Subscriber Questions – Abacus, Hybrids & Lithium stocks

**This is an extract from the Market Matters Morning Report from 20 January. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 2

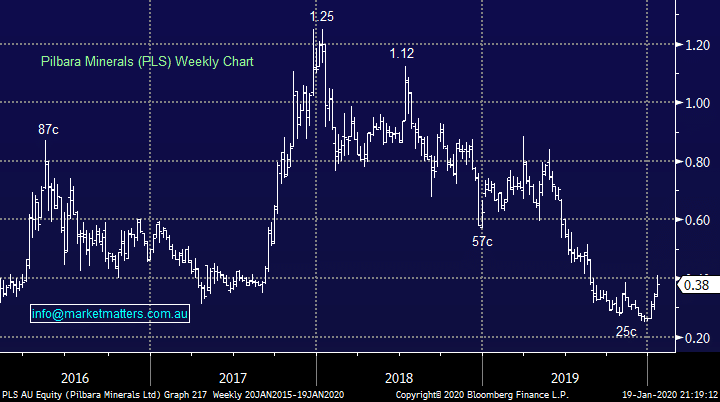

“Hi Just a question for your next report. I’m looking at Abacus (ABP) as an income play as an alternative to a term deposit. From my reading, they have changed their business strategy and appears appealing. I suspect there may be not large capital gains, but the yield looks attractive. I’m interested in your thoughts.” -Thanks Chris F.

Hi Chris,

Property group ABP is forecast to yield just over 5% unfranked over the next 12-months, certainly attractive in today’s environment. We do hold Abacus Property (ABP) in the MM Income Portfolio and your right Chris, they have made a conscious change progressively over the past few years from being a diversified REIT to being more focussed in self-storage and office assets. In 2016 they had ~50% of their funds in storage and office and today they hold around 80% of their assets across these areas. They still hold some retail assets however they’ve become a lot more negative on this part of the market in recent times, and it’s an area they’re unlikely to focus on in the future.

They’ve made a few recent acquisitions having bought 99 Walker Street in North Sydney at the end of last year for $311m, which is their largest asset to date, buying it on a cap rate of 5% (in other words, it generates a yield of 5%). Their office exposure should provide base line yield while self-storage is where they can differentiate / add value. In the longer term, I’m less bullish on office versus self-storage. Thinking more broadly, and Hamish Douglas from Magellan is good at doing this, as virtual reality becomes more mainstream, it’s easy to see less demand for traditional office buildings in expensive CBD locations whereas self-storage will benefit from the shift towards smaller higher density residential footprints. Market Matters income portfolio: https://www.marketmatters.com.au/new-income-portfolio-csv/

MM remains bullish on ABP for income

Abacus Property (ABP) Chart

Question 3

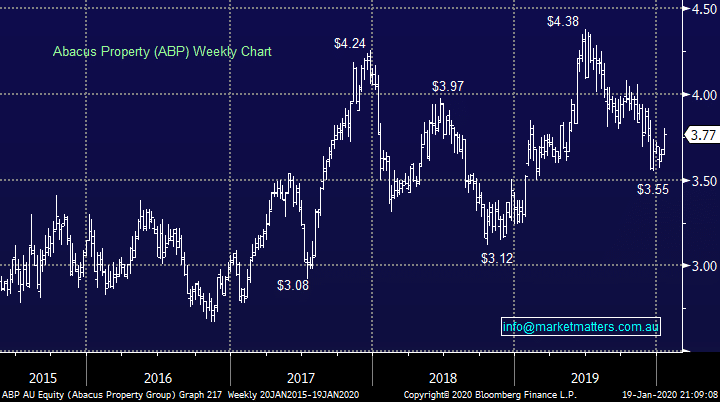

“Hi guys, hope you had a great Xmas and hope the New Year is great. My question involves choosing a suitable group of Hybrids to replace my Term Deposits. The best I get now is 2.10% at present, but I am sure when it is renewed in 6 months, this will diminish. I realise you can't offer specific advice, but some sort of indication of what the best Hybrid is or? investment to replace TD.” – Geoff.

