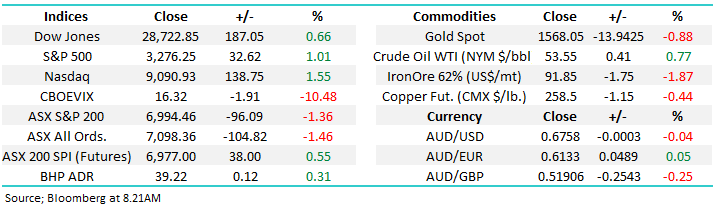

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (CGC, FMG, A2M, OZL, ILU, PGH, NCM, EVN, MC FP, GOLD US)

The ASX200 was whacked almost 100-points yesterday, registering its worst day in 2020 in the process, as the coronavirus epidemic continues to gain momentum, the number of reported cases had surged to 4500 with 106 related deaths as the infection rate appears to be accelerating. The newswires continue to buzz with headlines like India’s gearing up to evacuate citizens from China and 56 million people in 20 cities are being prevented from traveling in an almost desperate attempt to restrict the spread of the disease – February looks likely to live up to its volatile reputation.

The viruses impact on the market yesterday was extremely pronounced under the hood with the defensive related gold and utilities stocks holding up while anything dependant on a strong Chinese economy / consumer was basically hammered:

1 – Travel / tourism: Webjet -13.9%, Corporate Travel (CTD) -7% and Star Entertainment (SGR) -5.2%.

2 – Resources: Fortescue (FMG) -7.3%, Sandfire Resources (SFR) -5.7%, Iluka (ILU) -5.4% and OZ Minerals (OZL) -5.3%.

3 – Chinese consumer: Treasury Wines (TWE) -5.8% and a2 Milk (A2M) -2.7%.

It’s very important for subscribers not to panic at this point in time, global stock markets are following our playbook, at least for now! We continue to look for buying opportunities basis US stocks a few percent lower and locally less than 1% below yesterdays close – perhaps to micro for some! Across the MM portfolios we are likely to increase our overall exposure to stocks but we’re specifically looking for situations where the markets become too “anti-China” in the short-term – interestingly a number of stocks in the 3 categories mentioned above are on our Q1 shopping list.

I was on CBNC yesterday afternoon reiterating that bond yields / interest rates will ultimately drive markets.

MM remains bullish the ASX200 while it holds above 6930.

Overnight US stocks bounced strongly with the Dow up 187-points while the SPI futures point towards an opening up around 40-points – we don’t believe the markets correction has finished, hence MM is unlikely to be buying portfolios just yet but subscribers should remember one of our favourite sayings “be prepared”.

Today we’ve focused on the rapidly evolving opportunities both locally & overseas as weakness floods through equity markets as fears escalate of a Chinese led economic global slowdown increase.

ASX200 Chart

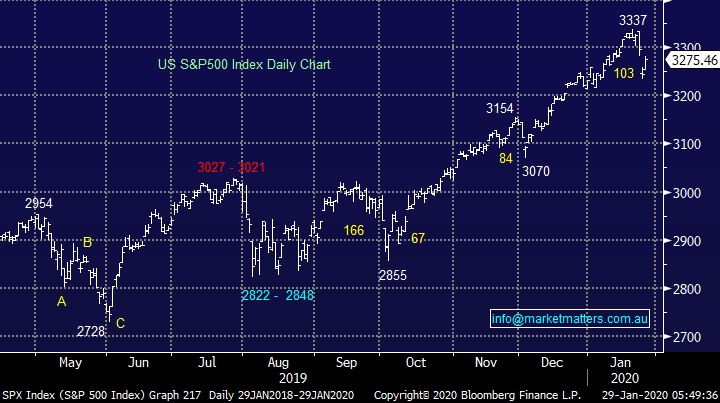

US equities are bouncing as I type but I doubt a 48-hour pullback of just 3% is enough of a correction for the 17% rally since October 2019 – our preference is another down leg will follow into February, often a volatile month in both directions.

While MM remains bullish US equities with an ideal buy level for the S&P500 ~3175.

