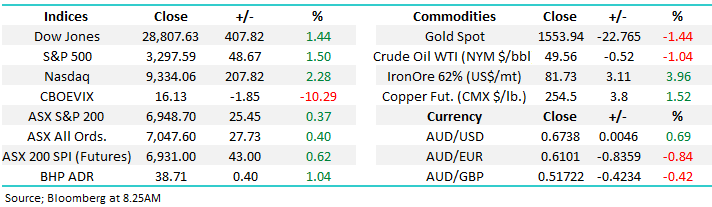

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (CBA, WBC, MLCO US, HLS, A2M, NCM, EVN, BABA US, GOLD US, GDX US, TBF US)

The ASX200 enjoyed a reasonable recovery yesterday managing to close less than 3% below its all-time high, a solid performance considering the concerns around the coronavirus growth implications. The Energy Sector remained the weakest on ground falling 1.1% as it followed crude oils 24% plunge over just 5-weeks however it was the recovery by the diversified miners that caught my eye with BHP Group (BHP), RIO Tinto (RIO (RIO) and Fortescue Metals (FMG) all recovering from early losses to close up on the day – the buyers appear to be “bottom picking”.

The coronavirus news is absolutely awful but as I alluded to in yesterday’s afternoon report its slowly becoming stale / old news with reporting season forcing its way back into the limelight, while the anticipated Chinese stimulus is starting to have an impact. Tuesday evening saw the death toll reach 420 with over 20,000 people infected, China continues to pull all the correct quarantine levers and while it’s easy for people in their ivory towers to cast blame I feel they’ve probably acted a lot faster than we would have, remember they built 2 hospitals in 10-days whereas the Sydney metro rail project is hoped to be finished by 2024 while costs have already blown out by a colossal $4.3bn, or over 30%.

The main news yesterday for equities was delivered by the RBA who left interest rates on hold at 0.75% while at the same time delivering a fairly optimistic outlook on the Australian economy, not what many had expected. Basically, they said that last year’s 3 rate cuts were providing a solid tailwind to both employment and growth while acknowledging the obvious uncertain impact from the bushfires and coronavirus – sounded to me like a classic case of “let’s wait and see” which makes sense. The futures markets are now pricing in a 66% chance of a cut in April although all of the “Big 4” banks expect the RBA to act, I’m far closer to 50-50 but the picture should at least become clearer as we move through reporting season.

MM will become very bullish the ASX200 if it can close back above 7000.

Overnight US stocks surged higher with the Dow closing up +407-points, although it was around 100 points from the session highs, while the SPI futures are pointing to an open up over 50-points by the ASX200.

Reporting season is ramping up locally and our coverage will expand on this front. Today there are reports from property companies CIP & CMA, along with mortgage insurer Genworth (GMA). A reporting calendar is available HERE

Today we’ve focused on our recent moves in the Overseas & ETF Portfolio’s as we position ourselves for what MM believes is another leg higher in risk assets.

ASX200 Chart

US equities are bouncing strongly as I type with the Dow up almost 500-points at its overnight best while the NASDAQ’s surging to fresh all-time highs, the coronavirus is already in the rear view mirror for the likes of Apple Inc (AAPL US) and Microsoft (MSFT US).

MM remains bullish US equities with an ideal sell level for the S&P500 close to 3400, 3% higher.

US S&P500 Index Chart

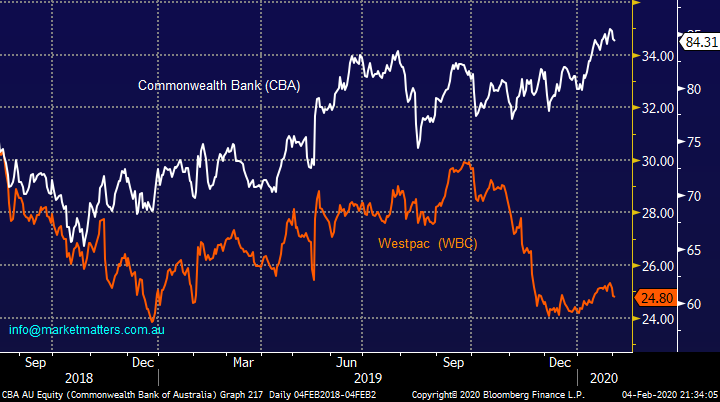

Over the last 3-months we’ve seen Commonwealth Bank (CBA) rally over +29% while Westpac (WBC) has fallen more than -11%, the outperformance elastic band feels extremely stretched. If we look at the basic simple metrics we see on a valuation perspective CBA is trading on an Est P./E of 17.5x compared to WBC on 13.8x while on the Est. yield its CBA @ 5.1% and WBC @ 6.45% , both fully franked i.e. as you would expect WBC is much “cheaper” and pays a higher yield. It’s being priced for the unknown of the pending Austrac investigation and likely large fine, the concern being they’ll need to raise additional capital however I personally doubt this, the cynic would suggest they raised before the announcement came from Austrac.

