Market smashes through 7000 (WHC, S32, WPL)

WHAT MATTERED TODAY

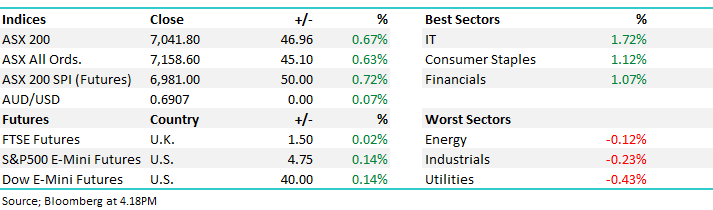

A bullish open to trade this morning where the market cracked and held above 7000, keying off the US/China love in overnight. While the US market was higher, local stocks well and truly outpaced the gains today. Tech stocks did well in Australia while the miners saw some headwinds coming from weakness in overnight commodity markets. We also had a raft of quarterly production numbers out today which Harry covers off on below. Ultimately, Woodside (WPL) Alumina (AWC) and South 32 (S32) pretty much inline, Whitehaven Coal (WHC) soft, although it was expected following a recent downgrade.

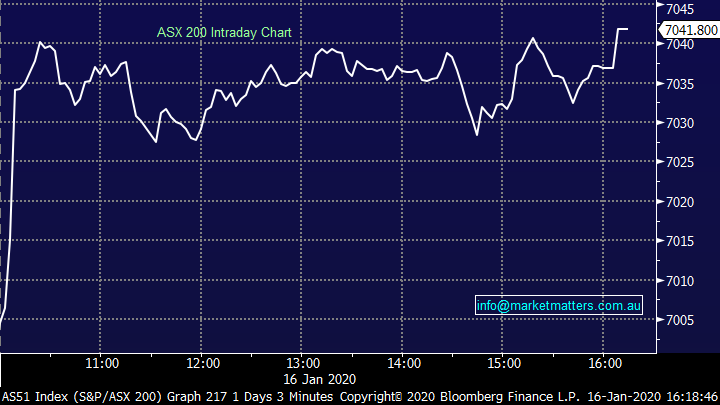

Buyers came in hard early today pushing the index through 7000 at the get go before the market ebbed and flowed in a fairly tight range. A couple of times it looked like it was going to sell off however ultimately, it seemed to acclimatise itself above the big milestone and a bid on the close saw the market close on the high for the day (and all-time).

Tech the strongest sector today while healthcare was also solid – CSL cracked the $300 mark. Utilities, which were the strongest cohort yesterday led the declines today. Asian stocks were a mixed bag today, Australia the clear bullish standout while US Futures were a tad higher. We’ve now seen just 2 down days in the last 11 sessions for the ASX with the mkt rallying nearly ~400pts.

Overall, the ASX 200 added +58pts / +0.85% today to close at 6962. Dow Futures are trading marginally higher up by +18pts/+0.06%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Woodside (WPL) +0.56%; a reasonable 4th quarter production report helped Woodside close in the black today against a weaker the energy sector. Production was up 3% on the prior quarter to 25.7MMboe, with revenue up to $US1,446M with better sales volumes more than offsetting the easing in LNG prices. Woodside was keen to show off the impressive performance of their new Greater Enfield project which started pumping in August with the quarter being the first full contribution – although production is still ramping up. The company gave guidance of 97-103MMboe for the 2020 year, around 10% higher than 2019. We like Woodside, it is our preferred energy play given the current market context. It pays a healthy dividend and is on the lower risk – production & investment – end of the energy market.

Woodside Petroleum (WPL) Chart

South32 (S32) unch; This is a stock firmly on our radar and today they delivered their December Quarter production & sales numbers – all looked OK. Aluminium was flat QoQ but there was power issues so a reasonable outcome, Alumina was up on the quarter and the half although prices were weaker, Manganese production was lowered due to low prices, nothing like low prices to cure low prices - in any case, looks like Manganese price has seen the low as we mused in the AM note today which covered our view on resources (click here). Met Coal used in steel making showed reasonable numbers despite some relocation of production during the period while Energy Coal saw lowered guidance, again though, prices here seem to have turned. Guidance across the board maintained other than Thermal Coal. All up, an okay result however the fate of the SP will be dictated by the underlying commodities, and pleasingly, most of them have turned higher during the Dec QTR. One we like but don’t own (yet)

South32 (S32) Chart

Whitehaven Coal (WHC) unch; mixed day for Whitehaven as they reported on their 2nd quarter production efforts. We have seen Whitehaven climb into the report – although more so on the back of some better coal prices than any real market exuberance about their chances today given the downgrade the company put through late last year. Sales were up, but Whitehaven were also forced to step up purchases with sales exceeding production by around 15%.

