NAB raises equity

NAB: the first bank to report their half year for the season - they brought forward their result to get the jump on the other banks. The result itself was largely inline – net interest income up 2% despite a small decline in net interest margin. Expenses offset the increase in net interest income by climbing 2%. Softer trading income and higher bad debts and impairment charges that were previously flagged weighed on earnings which fell nearly 25%.

NAB was forced into cutting the dividend to 30c, from 83c last year, and launched a $3.5bn capital raise to sure up their CET1 position ahead of the most severe economic impacts of COVID-19. While investors couldn’t sell NAB shares today, the other banks felt the weight of money to fill allocations into the NAB capital raise. We still prefer CBA then WBC, although WBC may well follow NAB down the capital raise path when they report this week. The raise was completed at $14.15, a 8.5% discount to last after the dividend is taken into account (new shares won't receive the 30c interim div).

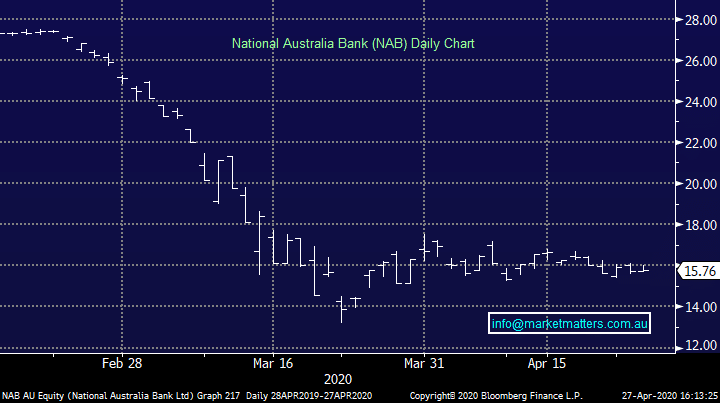

NAB Chart