At current prices CBA feels “rich” compared to its peers.

Commonwealth Bank (CBA) & Westpac Bank (WBC) Chart

Macau is now shutting down all of its casinos for 2 weeks, most certainly choking off all the income for the island hence we find ourselves asking whether this will create some opportunity in the sector which has seen the likes of Melco Resorts fall by 20% in a few weeks. The sector has been struggling since 2018 which makes the reaction to the negative news a little less attractive, but the risk / reward is ok for those keen on the sector.

MM likes MLCO as a very aggressive play around $US20.

Locally neither Crown (CWN) or Star Entertainment (SGR) are particularly exciting to MM even after recent weakness, shame but never a good idea to “push investments”.

Melco Resorts & Crown Entertainment (MLCO US) Chart

2 local stocks that are in the MM “ buy headlights.”

After the last fortnights volatility this list has understandably evolved and as we consider exiting / reducing our gold position it’s important to have a handle on our current shopping list:

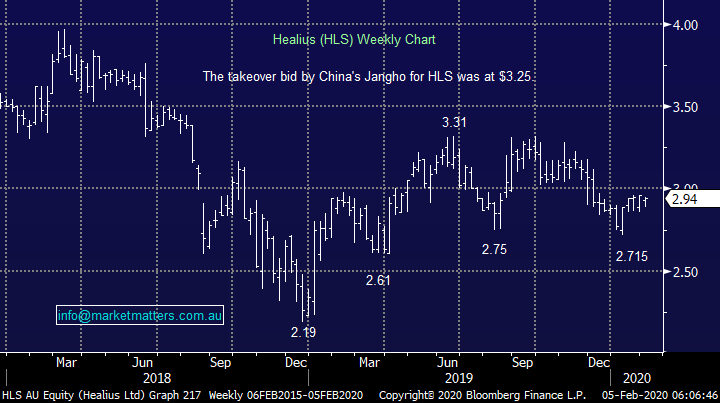

1 Healius (HLS) $2.94

Private hospital operator has been trading sideways over the last 6-months, but MM feels the time is right for another assault on $3.50 area especially from a risk / reward perspective.

Healius (HLS) Chart

2 a2 Milk (A2M) $14.05

One stock on our shopping list this week where we haven’t yet pressed the buy button is a2 Milk (A2M) which disappointed yesterday falling -0.8%. The Food & Beverage sector is one MM likes in the coming months and it’s been strong recently outperforming the index, we feel the virus outbreak in China can only help our food producers over the medium to longer-term.

MM remains bullish A2M around $14.

a2 Milk (A2M) Chart

2 local stocks that are in the MM “sell / reduce headlights.”

No surprises here and in hindsight we should have said “arrivederci” to our gold exposure when it first “felt wrong”.

1 Newcrest Mining (NCM) $29.31

MM has been disappointed with the performance of NCM and the overall Australian gold sector which has continued to ignore gold surging higher and uncertainty around coronavirus.

We are looking to exit NCM.

Newcrest Mining (NCM) Chart

2 Evolution Mining (EVN) $3.79

Similar to NCM we have been disappointed with gold miner Evolution Mining (EVN) which appears to remain oblivious to golds strength over recent weeks.

We are looking to exit EVN.

Evolution Mining (EVN) Chart

MM International Equites Portfolio

Last night we allocated 5% of our MM International Portfolio into Visa (V US) plus adding 3% to TenCent (700 HK) and Ping An Insurance (2318 HK) taking our cash position down to 21% : https://www.marketmatters.com.au/new-international-portfolio/

Our current thoughts are aligned with how MM sees equities in general - the recent pullback was a buying opportunity but we aren’t interested in chasing strength believing that when many indices / stocks scale fresh all-time highs it will be a time to take some money from the table. The tech based NASDAQ continues to lead the way making fresh highs as I type rallying well over 2%, our current technical target area for this high flying index is 9500-9700.

MM continues to expect that 2020 will be a choppy / volatile year – so far so good!

NASDAQ Index Chart

One of our China / Asia facing holdings Alibaba (BABA US) is following our anticipated path perfectly:

1 – We are targeting ~$US250 for BABA, or 10% higher.