Hi Geoff,

I covered some questions on Hybrids in the Income Note last Wednesday. To recap, when thinking about a hybrid security we need to understand the drivers of returns. 1. The issuer, how secure are they? Most investors stay in the bigger bank hybrids which are much the same, and that security issue is less relevant. 2. Type of security. There are generally two types, a tier 1 security or a tier 2 security. Tier 2 is safer; more debt like with less convertibility, so they pay lower rates while Tier 1’s are what the banks have generally been issuing given higher capital requirements. To keep things simple, tier 1 securities are the most common, so comparing these is probably most relevant & 3. Duration, the longer the time to first call date, the higher the yield should be, more time for things to go wrong.

Here’s the most attractive hybrids as of today with mixed durations. Shorter dated, all things being equal mean safer, less volatility.

Short Term (1.9 years): WBCPG $104.49, yield to first call date of 3.43%

Medium Term (4.3 years): CBAPH $103.78, yield to first call date of 3.82%

Long Term (~6-7 years): AMPPB $100.50, yield to first call date of 5.54%, MQGPD $106.96, yield to first call date of 4.17%, CBAPI $101.38, yield to first call date of 4.11%

For a full hybrid pricing sheet thanks to the Shaw & Partners Income Team – click here

RBA Official Cash Rate Chart

Question 3

“Hi guys, hope you had a great Xmas and hope the New Year is great. My question involves choosing a suitable group of Hybrids to replace my Term Deposits. The best I get now is 2.10% at present, but I am sure when it is renewed in 6 months, this will diminish. I realise you can't offer specific advice, but some sort of indication of what the best Hybrid is or? investment to replace TD.” – Geoff.

Hi Geoff,

I covered some questions on Hybrids in the Income Note last Wednesday. To recap, when thinking about a hybrid security we need to understand the drivers of returns. 1. The issuer, how secure are they? Most investors stay in the bigger bank hybrids which are much the same, and that security issue is less relevant. 2. Type of security. There are generally two types, a tier 1 security or a tier 2 security. Tier 2 is safer; more debt like with less convertibility, so they pay lower rates while Tier 1’s are what the banks have generally been issuing given higher capital requirements. To keep things simple, tier 1 securities are the most common, so comparing these is probably most relevant & 3. Duration, the longer the time to first call date, the higher the yield should be, more time for things to go wrong.

Here’s the most attractive hybrids as of today with mixed durations. Shorter dated, all things being equal mean safer, less volatility.

Short Term (1.9 years): WBCPG $104.49, yield to first call date of 3.43%

Medium Term (4.3 years): CBAPH $103.78, yield to first call date of 3.82%

Long Term (~6-7 years): AMPPB $100.50, yield to first call date of 5.54%, MQGPD $106.96, yield to first call date of 4.17%, CBAPI $101.38, yield to first call date of 4.11%

For a full hybrid pricing sheet thanks to the Shaw & Partners Income Team – click here

RBA Official Cash Rate Chart

Question 4

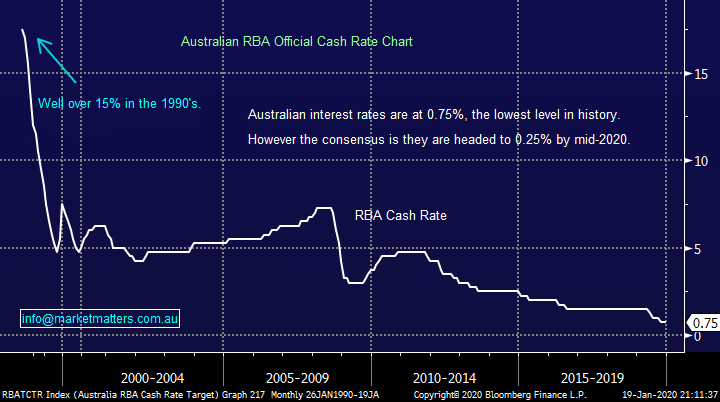

“Would be interested in your current view of the lithium mining space such as PLS, ORE, AJM, GXY etc. Any value here they've all fallen a long way in the last two years but seem to be on the uptick now.” - Cheers, Shannon N.

