Westpac (WBC) +2.80%: Westpac this morning released

1H20 results and there wasn’t a lot of new news from an earnings perspective - 1H20 was very similar to 2H19 with a few swings and roundabouts. Net interest income increased by 1% from 2H19 to 1H20 as a result of no change in net interest margins and a small increase in loans. Non-interest income declined by 18% from 2H19 to 1H20 with the insurance businesses responsible for most of the decline. Banking fee income declined as well. Expenses increased by 3%, excluding notable items, from 2H19 to 1H20 and a decision on the interim dividend was deferred and I expect it will probably not be paid. WBC’s cash net profit fell from $3.5B in 2H19 to $1B in 1H20 as a result of a $1B charge for AUSTRAC and $2.2B bad debt charge in 1H20. The size of that provision suggests WBC is being more conservative than both ANZ and NAB, however like the others, they are using the base case of a V shaped recovery in their economic assumptions.

WBC forecast a 5% contraction in GDP in calendar 2020, before growth of 4% is achieved in 2021, a similar dip then recovery in both unemployment and house prices. Time will tell if this is accurate however as Buffet said over the weekend, there is a very wide set of possible economic outcomes from this global pandemic. All up, the underlying result today was better than feared, the bad debt charge had been flagged, a known known while their decision to defer the dividend is sensible. Tier 1 capital sits at 10.8x and they have flagged the potential of asset sales, which I think is a real positive in today’s update, particularly the advice business, it’s all too hard in that space. By deferring the dividend and flagging asset sales, WBC are trying very hard not to raise capital, and at this stage, it’s unlikely they will need to.

We own WBC.

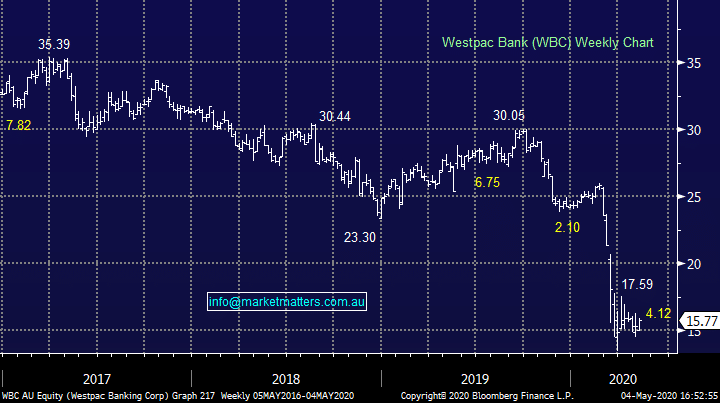

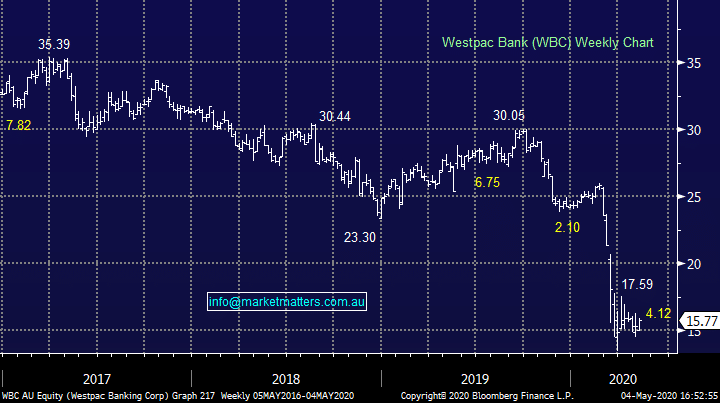

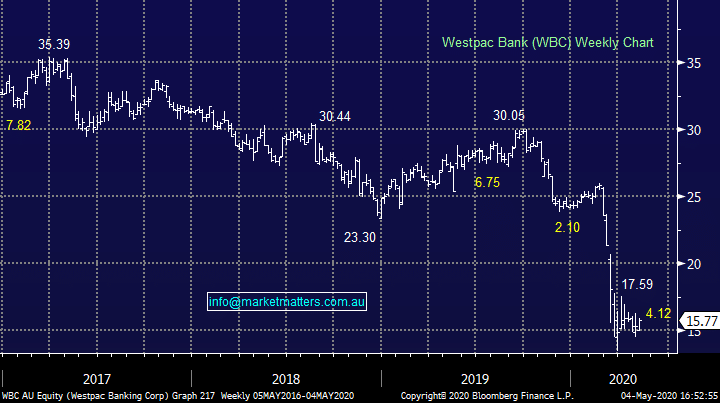

Westpac (

WBC) Chart