US S&P500 Index Chart

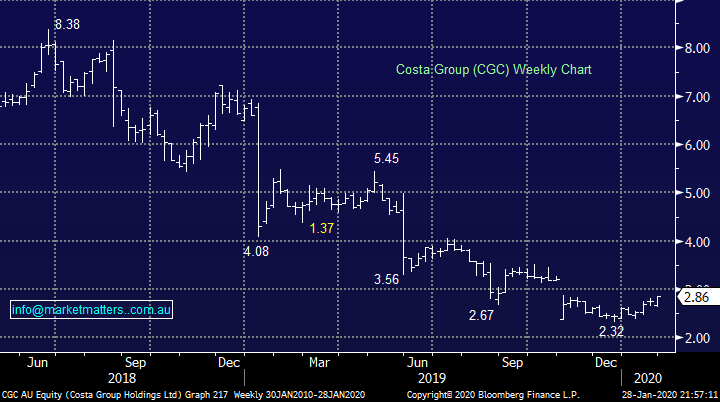

Yesterday afternoon as the market struggled to recover from its early battering Costa Group (CGC), the embattled fruit and vegetable grower rallied almost 9% from its lows as investors digested the news that the company’s JV Partner, US based Driscoll’s had built up a stake in CGC just shy of 5% hence alleviating the need to lodge a substantial shareholder notice. Either the company sees value at the current depressed prices or something on the corporate level is boiling under the surface, both ways it should be positive news for the share price.

MM likes CGC at current prices, we have an initial 20-25% upside target.

Costa Group (CGC) Chart

Yesterday iron ore fell 6% on concerns around Chinese steel production after the outbreak of coronavirus, indicators are it will open down another 8% this morning, that’s pain for the sector! However it might produce an opportunity for MM as the market feels long Fortescue Metals (FMG):

MM likes FMG around 10% lower.

Fortescue Metals (FMG) v Iron Ore Chart

3 local stocks that are in the MM “ buy headlights.”

Nothing particularly fresh here but when so much action is unfolding on a daily basis it’s imperative that we have our finger on the pulse:

1 a2 Milk (A2M) $15.08

MM likes A2M into current weakness, we believe once the dust settles foodstuffs from the perceived safety of Australia and NZ will be even more popular in China.

a2 Milk (A2M) Chart

2 OZ Minerals (OZL) $9.78

MM remains keen on the resources sector into weakness believing that China will embark on a major “spending spree” once coronavirus is under control, aggressively reinvigorating their economy in the process. MM is considering increasing our position in OZL into the current sector weakness.

OZ Minerals (OZL) Chart

3 Iluka (ILU) $8.93

As touched on in Mondays report MM is keen on ILU into the current weakness below $9.

Iluka (ILU) Chart

3 local stocks that are in the MM “sell / reduce headlights.”

Only one stock may be a slight surprise to subscribers in this list but its more a case of “housekeeping” as opposed to selling per se.

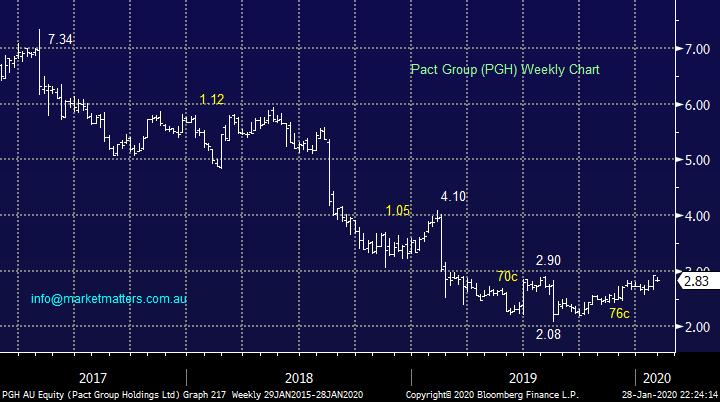

1 Pact Group (PGH) $2.83

PGH is included in the 3 more as a case of position size as opposed to concerns around the stock itself, after bouncing 40% we feel its prudent to consider trimming our PGH position from 6% back to 4%. We expect to trim this on open today

Pact Group (PGH) Chart

2 Newcrest Mining (NCM) $32.02

MM has been disappointed with the performance of NCM and the overall Australian gold sector which has continued to ignore gold surging higher.

We are looking to exit NCM ideally 5-10% higher.

Newcrest Mining (NCM) Chart

3 Evolution Mining (EVN) $3.86

Similar to NCM we have been disappointed with gold miner Evolution Mining (EVN) which appears to remain oblivious to golds strength over recent weeks.

We are looking to exit EVN ideally 5-10% higher.

Once we have sold one of our 2 gold positions MM may become more pedantic with our exit of the second.