“Could you please provide some feedback on the move in lithium and graphite stocks such as SYR, PLS and GXY. Is this the beginning of something or just a pump and dump” – thanks Arthur H.

“Hey James, I’m not a lithium man but the below may contradict your report this morning for those that are waiting to trade.” - Cheers mate :https://investorintel.com/sectors/cleantech/cleantech-intel/the-ev-downturn-looks-to-be-over-as-china-ev-sales-rebound-in-december-2019-and-subsidies-look-safe-for-2020/

Hi Guys,

Lithium stocks have certainly enjoyed a return to the winners circle over the last few weeks albeit from an extremely low base, an enormous short position in a number of the names is likely to have magnified the upside squeeze e.g. Orocobre (ORE) 13.8% and Pilbara (PLS) 7.9%. Importantly these shorts illustrate the professional traders are still bearish many names in the sector.

The link in the 3rd question above certainly makes some interesting bullish reading although a few months doesn’t make a trend i.e. a number of industries have enjoyed a pickup in activity since the US – China resolution on trade. Electric vehicle (EV) stocks have soared led by Tesla in recent weeks and we feel they may be a better way to play the economic evolution because the last few years illustrated how easily the supply tap can be turned on for lithium.

At this stage I stick with our conclusion in last Wednesdays International Report: “However, for the shorter-term traders I’m sure 2020 will provide some solid risk / reward trading opportunities in the likes of PLS and ORE but it’s tricky here following their recent pop higher.”

ORE has already fallen almost 12% from last week’s high, arguably a good time to jump on board for the bulls.

Pilbara Minerals (PLS) Chart

Question 4

“Would be interested in your current view of the lithium mining space such as PLS, ORE, AJM, GXY etc. Any value here they've all fallen a long way in the last two years but seem to be on the uptick now.” - Cheers, Shannon N.

“Could you please provide some feedback on the move in lithium and graphite stocks such as SYR, PLS and GXY. Is this the beginning of something or just a pump and dump” – thanks Arthur H.

“Hey James, I’m not a lithium man but the below may contradict your report this morning for those that are waiting to trade.” - Cheers mate :https://investorintel.com/sectors/cleantech/cleantech-intel/the-ev-downturn-looks-to-be-over-as-china-ev-sales-rebound-in-december-2019-and-subsidies-look-safe-for-2020/

Hi Guys,

Lithium stocks have certainly enjoyed a return to the winners circle over the last few weeks albeit from an extremely low base, an enormous short position in a number of the names is likely to have magnified the upside squeeze e.g. Orocobre (ORE) 13.8% and Pilbara (PLS) 7.9%. Importantly these shorts illustrate the professional traders are still bearish many names in the sector.

The link in the 3rd question above certainly makes some interesting bullish reading although a few months doesn’t make a trend i.e. a number of industries have enjoyed a pickup in activity since the US – China resolution on trade. Electric vehicle (EV) stocks have soared led by Tesla in recent weeks and we feel they may be a better way to play the economic evolution because the last few years illustrated how easily the supply tap can be turned on for lithium.

At this stage I stick with our conclusion in last Wednesdays International Report: “However, for the shorter-term traders I’m sure 2020 will provide some solid risk / reward trading opportunities in the likes of PLS and ORE but it’s tricky here following their recent pop higher.”

ORE has already fallen almost 12% from last week’s high, arguably a good time to jump on board for the bulls.

Pilbara Minerals (PLS) Chart