BHP finishes the year strong

BHP Group (BHP) +1.09%

Performed in line with peers – which underperformed the market – on the back of their 4th quarter production numbers. For the bulk, they were largely as expected, particularly in the key profit drivers. BHP’s largest earner is Iron ore with around 60% split at the EBIT level and the company delivered as expected here with 67mt produced for the last 3 months for their best quarter of the year. Copper, the next cab off the rank in terms of EBIT contribution, was marginally below the streets number though BHP was given some wiggle room here given COVID shutdowns impacting their Peru mine. The other two key copper mines – Escondida & Olympic Dam – both saw higher production rates in the quarter to make up for some of the shutdown with 1,724kt of copper scraping in to the lower end of previous guidance. The two smallest earners – petroleum and coal – finished the year with a miss and a beat respectively, but largely uncared for by the market.

For the most part it was a good set of numbers from the big Australian. FY21 guidance does look light on but not a huge concern for investors at the moment. Eyes will be on the full year results out in a matter of weeks – a record quarter of iron ore sales in Q4 could see BHP once again beat dividend expectations – a positive thing in a market which has been starved of yield.

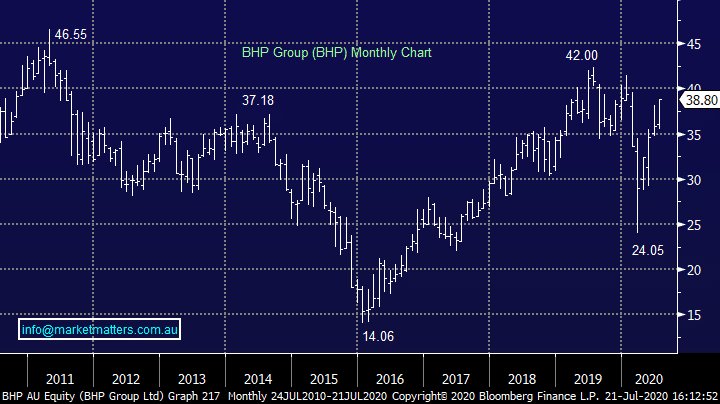

BHP Group (BHP) Chart