1 Seven Group Holdings (SVW) $19.77

SVW is a diversified operating and holding company which also operates Caterpillar dealerships in Australia and North Eastern China. The Stokes family’s investment vehicle SVW has its fingers in a number of pies including media & TV, publishing, Telco plus a major exposure to Beach Petroleum (BPT) which MM already holds. This BPT position held by the company makes it an unlikely investment for MM as the overlap is too high.

The stock’s trading on a relatively conservative Est P/E for 2020 of 13.83x while the 2.2% fully franked yield is better than cash – we like the stock with short-term stops below $18.

MM remains bullish SVW expecting a breakout above $20 shortly.

Seven Group Holdings (SVW) Chart

2 Reliance Worldwide (RWC) $4.19.

Plumbing business RWC shares have experienced a tough time in 2019 with a sell down by the previous Chairman plus a lack of “winter freeze” in the US being the two major headwinds. We feel the worst is behind this $3.3bn business especially as we anticipate major fiscal stimulus in 2020 which should greatly assist the business, while the current Est P/E for 2020 of 21.1x is not too challenging.

MM is bullish RWC with an ideal entry sub $4.

Reliance Worldwide (RWC) Chart

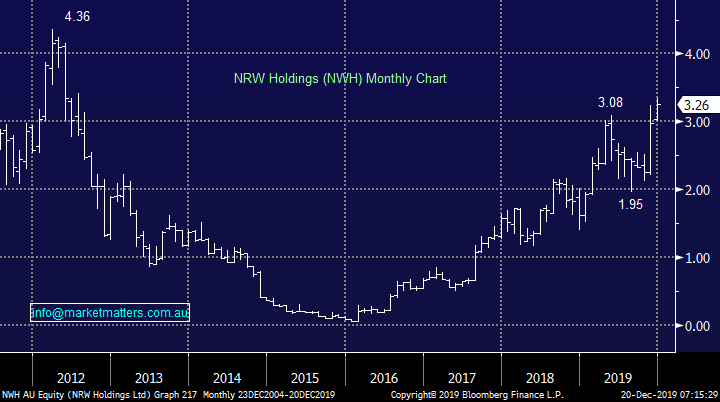

3 GWA Group (GWA) $3.44.

GWA manufactures building fittings for households and commercial premises. The market is heavily short GWA with over 12% of its stock sold short which we believe is interesting in this case as the unfolding housing market recovery should positively impact the company’s earnings.

The stock’s trading at an ok Est valuation for 2020 of 17.5x while it yields almost 6% fully franked which would worry me if I was short. Technically we could be long with stops below $3.20, less than 8% risk in a stock that feels poised to “pop” higher.

MM is bullish GWA.

GWA Group (GWA) Chart

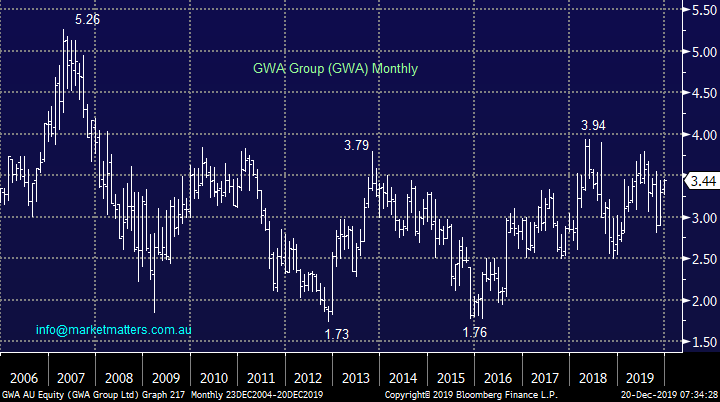

4 Austal Ltd (ASB) $3.96

Shipbuilder ASB appears to have been hit by simple profit taking, not a phrase we like to throw around as loosely as the press, but still feels correct in this case. We believe the Phase 1 trade resolution will eventually reignite this Australian success story with our ideal target above $5. However in the short-term after such a strong 2019 another few months consolidation / pullback feels likely.

With those unfamiliar with the stock, it trades on an Est P/E of 19.2x for 2020 which is not too demanding considering the companies profile while it’s 1.5% unfranked yield is a small added bonus for this growth orientated business.

MM is bullish ASB below $4 with an ideal entry sub $3.50.

Austal Ltd (ASB) Chart

Conclusion (s)

Of the 4 stocks we looked at today our order of preference today are GWA, ASB, SVW and RWC.

Overseas Equities.

No change, US stocks again made fresh all-time highs this morning as they continue to embrace positive macro themes – we remain bullish the S&P500 while its trading above 3025.

MM remains bullish but cautious US stocks.

US S&P500 Chart

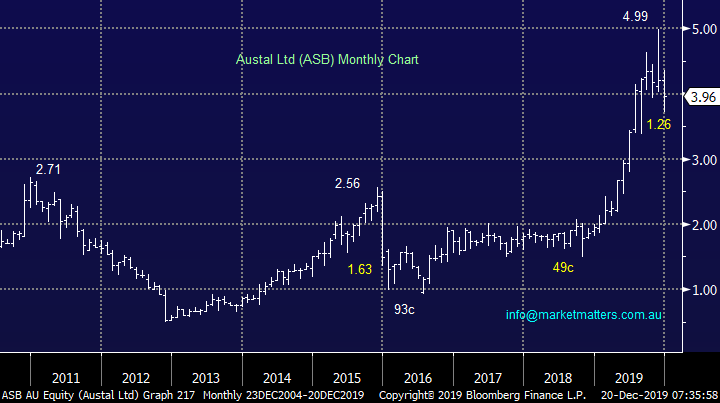

Overnight Market Matters Wrap

- The US equities closed in yet another record high, led by the tech. sector, as investors ignored the impeachment of President Trump and focused on recent reports of China being close contract with the US the sign the initial trade deal.

- On the commodities front, crude oil lifted to $61.22/bbl., along with gold up 0.24% to US$1478.87/oz.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 0.31% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 6 points lower this morning, around the 6830 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.