Our call on inflation for the year ahead

**This is an extract from the Market Matters Weekend Report from 22 December. Click here to get access to the full report and more

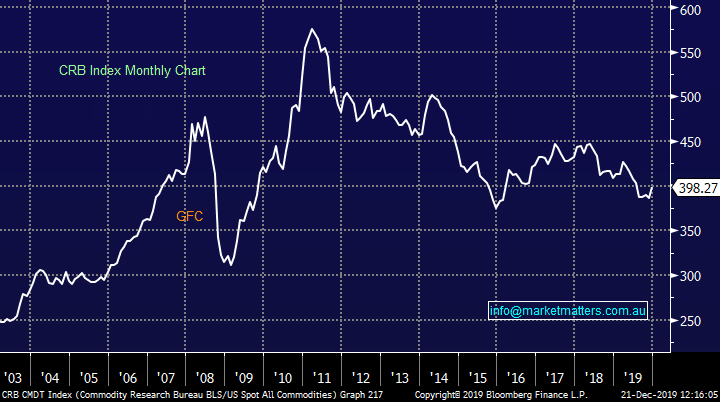

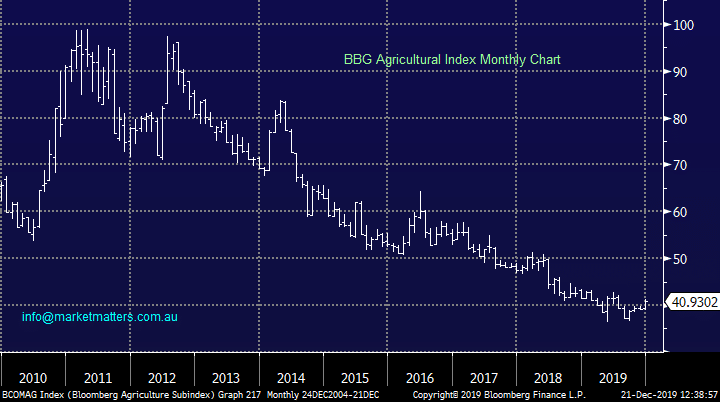

MM has been discussing our view that industrial metals were looking strong into 2020 which has panned out over the last month. Last we added the Agricultural Index to the mix which is also now looking bullish in our opinion, if both the Agricultural and Metal complexes are going to rally then inflation is almost definitely going to follow higher.

Rising inflation will eventually take bond yields along for the ride.

CRB Index (All Commodities) Chart

BBG Agricultural Index Chart

BBG Agricultural Index Chart

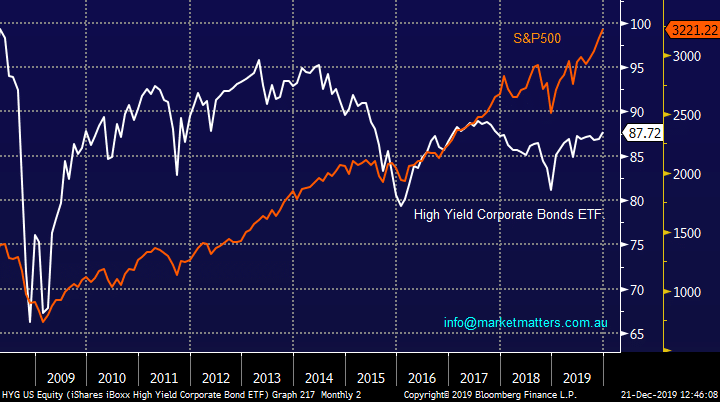

US bonds are well below their lows of 2013 / 2014 which illustrates how impressive the rally has been by US stocks, sure it’s been supported by consistently low interest rates but not by plunging interest rates like in Australia. US stocks are enjoying sitting in the eye of the perfect storm with corporates performing strongly while bond yields remain close to their all-time low, rising inflation could easily become a “spanner in the works”.

If / when bonds turn lower / yields higher it’s going to create a major headwind for stocks.

The US Fed is currently flooding the market with liquidity in an attempt to avoid a rise in short-term borrowing costs – the Feds policy appears to be “there’s no such thing as too much $$”. For now we believe it’s simple: don’t fight the tape, or Fed, makes 100% sense but one day the global economy will have to stand up on its own 2-feet but that day of reckoning might be still years away, investors have forgone huge profits by being scarred of “what ifs” over recent years.

US S&P500 v High Yield Bond (Junk Bond) ETF Chart

US bonds are well below their lows of 2013 / 2014 which illustrates how impressive the rally has been by US stocks, sure it’s been supported by consistently low interest rates but not by plunging interest rates like in Australia. US stocks are enjoying sitting in the eye of the perfect storm with corporates performing strongly while bond yields remain close to their all-time low, rising inflation could easily become a “spanner in the works”.

If / when bonds turn lower / yields higher it’s going to create a major headwind for stocks.

The US Fed is currently flooding the market with liquidity in an attempt to avoid a rise in short-term borrowing costs – the Feds policy appears to be “there’s no such thing as too much $$”. For now we believe it’s simple: don’t fight the tape, or Fed, makes 100% sense but one day the global economy will have to stand up on its own 2-feet but that day of reckoning might be still years away, investors have forgone huge profits by being scarred of “what ifs” over recent years.

US S&P500 v High Yield Bond (Junk Bond) ETF Chart

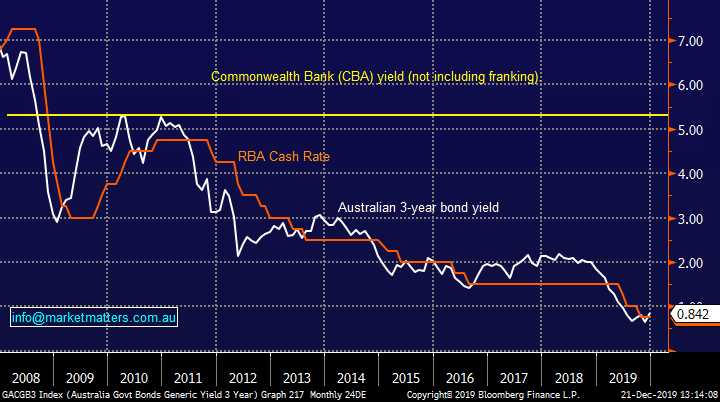

For now, bond yields / interest rates are extremely supportive of equities, term deposits are on the whole yielding less than 1/3 of CBA shares before we even consider the benefits of franking credits. At MM we feel bond yields will increase in 2020 the tricky part is by how much; a small increase will have little impact on their comparative yield but stocks / sectors who are priced for further falls in rates / yields could be in for a tough year.

If MM is correct and bond yields are “looking for” a major low, then portfolios should be structured in favour of value as opposed to growth / bond proxies.

Australian 3-year Bonds v Official RBA Cash Rate Chart

For now, bond yields / interest rates are extremely supportive of equities, term deposits are on the whole yielding less than 1/3 of CBA shares before we even consider the benefits of franking credits. At MM we feel bond yields will increase in 2020 the tricky part is by how much; a small increase will have little impact on their comparative yield but stocks / sectors who are priced for further falls in rates / yields could be in for a tough year.

If MM is correct and bond yields are “looking for” a major low, then portfolios should be structured in favour of value as opposed to growth / bond proxies.

Australian 3-year Bonds v Official RBA Cash Rate Chart