Overseas Wednesday – International Equities & Global Macro ETF Portfolios (BLD, SFR, IEM US, 700 HK) **700 HK**

The ASX200 took a rest yesterday but it remains less than 0.4% below its all-time high posted earlier in the week, buyers still appear very comfortable to nibble away into any weakness but similarly we feel sellers will be more active into strength above / around 7100. In other words at MM we continue to anticipate the local index will rotate around between 7000 and 7100 over the next 1-2 weeks as the main market volatility is likely to unfold on the stock level during reporting season - most of us would agree a rest would be healthy for stocks after its recent surge higher.

Considering Asia was smacked yesterday the local markets performance was impressive as the news that 6-people have now died from coronavirus, a cousin of the SARS virus, plus an additional ~300-people have been identified as infected e.g. the Hang Seng fell -2.8% and Japans Nikkei -0.9%. The World Health Organisation is obviously working hard to isolate the virus, but we already have cases in South Korea, Thailand, Japan and now the US with China not surprisingly confirming it can be transmitted from human to human. With this weekend heralding the largest human migration in history for Chinese New Year it’s unfortunately hard to imagine things not getting worse before they get better – an obvious reason that a market rest / pullback might be close at hand.

On a more positive front the focal point of today’s report is a “Market Chat” I had with Martin Crabb yesterday. Martin was previously our Head of Research however is now our Chief investment Officer at Shaw and Partners. He’s had a broad cross section of experience over a few decades and I enjoy his pragmatic approach to markets – it’s similar to how we view the world and as a consequence manage our investments. Martin has just returned from an international investment conference in the UK, an excellent opportunity to get a handle on what the majority of global market players are anticipating for 2020 – but not necessarily to follow them! I made reference of him flying first class, I can assure you he didn’t!

Interview with Martin Crabb following a European Investment Conference – click here or on the image below

MM remains bullish the ASX200 while it holds above 6930.

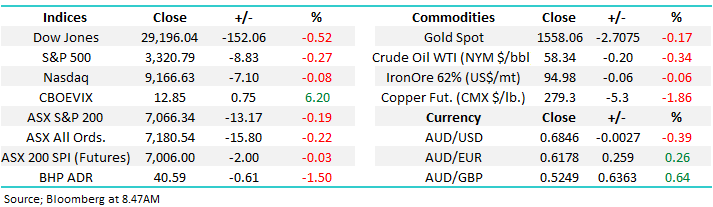

Overnight US stocks closed marginally lower with the S&P500 giving back -0.3%, the SPI futures are calling our market to open basically unchanged this morning.

Today we’ve focused on back foot opportunities as weakness washes across Asian indices.

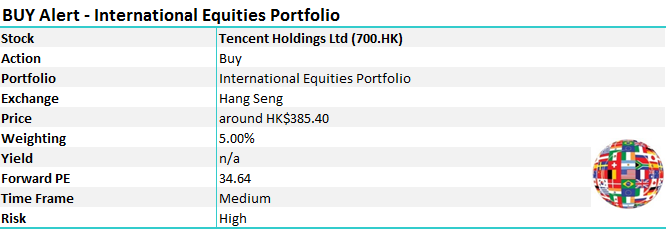

International equities Alert

MM is allocating 5% of our International Portfolio into Tencent (700 HK) this morning, the alert is in this report as the stock trades in Asia. We plan to increase to 8-10% if we see further panic around coronavirus.

ASX200 Chart

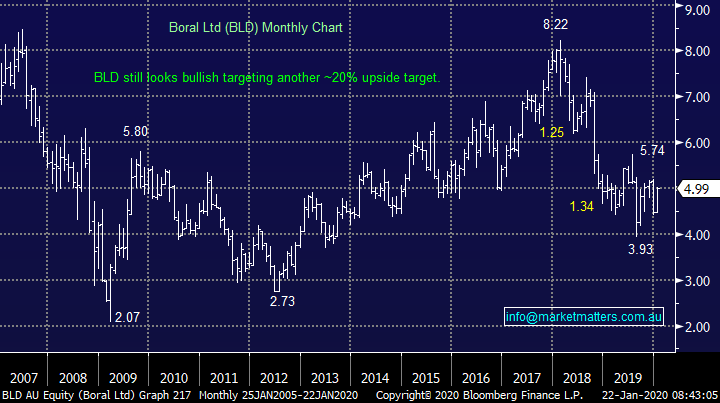

MM is long building & construction business Boral (BLD) in our Growth Portfolio consequently we were delighted to read at 9am this morning in The Australian that Irish firm CRH were being linked with a buyout of BLD – hopefully there’s no smoke without fire!

