Should you buy healthcare stocks or resources stocks?

Today we have taken a look at 2 of the major sectors within the ASX200 as rotation is dominating the market i.e. money is being switched between both stocks and sectors as opposed to leaving / entering the overall market, this is illustrated by the ASX200 bouncing around the 6200 region for ~8-weeks.

This is an extract from a MarketMatters report from April 18 that also covered a number of other stocks and sectors - subscribe to receive the full reports

1 Australian Healthcare sector

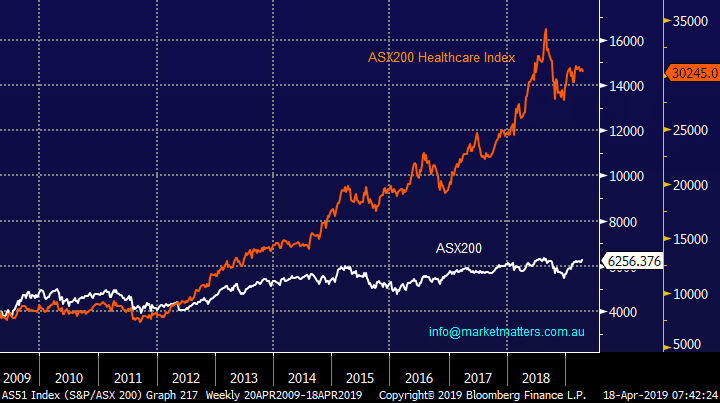

I have started off with the healthcare sector as we have been fairly vocal around the sector in 2018/9. Since the GFC the ASX200 has doubled while the Healthcare sector has more than quadrupled but the story has been very different since August last year when we have seen the popular sector fall ~10% while the index has slipped less than 2%, before we include dividends. The market has rerated the sector on a price / valuation basis with the question is there further to go.

The major stocks in the sector like CSL, Cochlear (COH) and ResMed (RMD) are world class businesses but what price should we pay, especially as we still believe the market is overweight these outperformers – it’s a similar story to Telstra earlier but in reverse. In this case we like these businesses but MM feels there is a very good chance of buying them cheaper.

Over the last decade the sector has enjoyed the strong tailwind of a weak $A and falling interest rates but we feel these multi-year trends are slowly coming to a conclusion – remember stocks generally turn at least 6-months before the underlying fundamental changes.

MM remains cautious at best towards the healthcare sector at current levels and will maintain an underweight position at most.

ASX200 v ASX200 Healthcare sector Chart

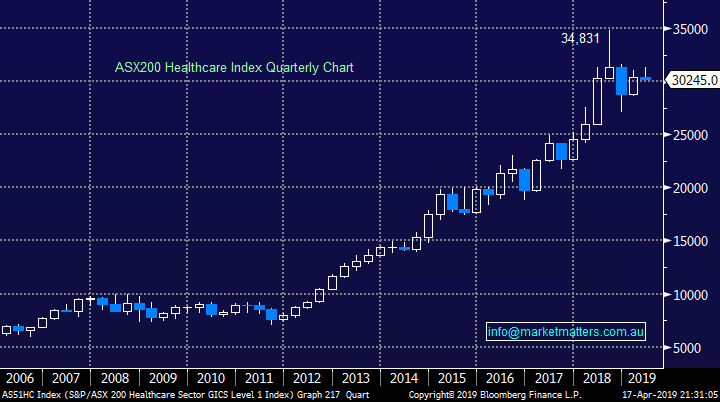

When we look at the Healthcare sector long-term a further 15% pullback would not surprise, in the bigger picture its hardly a dent in the extremely impressive advance which primarily kicked into gear ~2011.

From a risk / reward perspective we like the Healthcare sector as one over 10% lower.

ASX200 Healthcare Index Chart

When we look at the Healthcare sector long-term a further 15% pullback would not surprise, in the bigger picture its hardly a dent in the extremely impressive advance which primarily kicked into gear ~2011.

From a risk / reward perspective we like the Healthcare sector as one over 10% lower.