Production was down substantially and has been softer for the early weeks of the new year compared to the same period’s last year, with drought, skills shortages and maintenance disrupting some operations. The Narrabri mine had a planned production unit relocation and Whitehaven used the opportunity to upgrade some of the gear. Maules Creek saw production down as a result of the impact from dust storms, as well as a skills shortage – Whitehaven were confident weather would have a lesser impact into the second half (coal miners turned weather reporters), while a new labour management plan that was implemented late in the quarter appears to have started to ease the pressure. Maules Creek has also reached its limits in certain areas giving Whitehaven the ability to commence in pit dumping which will lower run costs from here. Guidance unchanged (post the December downgrade) shows WHC may been near the end of their production struggles, while a bottoming pattern in coal looks to be forming, Whitehaven is on the radar.

Whitehaven Coal (WHC) Chart

Broker moves;

· CBA Cut to Hold at Bell Potter; PT A$86

· FlexiGroup Raised to Buy at UBS; PT A$2.30

· Domain Holdings Cut to Sell at UBS; PT A$3.50

· Summerset Cut to Neutral at Jarden Securities; PT NZ$8.50

· National Storage REIT Cut to Sell at Morningstar

· Sims Metal Cut to Sell at Morningstar

· Incitec Raised to Equal-Weight at Morgan Stanley; PT A$3.20

· Pendal Group Raised to Buy at Goldman; PT A$9.43

· Super Retail Cut to Neutral at JPMorgan; PT A$10

· Beach Energy Cut to Neutral at JPMorgan; PT A$2.65

· Santos Cut to Hold at Morgans Financial Limited; PT A$8.86

· Saracen Mineral Rated New Overweight at JPMorgan; PT A$4

· QBE Insurance Raised to Outperform at Credit Suisse; PT A$15

OUR CALLS

No changes across portfolios today

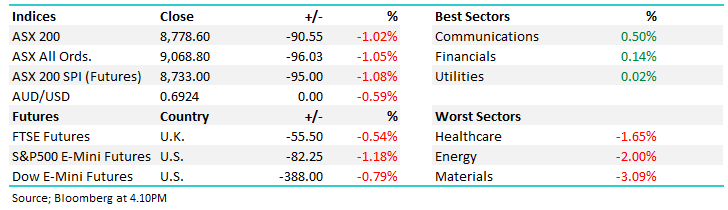

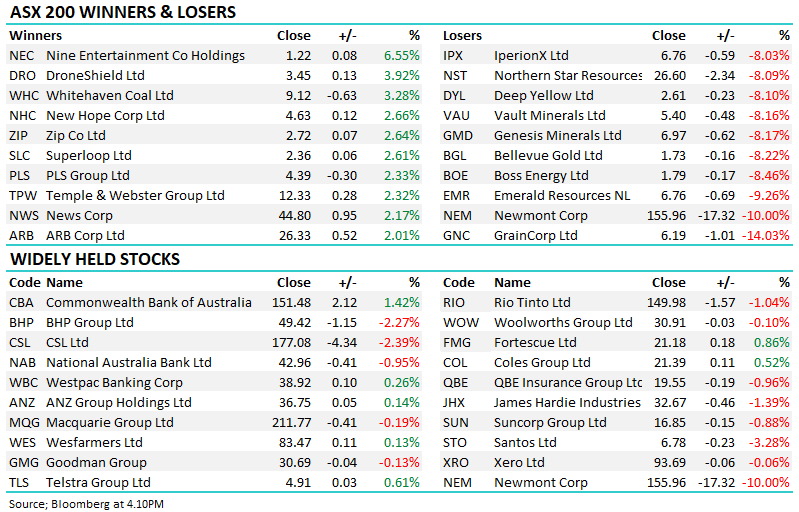

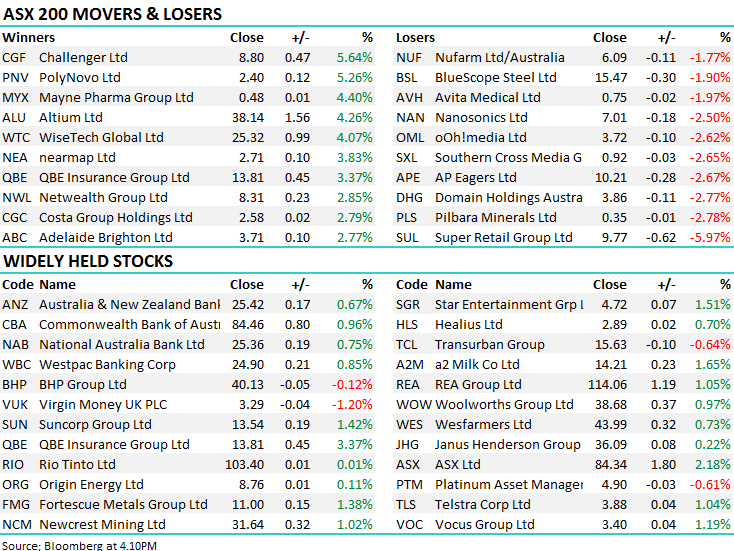

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.