2020 Outlook – Currency drivers for the year ahead

**This is an extract from the Market Matters Morning Report from 13 January. Click here to get access to the full report and more

Markets are global and currencies are very important. The $A is largely driven by interest rate differentials among other factors, but it’s the positioning around the $A which makes the local currency a fascinating subject to us at the moment – we believe investors are positioned for a lower for longer $A implying the more aggressive move could happen on the upside.

We have a contrarian bullish opinion on the $A, which if correct will remove the major earnings tailwind that has been helping Australian companies with significant $US earnings.

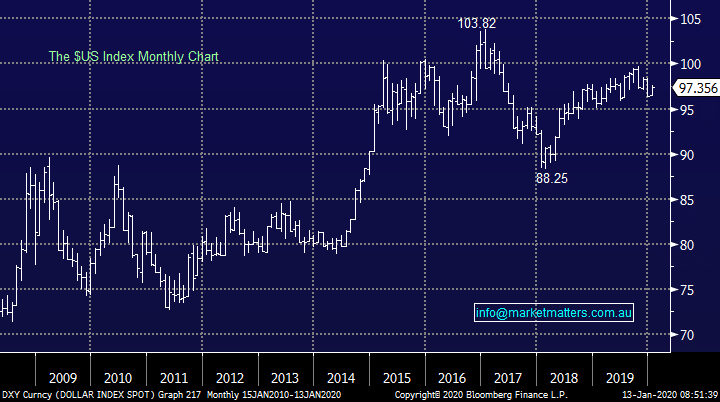

Our view is primarily driven by a bearish outlook for the $US which we believe has reached a major point of inflection after a decade-long rally since the GFC. As we approach the November 2020 election in the US, the President will likely pull all stops for re-election and applying pressure on the currency in various ways would be very supportive of economic growth. While the Federal Reserve cut rates in October, Chairman Powell made it very clear that any rate hikes will be conditional upon a marked and sustained uptick in inflation while they will cut again if economic conditions warrant it.

US Dollar Index (DXY) Chart

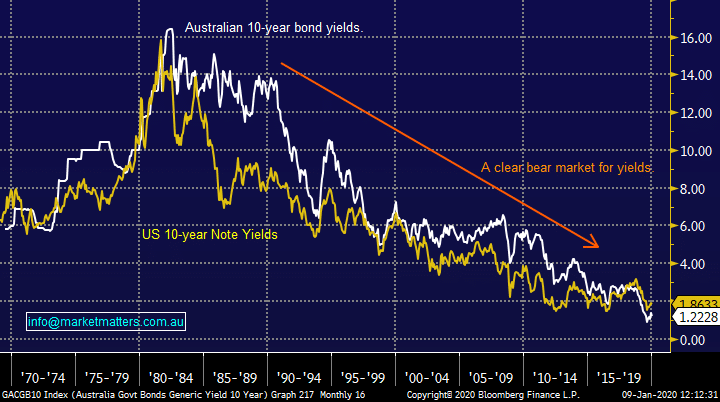

Historically, it's extremely rare to see Australian 10-year bond yields below their American counterparts but that’s very much the case today, a huge contributing factor to the prolonged bear market for the $A. If we are correct and Australian bond yields again converge and eventually go above their US equivalent, as has been the norm for the past 50-years, it’s easy to envisage the $A back up around 80c.

Australian & US 10-year Bond Yields Chart

Historically, it's extremely rare to see Australian 10-year bond yields below their American counterparts but that’s very much the case today, a huge contributing factor to the prolonged bear market for the $A. If we are correct and Australian bond yields again converge and eventually go above their US equivalent, as has been the norm for the past 50-years, it’s easy to envisage the $A back up around 80c.

Australian & US 10-year Bond Yields Chart

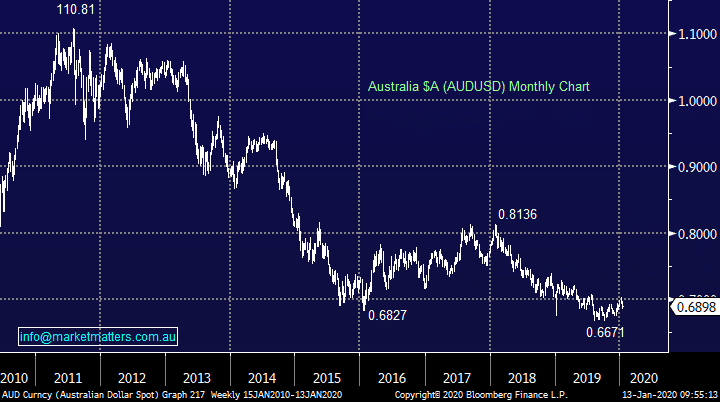

MM is bullish the $AU versus the $US ultimately targeting the 80c region.

Australian Dollar vs US Dollar Chart

MM is bullish the $AU versus the $US ultimately targeting the 80c region.

Australian Dollar vs US Dollar Chart

Finally, as the fog lifts around the future of the UK following 3 years of BREXIT uncertainty, the Pound remains cheap in our view relative to the $US. UK Equities have been major laggards in recent years and from a global perspective, could play catch up with other markets, and performance would be improved via a rally in the currency.

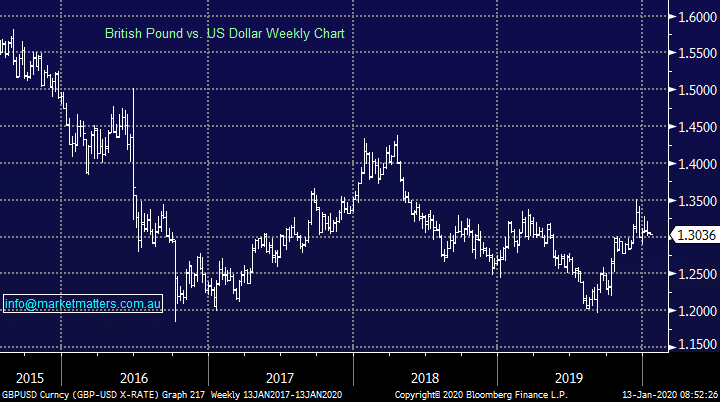

MM is bullish the GBP

British Pound vs US Dollar Chart

Finally, as the fog lifts around the future of the UK following 3 years of BREXIT uncertainty, the Pound remains cheap in our view relative to the $US. UK Equities have been major laggards in recent years and from a global perspective, could play catch up with other markets, and performance would be improved via a rally in the currency.

MM is bullish the GBP

British Pound vs US Dollar Chart