ASX200 Healthcare Index Chart

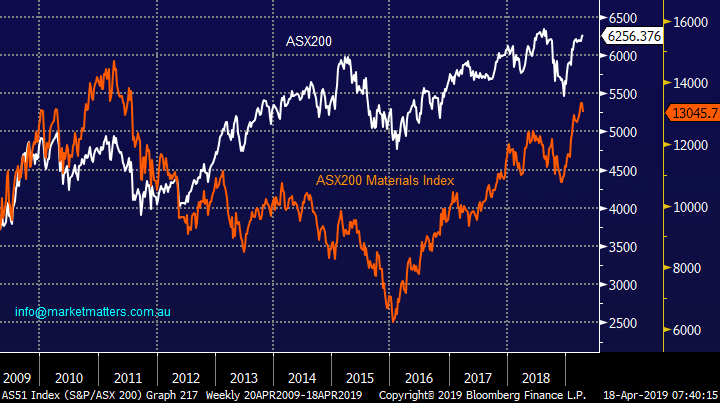

2 Australian Materials / Resources sector

The Australian resources sector has enjoyed a bumper few years but we should not lose sight that along the way the sector has pulled back 11% and 15% warning us that chasing the current new highs is a dangerous game. Much of the surge in 2019 is due to the Vale disaster in Brazil which sent the price of iron ore up over 50% but history tells us that this type of event has often created tops in markets – in the last 2-days Fortescue (FMG) has dropped over 10% showing the volatility in the sector.

Undoubtedly the “Big 3” have now become impressive cash cows and their capital management programs has clearly put them into the corner of high yielding stocks but with the underlying risk of commodity prices moving forward.

MM likes the resources stocks into weakness where the risk / reward becomes more attractive..

ASX200 v ASX200 Materials / Resources sector Chart

2 Australian Materials / Resources sector

The Australian resources sector has enjoyed a bumper few years but we should not lose sight that along the way the sector has pulled back 11% and 15% warning us that chasing the current new highs is a dangerous game. Much of the surge in 2019 is due to the Vale disaster in Brazil which sent the price of iron ore up over 50% but history tells us that this type of event has often created tops in markets – in the last 2-days Fortescue (FMG) has dropped over 10% showing the volatility in the sector.

Undoubtedly the “Big 3” have now become impressive cash cows and their capital management programs has clearly put them into the corner of high yielding stocks but with the underlying risk of commodity prices moving forward.

MM likes the resources stocks into weakness where the risk / reward becomes more attractive..

ASX200 v ASX200 Materials / Resources sector Chart

When we take a glance at the Materials sector as an index its only 3.7% below its multi-year high following a very impressive rally, the sector “feels” like it’s in the relatively early stages of at least a mild pullback.

Technically we like the sector ~2.5% lower with stops another 5% lower, good risk / reward.

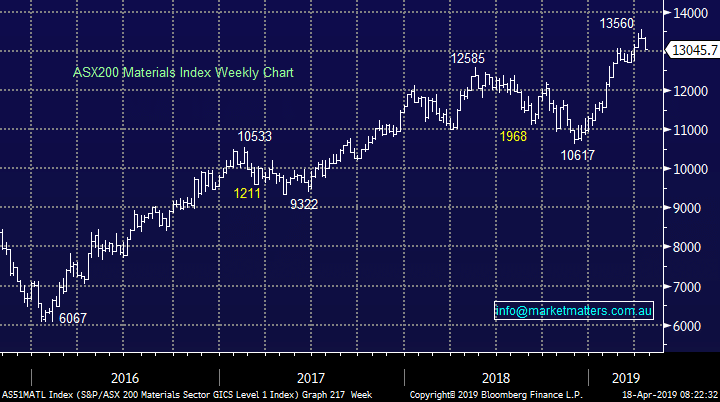

ASX200 Materials Sector Chart

When we take a glance at the Materials sector as an index its only 3.7% below its multi-year high following a very impressive rally, the sector “feels” like it’s in the relatively early stages of at least a mild pullback.

Technically we like the sector ~2.5% lower with stops another 5% lower, good risk / reward.

ASX200 Materials Sector Chart