Subscriber Questions – CIA, DCG, XARO and more

**This is an extract from the Market Matters Morning Report from 21 October. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 5

“Hi, what are your thoughts on CIA & DCG?” – David H.

Morning David,

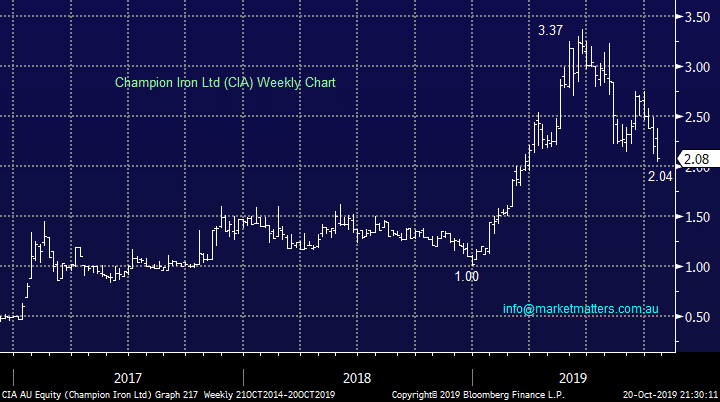

I believe these are 2 new companies to the MM question report in 2019, thanks as we always like going out of comfort zone. Dual-listed Canadian iron ore miner (CIA) now has a market cap over $900m, its share price has been following the underlying bulk commodity price closely in 2019 - just like Fortescue Metals (FMG).

We prefer FMG over CIA, especially if Twiggy Forests stock is sold off today on the native title news from late last week ,which is pointing to a large claim on FMG, not fresh news but a negative twist in the tail.

MM prefers FMG over CIA.

Champion Iron Ltd (CIA) Chart

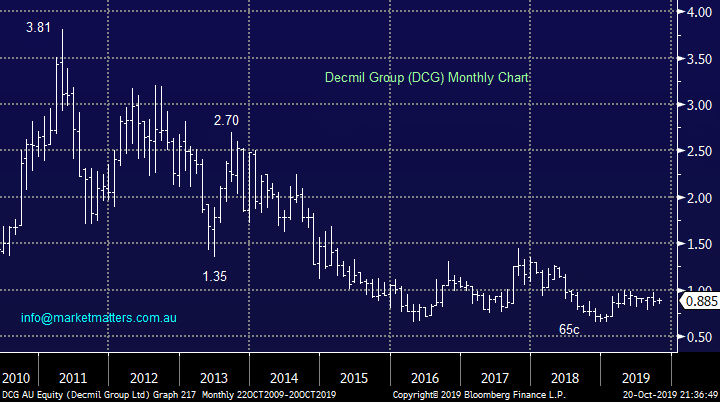

Mining services business Decmil Group (DCG) has clearly endured a tough few years with its share price tumbling. The stock now yields 4.8% fully franked but the capital decline clearly has more than offset this over the last few years.

Technically we could buy DCG with stops below 77c but its an aggressive play that’s not for us.

MM is neutral DCG.

Decmil Group (DCG) Chart

Mining services business Decmil Group (DCG) has clearly endured a tough few years with its share price tumbling. The stock now yields 4.8% fully franked but the capital decline clearly has more than offset this over the last few years.

Technically we could buy DCG with stops below 77c but its an aggressive play that’s not for us.

MM is neutral DCG.

Decmil Group (DCG) Chart

Question 6

“Sorry to be so dumb but what do you regard as cyclical s apart from resources?” Marvin C.

Hi Marvin,

No such thing as a dumb question except the one which isn’t asked!

A cyclical stock is one which benefits from economic growth but struggles if we have contraction / slowing growth. Recently we’ve seen profit downgrades from cyclicals like Nick Scali (NCK) and Southern Cross Media (SXL) which suggests the RBA’s optimism on the Australian economy is wrong or premature. Our view at MM is global central banks are loading the cannons for some major fiscal stimulus to support the already extremely accommodative monetary policy (low rates) and its this stimulus which will provide a much needed shot in the arm for some cyclical stocks / sectors. At this stage things look pretty bleak for the group but it always does at the bottom!

Many professionals will argue that most market sectors are cyclical to varying degrees with the exception of the Utilities and “yield play” names, we would add Healthcare, Telcos and IT stocks to that list. Hence to MM the cyclicals also includes the banks and Consumer Services but its important to remember we consider each stock on its individual merit.

Question 7

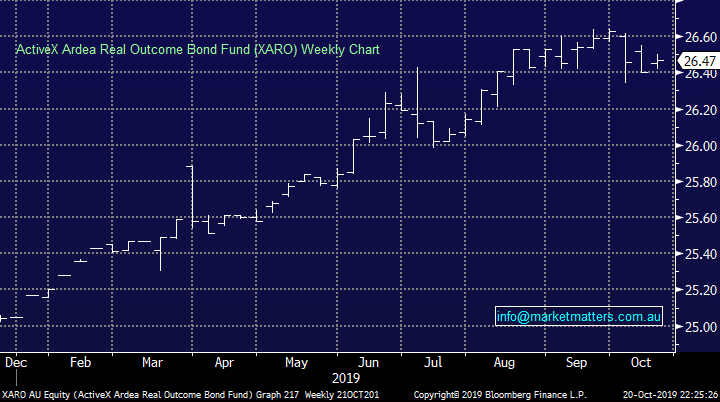

“What are the factors that affect price change for XARO ?” - Thanks Mike C.