2 – MM is likely to take some $$ from the table if / when this unfolds before sitting back to reassess.

Alibaba (BABA US) Chart

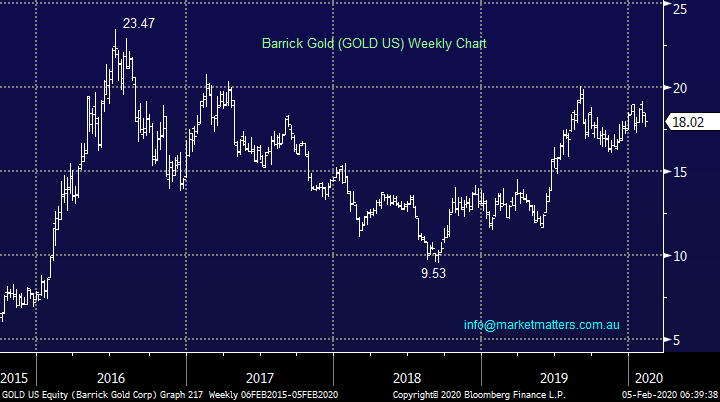

Barrick Gold has significantly outperformed the Australian precious metals miners leaving us a little more patient with our holding.

Barrick Gold (GOLD US) Chart

Conclusion (s)

MM continues to believe 2020 will be a volatile year where investors should be active - sell strength and buy weakness.

The MM Global Macro ETF Portfolio

Overnight for the MM Global Macro Portfolio we added 5% to our Global X Copper Miners ETF (CPOX) position plus adding 3% to our iShares MSCI Emerging markets (IEM) & 2% to our BetaShares Global Banks ETF (BNKS US) holdings reducing our cash position down to 41.5% . : https://www.marketmatters.com.au/new-global-portfolio/

Things continue to feel like they are slowly coming together for the MM viewpoint as equities experience increased volatility into February, as is so often the case. We anticipate being fairly busy in the coming weeks / months assuming our outlook remains on-point.

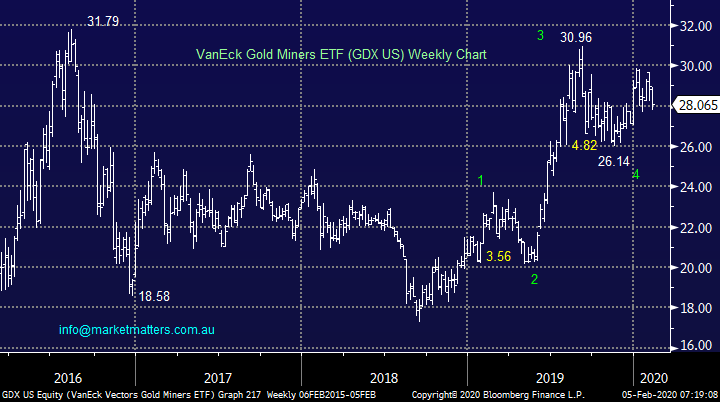

1 – MM is looking to sell / reduce our positions in the iShares MSCI Silver ETF (SLVP US) and Van Eck Gold Miners ETF (GDX US)– both are currently moving in the opposite direction to equities hence if we are correct and stocks are ready to move higher precious metals are unlikely to follow in their footsteps.

VanEck Gold Miners ETF (GDX US) Chart

2 - MM will look to increase our short S&P500 ProShares ETF position into fresh highs if / when they occur.

3 – MM is looking to fade a new low in bond yields, our preferred ETF is the ProShares short 20+ Treasury ETF (TBF US) : https://etfdb.com/etf/TBF/#etf-ticker-profile

MM is ideally looking to buy the TBF below 18.

ProShares Short 20+year US Treasury ETF Chart

Conclusion (s)

MM believes US stocks have bottomed for now and will now rally to fresh all-time highs, just like the NASDAQ. We have tweaked our portfolio for this move and will look to again reverse its skew if / when new highs are achieved.

Overnight Market Matters Wrap

- Investors switched their risk back on across the globe as they assume the current coronavirus would not dampen global growth as much as they had expected earlier. This, along with China’s current stimulus, had the key major indices rally, with the broader S&P 500 up 1.5% overnight.

- On the commodities front, Dr. Copper rose for the first time in 14 sessions and other metals on the LME closed in the black. Crude oil, however, is trading slightly lower even though there is talk of OPEC production cuts. Gold lost its lustre, while the yield on US 10-year government bonds rose to 1.6%.

- BHP is expected to outperform the broader market, after ending its US session up an equivalent of 1.04% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 54 points higher, testing the 7000 level this morning

Have a grat day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.