Evolution Mining (EVN) Chart

MM International Equites Portfolio

Last week we allocated 5% of our portfolio into TenCent (700 HK) as the Asian market plunged lower on virus fears, the purchase took our cash position down to 32% : https://www.marketmatters.com.au/new-international-portfolio/

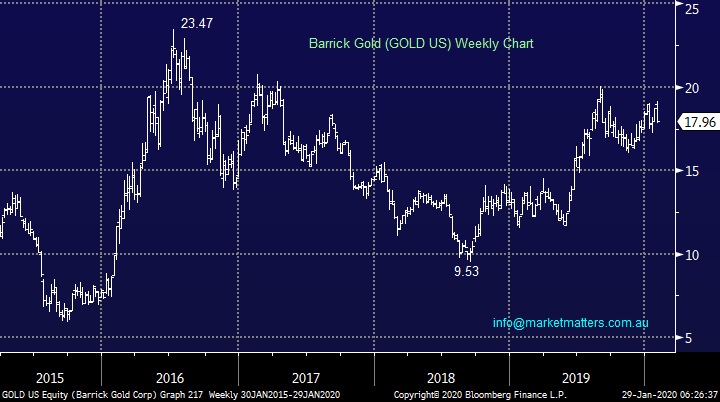

Our current thoughts are aligned with how we see equities in general i.e. buy the current pullback but ideally at lower levels plus take profit on our Barrick gold position into strength.

Our evolving shopping list includes a combination of stocks we already hold and want to add to into weakness plus fresh purchases but obviously in all / other cases it depends on the respective stock and market levels at the time:

1 – Positions we are considering increasing: Tencent (700 HK) and Alibaba (BABA).

2 – Potential fresh purchases: LVMH Moet Hennessy (MC FP) and Alphabet (GOOGL US)

LVMH Moet Hennessy (MC FP) Chart

Our ideal target area for Barrick Gold (GOLD US) remains above $US20.

Barrick Gold (GOLD US) Chart

Conclusion (s)

MM still likes the Asian and Emerging Markets into 2020, hence we plan to start accumulating related / influenced stocks into any renewed weakness.

The MM Global Macro ETF Portfolio

The MM Global Macro Portfolio remains 51.5% in cash as we watch the current volatile markets very closely. : https://www.marketmatters.com.au/new-global-portfolio/

Things feel like they are slowly coming together for the MM view as equities experience increased volatility into February, as is so often the case. We anticipate being fairly busy in the coming weeks:

1 – MM is looking to sell our positions in the iShares MSCI Silver ETF (SLVP US) and Van Eck Gold Miners ETF (GDX US) into continued strength over coming weeks – both are currently moving in the opposite direction to equities hence if we are correct and stocks have further to fall then precious metals “should” move higher.

VanEck Gold Miners ETF (GDXUS) Chart

2 – MM is still looking to increase our Emerging Markets (IEM) and Global X Copper Miners (COPX US) ETF’s into further weakness.

3 – MM will look to buy a bullish facing NASDAQ ETF into ~5% further weakness in the tech based index, our preferred vehicle is the NDQ from Betashares as its listed on the ASX : https://www.betashares.com.au/fund/nasdaq-100-etf/

4 – MM is looking to fade a new low in bond yields, our preferred ETF is the ProShares short 20+ Treasury ETF (TBF US) again for MM to get are targeted entry we are likely to need equities to take another leg lower : https://etfdb.com/etf/TBF/#etf-ticker-profile

MM is looking to buy the TBF below 18.

ProShares Short 20+year US Treasury ETF Chart

Conclusion (s)

Our ideal scenario for stocks is some short term consolidation now, another leg lower into February setting up the opportunity to tweak portfolios.

We clearly have our ideal scenario figured out now its time to sit back and wait and see if we are correct, remember when we are dealing with news driven panic (coronavirus) investors should always remain open-minded and flexible.

Overnight Market Matters Wrap

- Global equity markets gained overnight as the coronavirus concerns dissipated from yesterday afternoon, our time.

- Base metals however eased further with copper losing 0.44% to its lowest level since October, while the crude oil price has firmed slightly US$53.55/bbl.

- With the Chinese market closed for the New Year holiday, the iron ore price in Singapore yesterday dropped around 8% to US$84.70/tonne. and BHP expected to open marginally higher after ending its US session up an equivalent of 0.31% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to retrace half of yesterday’s losses and open 52 points higher, testing the 7050 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.