Subscriber Questions – Bitcoin, Tesla, Uber and Hybrids

**This is an extract from the Market Matters Morning Report from 28 October. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 4

“Your view on Bitcoin as an investment and can this be done on the ASX or other share markets. I.e. ETF ?” – Mike C.

Hi Mike,

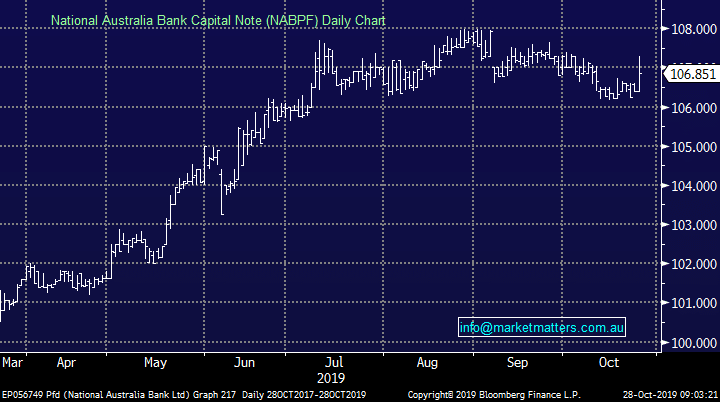

At MM we don’t regard Bitcoin as an investment, its more of a casino, highly speculative asset (kind of) in our opinion and as such we would only look at trading it with when attractive risk / reward opportunities present themselves – the chart below illustrates the volatility in Bitcoin, it’s a beast!

However interestingly technically we are bullish Bitcoin looking for an eventual rally back towards 15,000 but again I stress it’s not for us.

There are a number of platform providers but as I’ve never considered joining this game unfortunately I cannot offer any personal experience on the best ways to implement a view . However Adam who has been with MM for many years has been known to venture into this arena and his preferred vehicle is: https://www.independentreserve.com/market/btc

Bitcoin ($US) Chart

Question 5

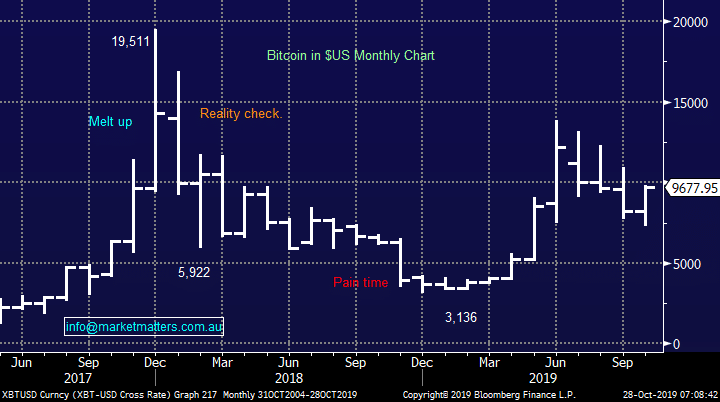

“Dear James, Since SKI was purchased for the Income fund, the position has gradually fallen. Is SKI still a buy, or should one's losses be cut now ?” - best wishes John K.

Morning John,

Utility investor Spark Infrastructure (SKI) was purchased for the Income Portfolio primarily for its greater than 7% unfranked dividend at $2.16, now the stock is trading around $2.04. We originally paid up above our $2 intended target given the movement in bond yields at the time – they had rallied and we took to view of fading them by buying SKI & TCL for the income portfolio – we were right on yields however SKI has not traded to plan (yet). If we see ongoing weakness towards $1.90 we will consider averaging this position.

MM remains comfortable holding SKI in our Income Portfolio.

Spark Infrastructure (SKI) Chart

Question 5

“Dear James, Since SKI was purchased for the Income fund, the position has gradually fallen. Is SKI still a buy, or should one's losses be cut now ?” - best wishes John K.

Morning John,

Utility investor Spark Infrastructure (SKI) was purchased for the Income Portfolio primarily for its greater than 7% unfranked dividend at $2.16, now the stock is trading around $2.04. We originally paid up above our $2 intended target given the movement in bond yields at the time – they had rallied and we took to view of fading them by buying SKI & TCL for the income portfolio – we were right on yields however SKI has not traded to plan (yet). If we see ongoing weakness towards $1.90 we will consider averaging this position.

MM remains comfortable holding SKI in our Income Portfolio.

Spark Infrastructure (SKI) Chart

Question 6

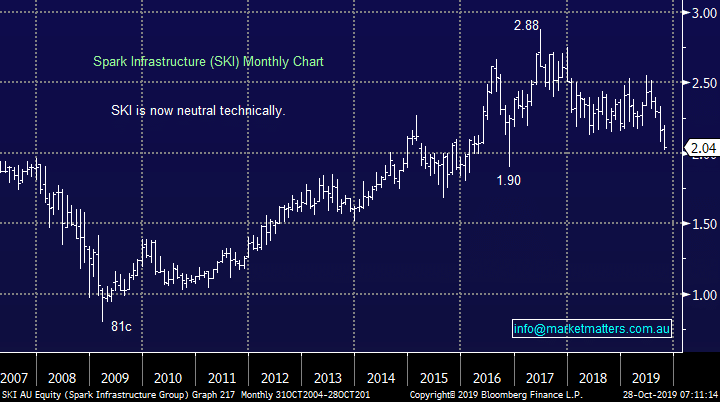

“Hi there, quick question - do you have a view on Uber. There is increasing view that the entire business is fundamentally overvalued and unsustainable. If one wanted to short uber, is that possible from Australia?” - Regards, James D.

