Westpac full year weighed by costs

Westpac (WBC) -0.61%

Full year results for WBC out pre-market this morning booking cash profit of $2,6b which was in line with expectations. Cash EPS was 72c which compares to the 74c expected while the dividend was 31cps representing a 49% payout ratio. In terms of the dividend, the market was forecasting 25c while a few brokers had in zero. They commented on the payout being hampered by APRA and it seems they would have paid more if they could have.

Tier 1 capital was also stronger than expected coming in at 11.13%. Net interest income was down 3% to $8,420m while Net Interest Margin fell 10bp to 2.03%, largely given headwinds from deposits and liquidity. The start of the period NIM was 2.16%. Loan volumes were down across the book (Australia Housing was down 1%, Australia Business lending fell 5%), while underlying costs rose 6%, driven by increased spending on risk and compliance – a common theme at the moment.

Clearly, it’s been a tough period for the banks, however the outcomes we’re seeing have been better than feared back in March.

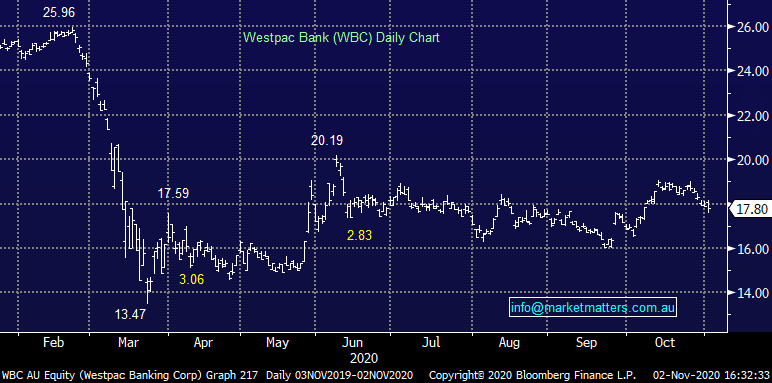

Westpac (WBC) Chart