Our current target for BLD is around 20% higher which might be close to the premium a suitor would offer.

Boral (BLD) Chart

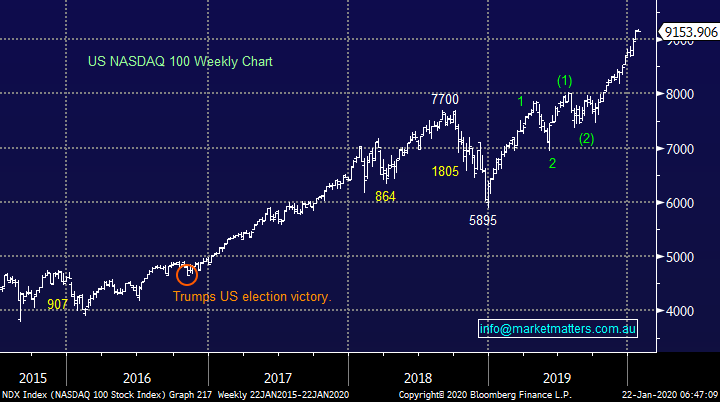

The US tech space has clearly been revelling in the current economic back drop, but we feel the risks are slowly but surely mounting for a pullback, perhaps in that traditionally volatile end of January / start of February period.

While MM remains bullish US equities although the risk / reward is not exciting at present.

US NASDAQ Index Chart

Yesterdays -810-point / 2.8% plunge by the Hong Kong bourse illustrated the risks equities always carry with them following strong advances, although obviously this unfolded on very concerning news.

MM remains bullish the Hang Seng liking the risk / reward into weakness.

Hang Seng Index Chart

Growth indicator copper understandably has taken a dip lower as the concerns around coronavirus mounts i.e. if the China engine slows down so will global growth. However, at this stage we regard this correction as one to buy, not sell, with technically a few % lower an ideal time to consider increasing exposure to the industrial metal.

MM remains bullish both copper and reflation.

Copper Futures ($US/lb) Chart

From a risk / reward perspective we like Sandfire Resources in the $5.80-$6 region if it follows coppers lead and corrects after its recent improvement.

MM likes SFR between $5.80 and $6.

Sandfire Resources (SFR) Chart

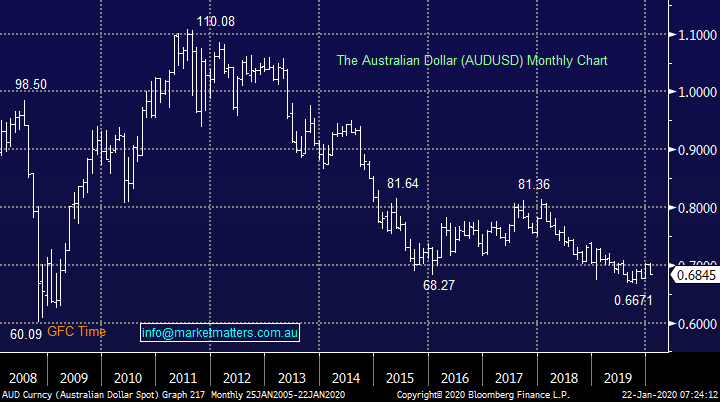

The Aussie Dollar has also followed the negative lead from Asia and the resources over the last few days falling from above 70c back towards 68c, we’ve been in the same trading range since May of last year. Ironically if the market stays true to form the ASX200 should outperform today as its been enjoying periods when the local currency has struggled.

MM remains bullish the $A.

Australian Dollar (AUDUSD) Chart

MM International Equites Portfolio

We made no changes to our International Equities Portfolio last week with our cash position remaining at 37% : https://www.marketmatters.com.au/new-international-portfolio/

Our positions within the portfolio continue to unfold nicely and with a period of consolidation feeling likely the opportunity to deploy some further cash into equities feels close at hand, starting today.