Hi James,

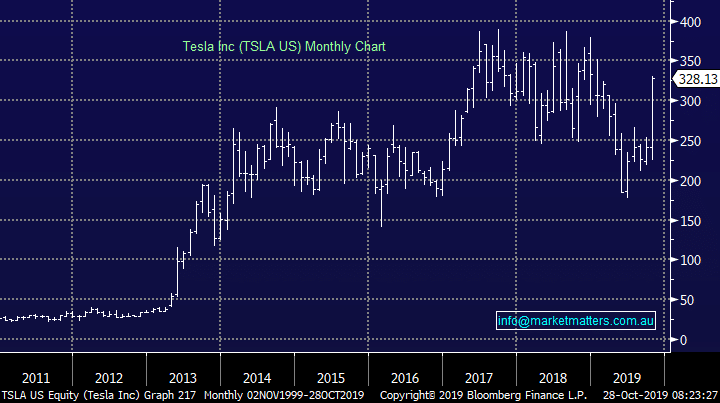

Uber is not a story / stock that I like, its valued at $US55bn yet it lost $US1bn in Q1 of 2019, on revenue of $US3.1bn but shorting it is a very different proposition. Consider Tesla who is also burning cash at a rate of knots, there have been many high profile shorter’s of Elon Musk’s business and most have taken a bath. It is easy / straight forward to short Australian stocks however I haven’t looked at shorting overseas stocks.

MM prefers to watch Uber with interest but not short.

Uber Technologies (UBER US) Chart

Question 6

“Hi there, quick question - do you have a view on Uber. There is increasing view that the entire business is fundamentally overvalued and unsustainable. If one wanted to short uber, is that possible from Australia?” - Regards, James D.

Hi James,

Uber is not a story / stock that I like, its valued at $US55bn yet it lost $US1bn in Q1 of 2019, on revenue of $US3.1bn but shorting it is a very different proposition. Consider Tesla who is also burning cash at a rate of knots, there have been many high profile shorter’s of Elon Musk’s business and most have taken a bath. It is easy / straight forward to short Australian stocks however I haven’t looked at shorting overseas stocks.

MM prefers to watch Uber with interest but not short.

Uber Technologies (UBER US) Chart

Tesla (TSLA US) Chart

Tesla (TSLA US) Chart

Question 7

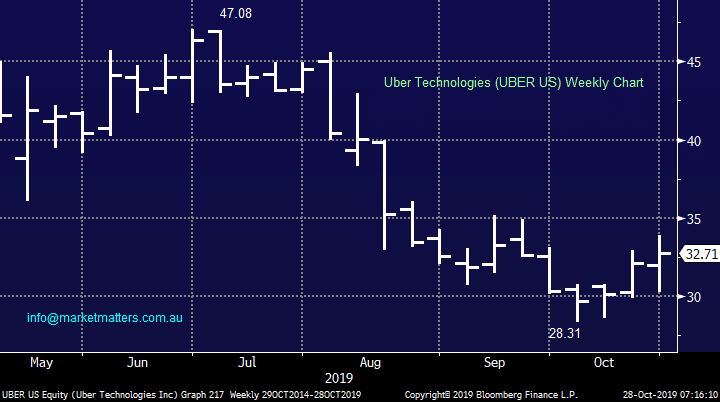

“Hi, Given your report on the upcoming Perls X11 offer and commentary regarding existing hybrids of similar timeframes for first call, what is your expectation of the market price on listing. I note MQG hybrid is trading at around $107, ANZ $105 and CBAPH $104.50. Thanks Paul B.

Hi Paul,

The best listed comparable at the moment is the NABPF which has 6.9 years to first call date. This security is now trading on a yield to first call of 2.99% implying that the CBA will likely list around its $100 face value, maybe $101ish given it’s a CBA issue that was well overbid. The nearest CBA note is the CBAPG which has 5.5 years to first call and is trading on a margin of 2.89%, again implying the new CBA hybrid which will trade under code CBAPI and is expected to list on the 19th November 2019 will trade near enough to par unless something meaningfully changes in risk premium between now and then.

MM is neutral the new CBA issue and we did not add it to our income portfolio

National Australia Bank Capital Note (NABPF) Chart

Question 7

“Hi, Given your report on the upcoming Perls X11 offer and commentary regarding existing hybrids of similar timeframes for first call, what is your expectation of the market price on listing. I note MQG hybrid is trading at around $107, ANZ $105 and CBAPH $104.50. Thanks Paul B.

Hi Paul,

The best listed comparable at the moment is the NABPF which has 6.9 years to first call date. This security is now trading on a yield to first call of 2.99% implying that the CBA will likely list around its $100 face value, maybe $101ish given it’s a CBA issue that was well overbid. The nearest CBA note is the CBAPG which has 5.5 years to first call and is trading on a margin of 2.89%, again implying the new CBA hybrid which will trade under code CBAPI and is expected to list on the 19th November 2019 will trade near enough to par unless something meaningfully changes in risk premium between now and then.

MM is neutral the new CBA issue and we did not add it to our income portfolio

National Australia Bank Capital Note (NABPF) Chart