Subscriber Questions – Gold and Coal stocks, AMP & MXT

**This is an extract from the Market Matters Morning Report from 3 February. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more Question 3 “Hi Team, Thanks for a great and profitable service over the last year or so—don’t ever stop!!! Happy Belated New year to all. I have been running my own SMSF portfolio for many years, but became disillusioned with the “advice”/newsletter/broker industry in general and sold the lot and replaced everything with my own system picks just after Trump was ushered in. Since then I’m happy to say I’m 45% up (excluding all the nice dividends) with low risk stocks , and my “old experts” portfolio would have shown maybe 10% growth for the period...I have you MM guys to thank for quite some of that—so thanks. I have a few questions that I hope you can help with.

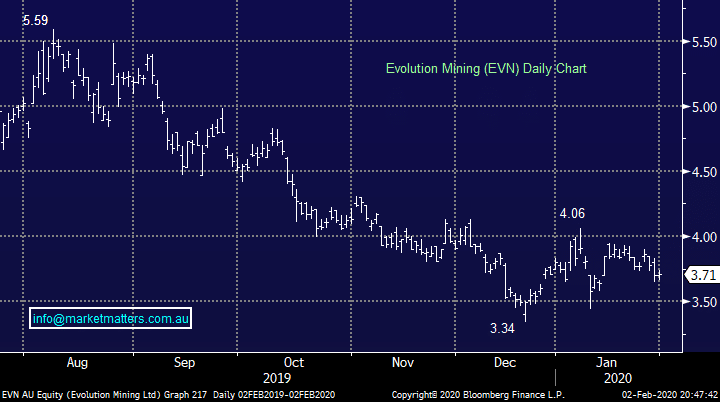

- EVN/DCN—I bought these mid last year I think after avoiding the gold sector successfully for about 20 years! Since then, I continue to see DCN running at around 195% profit and EVN a steady 20 odd % loss, despite EVN having, according to brokers a “pristine “balance sheet, good management, reserves and prospects. DCN not quite so glowing, but far more profitable (so far) Given that gold stocks are a capital growth play (negligible dividends), I wonder what your opinion is of EVN growth possibilities for remainder of this FY? (I’m tempted to sell both to be honest…. certainly, watching the stubborn red colour attached to EVN gets a bit old.)

- WHC/CRN ….

Question 7

“Hey James, any thoughts on AMP and Metrics Credit Master Income Trust. Returned about 5% in the last 12-months and looks relatively safe??” - Cheers Tim N.

Morning Tim,

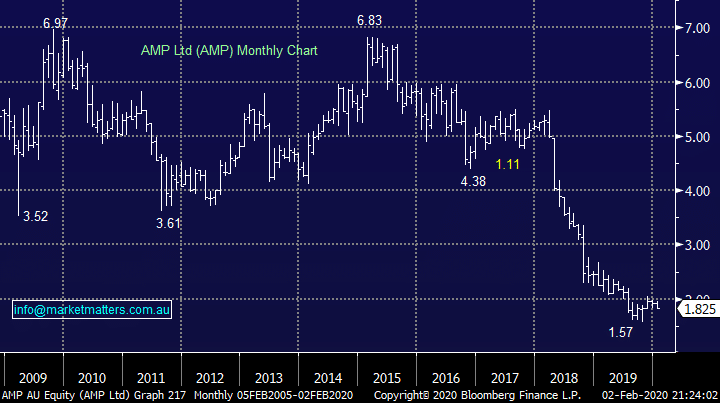

AMP is in the too hard basket, it will probably bounce over 25% at some stage in 2020 but a heap of money has been lost by investors trying to pick a bottom in this market underperformer.

We own MCP Metrics Master Income Trust (MXT) in our Income Portfolio and wrote the following on it a while back – still remains true.

MCP Income Opportunities Trust (MOT) $2.06: After the success of MXT, Metrics came back to market with another offering in May of this year which we described at the time as being MXT’s riskier cousin. The fund invests in a number of different sub trusts with the underlying investments being higher risk credit described as sub investment grade. They pay higher yield but come with a higher level of risk. The manager has more discretion in MOT than they do in MXT to take advantage of opportunities as they arise, however less structure means returns rely more heavily on the Portfolio Manager getting it right. There is a bunch of risk management limitations in MXT that are not in MOT and as a consequence the risk is higher and so to the targeted returns, 7% p.a. income (plus a few % capital growth to get the 8-10% total return target).

What we like: A higher risk, higher return offering from a quality manager with a good track record, distributions will not be topped up by capital if there is a shortfall in income from loans.

What we don’t: High fees with annual management fee of 1.45% and a pretty aggressive +15.38% performance fee over RBA + 6% benchmark. Worth noting that with the RBA rates below 1%, the performance fee will be paid before the income target of 7% is hit and distributed. On the flipside, if the RBA raise rates this becomes a more challenging task and given the broad structure of the trust and discretion of the Manager it could push them to take more risk to achieve performance targets.

AMP Ltd (AMP) Chart

Question 7

“Hey James, any thoughts on AMP and Metrics Credit Master Income Trust. Returned about 5% in the last 12-months and looks relatively safe??” - Cheers Tim N.

Morning Tim,

AMP is in the too hard basket, it will probably bounce over 25% at some stage in 2020 but a heap of money has been lost by investors trying to pick a bottom in this market underperformer.

We own MCP Metrics Master Income Trust (MXT) in our Income Portfolio and wrote the following on it a while back – still remains true.

MCP Income Opportunities Trust (MOT) $2.06: After the success of MXT, Metrics came back to market with another offering in May of this year which we described at the time as being MXT’s riskier cousin. The fund invests in a number of different sub trusts with the underlying investments being higher risk credit described as sub investment grade. They pay higher yield but come with a higher level of risk. The manager has more discretion in MOT than they do in MXT to take advantage of opportunities as they arise, however less structure means returns rely more heavily on the Portfolio Manager getting it right. There is a bunch of risk management limitations in MXT that are not in MOT and as a consequence the risk is higher and so to the targeted returns, 7% p.a. income (plus a few % capital growth to get the 8-10% total return target).

What we like: A higher risk, higher return offering from a quality manager with a good track record, distributions will not be topped up by capital if there is a shortfall in income from loans.

What we don’t: High fees with annual management fee of 1.45% and a pretty aggressive +15.38% performance fee over RBA + 6% benchmark. Worth noting that with the RBA rates below 1%, the performance fee will be paid before the income target of 7% is hit and distributed. On the flipside, if the RBA raise rates this becomes a more challenging task and given the broad structure of the trust and discretion of the Manager it could push them to take more risk to achieve performance targets.

AMP Ltd (AMP) Chart