AMP launch Capital Notes 2

**This is an extract from the Market Matters Income Report from 27 November. Click here to get access to the full report and more

The AMP CFO and Treasurer were in yesterday to talk about the new AMP Hybrid issue as they look to raise up to $250m. Most will stop reading here given its AMP, I can hardly blame you however there are a few reasons why this hybrid is worth a look and why we’re adding it to the Market Matters Income Portfolio. I’ve often found that the best investments have some curly parts to them, but importantly an identifiable catalyst that can re-rate them at some point in the future. While we doubt the AMP Hybrid will be up there with the best, there are a few elements to this deal that we like.

The Numbers

Issue Type: Tier 1, floating rate capital note

Par value: $100

Issue Margin: 4.50% to 4.70%

Yield to First Call: 5.51% to 5.71%

First optional call date: 16th December 2025 (6-year deal)

Distributions: Quarterly

This is a typical tier 1 security however for all conditions please review the prospectus available here.

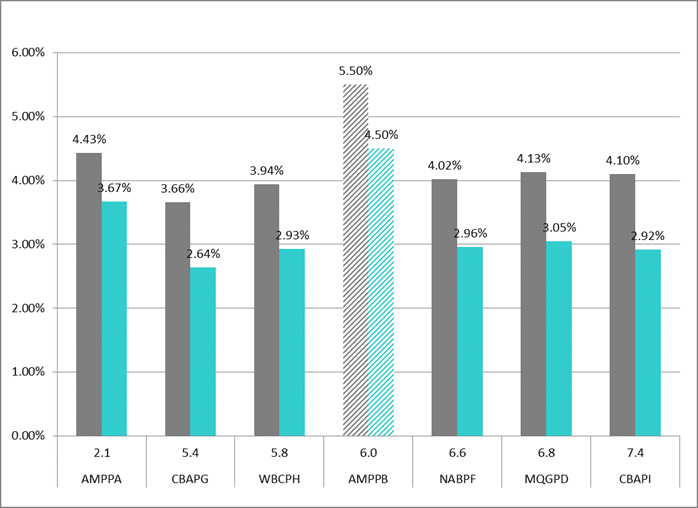

Comparison with current issues

There are currently four main parts to the AMP business - Life Insurance, Wealth Management, the Bank, and AMP Capital. Wealth Management is the weak link, AMP Bank is okay, and AMP Capital is strong while they are in the process of selling off the capital-intensive life insurance business, and that really provides the catalyst mentioned above.

While we are not keen on AMP equity (too many variables in terms of earnings), their capital position makes this hybrid attractive.

The hybrid being marketed is said to be raising money for general business operations, however there is a hybrid due to be called early next year (issued in the over the counter market) and we’d expect these funds to be used to refinance this issue. Given their reporting dates and subsequent blackout period beforehand, they need to raise the capital now which is not ideal from AMP’s perspective - we believe they’re having to pay more for this hybrid due to a couple of timing issues

1. AMP has recently raised new equity which means they’ve used their 15% placement capacity. In a Hybrid there are conversion triggers that mean under certain circumstances, hybrids can covert to equity, however given AMP has used their 15% placement limit, AMP need to seek shareholder approval for these conditions in the hybrid to be met. They made a big point of this in the presentation with a negative slant, however it’s largely irrelevant as it does not apply at the mandatory conversion date in any case. We think this perceived complexity added to the issue margin

2. The sale of the life insurance business is progressing which will ultimately improve their capital position once complete by over $1bn. Ultimately, the timing and uncertainty of the life sale means they needed to issue this hybrid now. If the life sales go through as we expect it will, then the capital position of AMP is very strong and the hybrid would re-rerate, meaning the margin would contract pushing the price higher.

**Please note Shaw and Partners are a co-manager to this deal and will be paid a fee**

ASIC has published guidance on hybrid securities on their MoneySmart website which may be relevant to your consideration of AMP Capital Notes 2. You can find this guidance by searching ‘hybrid securities’ at www.moneysmart.gov.au. The guidance includes a series of questions you may wish to consider, and a short quiz you can complete to check your understanding of how hybrids work, their features and risks.

There are currently four main parts to the AMP business - Life Insurance, Wealth Management, the Bank, and AMP Capital. Wealth Management is the weak link, AMP Bank is okay, and AMP Capital is strong while they are in the process of selling off the capital-intensive life insurance business, and that really provides the catalyst mentioned above.

While we are not keen on AMP equity (too many variables in terms of earnings), their capital position makes this hybrid attractive.

The hybrid being marketed is said to be raising money for general business operations, however there is a hybrid due to be called early next year (issued in the over the counter market) and we’d expect these funds to be used to refinance this issue. Given their reporting dates and subsequent blackout period beforehand, they need to raise the capital now which is not ideal from AMP’s perspective - we believe they’re having to pay more for this hybrid due to a couple of timing issues

1. AMP has recently raised new equity which means they’ve used their 15% placement capacity. In a Hybrid there are conversion triggers that mean under certain circumstances, hybrids can covert to equity, however given AMP has used their 15% placement limit, AMP need to seek shareholder approval for these conditions in the hybrid to be met. They made a big point of this in the presentation with a negative slant, however it’s largely irrelevant as it does not apply at the mandatory conversion date in any case. We think this perceived complexity added to the issue margin

2. The sale of the life insurance business is progressing which will ultimately improve their capital position once complete by over $1bn. Ultimately, the timing and uncertainty of the life sale means they needed to issue this hybrid now. If the life sales go through as we expect it will, then the capital position of AMP is very strong and the hybrid would re-rerate, meaning the margin would contract pushing the price higher.

**Please note Shaw and Partners are a co-manager to this deal and will be paid a fee**

ASIC has published guidance on hybrid securities on their MoneySmart website which may be relevant to your consideration of AMP Capital Notes 2. You can find this guidance by searching ‘hybrid securities’ at www.moneysmart.gov.au. The guidance includes a series of questions you may wish to consider, and a short quiz you can complete to check your understanding of how hybrids work, their features and risks.