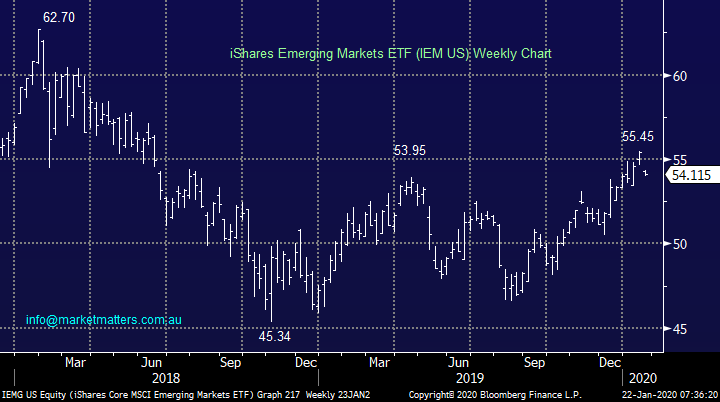

At this stage it’s all about Asia and the Emerging markets as the health concerns from China reverberate throughout the region. Overall there’s no change as MM continues to like the Emerging Markets moving into 2020, a view strongly supported by our bearish $US view Hence any buying this month appears likely to be focused in this region.

Emerging Markets ETF (IEM US) Chart

Our preferred method to implement this view is by adding to our Samsung (005930 KS) and Ping An (2318 HK) positions plus internet and e-commerce goliath Tencent (700 HK) however we are scanning the horizon for some alternatives to aid some diversification. As we’ve discussed previously on-line goliath Tencent struggled in 2018 and the majority of 2019 before rallying in December in-line with global markets, we now feel a significant move higher is underway, at MM we can see fresh all-time highs in 2020.

The current ~7% pullback feels like an ideal opportunity to start accumulating Tencent.

MM is bullish Tencent (700 HK).

See earlier alert.

Tencent (700 HK) Chart

Conclusion (s)

MM still likes the Asian and Emerging Markets into 2020, hence we plan to start accumulating into current weakness.

The MM Global Macro ETF Portfolio

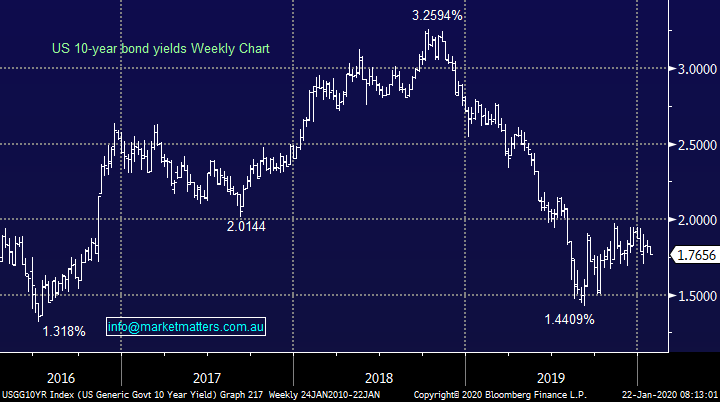

The MM Global Macro Portfolio remains 51.5% in cash as we continue to watch bond yields closely. : https://www.marketmatters.com.au/new-global-portfolio/

At this stage we remain happy with our position mix but anticipate some restructuring sooner rather than later as opportunities appear to be unfolding:

1 – If copper corrects back to the 275 area (see earlier chart) we are considering increasing our 5% position i.e. COPX US.

2 – MM is looking to increase its 5% exposure to the Emerging Markets into current weakness i.e. IEM.

Watch for alerts which will be in afternoon reports.

As investors we must always consider the “what ifs” and today that is clearly focused on the coronavirus, it may get much worse before the W.H.O. can contain it and that’s likely to see weakness in stocks and strength in bonds. Remember what happened back in 2003 when SARS broke out:

1 – The impact was devastating from both the human and financial market perspective e.g. Cathay Pacific fell close to 30%.

2 – However the recovery in the focal point Hong Kong was basically instantaneous when the picture showed initial signs of improvement,

Hence back foot buying of stocks / indices makes sense, picking the bottom is luck.

US 10-year Bond Yields Chart

Conclusion (s)

MM is looking to buy copper and the Emerging Markets into current weakness. Also if we see further contagion in the coronavirus impact through financial markets we will be looking for a point (s) of inflection.

Overnight Market Matters Wrap

· US equities caught up to the global market risk off sentiment overnight and weakened following reports that a deadly respiratory illness in China had migrated to their shores.

· As expected, travel stocks including airlines, casino operators and luxury goods companies sold off, while a few drug makers and the producers of protective face masks benefited from this outbreak.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of 1.50% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open marginally higher, towards the 7075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.