Hi Mike,

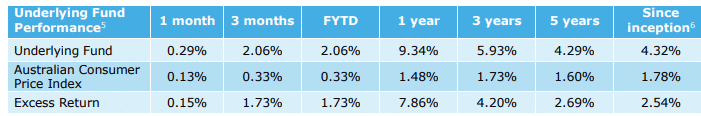

A very good question and not as simple as it might imply. Firstly, the XARO invests in an existing fund and mirrors the performance of the fund. That fund started on the 20th July 2012 and has the following performance metrics.

Question 6

“Sorry to be so dumb but what do you regard as cyclical s apart from resources?” Marvin C.

Hi Marvin,

No such thing as a dumb question except the one which isn’t asked!

A cyclical stock is one which benefits from economic growth but struggles if we have contraction / slowing growth. Recently we’ve seen profit downgrades from cyclicals like Nick Scali (NCK) and Southern Cross Media (SXL) which suggests the RBA’s optimism on the Australian economy is wrong or premature. Our view at MM is global central banks are loading the cannons for some major fiscal stimulus to support the already extremely accommodative monetary policy (low rates) and its this stimulus which will provide a much needed shot in the arm for some cyclical stocks / sectors. At this stage things look pretty bleak for the group but it always does at the bottom!

Many professionals will argue that most market sectors are cyclical to varying degrees with the exception of the Utilities and “yield play” names, we would add Healthcare, Telcos and IT stocks to that list. Hence to MM the cyclicals also includes the banks and Consumer Services but its important to remember we consider each stock on its individual merit.

Question 7

“What are the factors that affect price change for XARO ?” - Thanks Mike C.

Hi Mike,

A very good question and not as simple as it might imply. Firstly, the XARO invests in an existing fund and mirrors the performance of the fund. That fund started on the 20th July 2012 and has the following performance metrics.

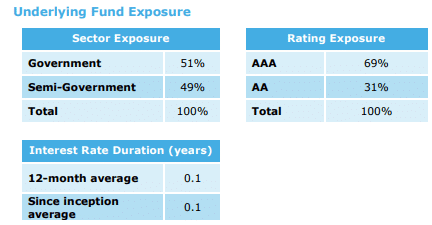

Clearly, the performance over 1 year is exceptional (for bonds) and that’s been a function of money going into bonds, pushing prices up and yields down, which has driven this performance, so, just like a share it is demand that drives the price and ultimately the return. However, as markets become tougher, which is likely to be the case in bonds, then good active management will be important in our view, and we think the guys that run XARO are good active managers of this specific bond strategy.

We’ve written a lot recently about our concern for bond like equities, and traditional yield play stocks given the potential bottoming in rates. That is the reason (in our income portfolio) we are heavily skewed to floating rate notes (hybrids) or funds that are floating, while the XARO is a very actively managed fund with really no duration risk. The simplest way to think about duration is that investors tend to buy longer dated securities to get higher yield when rates are low. They tend to say, we need 5% and we can get that by buying longer dated securities, however by buying longer dated securities you have exposure to greater risks given there is more time for things to change. One of the reasons why we like the XARO at this point in the cycle as it has really no duration risk across its book so the risk there is low, while they hold Government & Semi Government Debt, which are bonds offered by states and territory governments and trades them for relative value on the long and short side.

Clearly, the performance over 1 year is exceptional (for bonds) and that’s been a function of money going into bonds, pushing prices up and yields down, which has driven this performance, so, just like a share it is demand that drives the price and ultimately the return. However, as markets become tougher, which is likely to be the case in bonds, then good active management will be important in our view, and we think the guys that run XARO are good active managers of this specific bond strategy.

We’ve written a lot recently about our concern for bond like equities, and traditional yield play stocks given the potential bottoming in rates. That is the reason (in our income portfolio) we are heavily skewed to floating rate notes (hybrids) or funds that are floating, while the XARO is a very actively managed fund with really no duration risk. The simplest way to think about duration is that investors tend to buy longer dated securities to get higher yield when rates are low. They tend to say, we need 5% and we can get that by buying longer dated securities, however by buying longer dated securities you have exposure to greater risks given there is more time for things to change. One of the reasons why we like the XARO at this point in the cycle as it has really no duration risk across its book so the risk there is low, while they hold Government & Semi Government Debt, which are bonds offered by states and territory governments and trades them for relative value on the long and short side.

ActiveX Area Real Outcome Bond Fund (XARO) Chart

ActiveX Area Real Outcome Bond Fund (XARO) Chart