Metcash (ASX: MTS) outlook marred strong first half result

Stock

Metcash (ASX: MTS) $2.57 as at 29/11/2018

Event

The supermarket & hardware name Metcash (ASX: MTS) has slumped today following soft outlook statements after a reasonable half result. The stock is trading down -6.7% at the time of writing. Commentary suggests the company has a rough ride ahead.

Metcash grew sales in the grocery, liquor & hardware businesses, with hardware EBIT growing 34% thanks to further synergies from the Home Timber & Hardware acquisition completed in 2017. Profit grew 3% for the six months to 31 October.

Despite the solid growth, the company has put a dampener on this momentum continuing by downplaying expectations.

Hardware is expected to be impacted by a falling housing market, dragging on the home improvement sales that has driven much of this areas growth.

The company also noted the food market continues to see increased competition which is ultimately squeezing margins for the wholesaler. Click here to see why we don’t own Coles (ASX: COL).

Liquor is the one area expected to push on, with the company pointing to the ‘premiumisation’ of the market helping drive sales. Despite this, liquor was the one are that saw EBIT fall over the first half as costs crept higher.

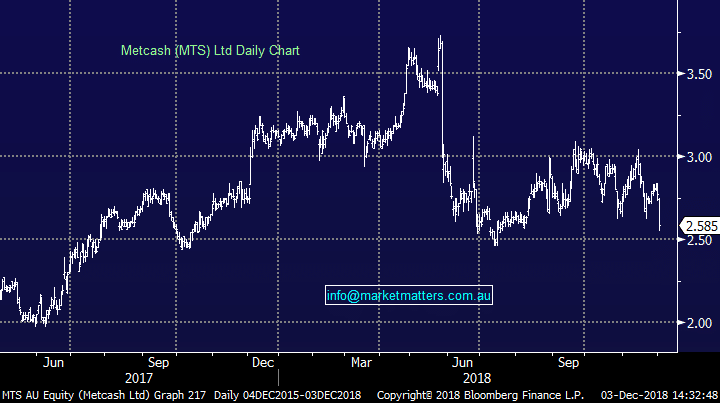

Metcash (ASX: MTS) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook