Three areas of the market we are watching closely – and so should you!

**This is an extract from the Market Matters Morning Report from 30 August. Click here to get access to the full report and more

1 The Yield Play

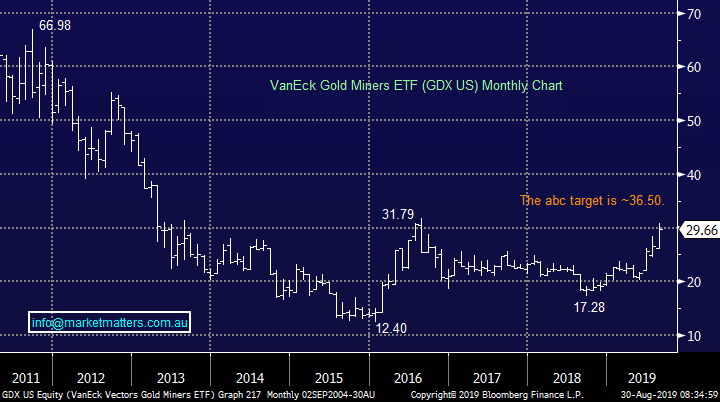

Interestingly the Australian Utilities sector has already come off the boil while bond yields continue to fall – not a good sign. Hence we now have no interest chasing the classic yield play stocks.

While local term deposits sit ~1.5% and the likes of CBA yields over 5.5% fully franked a huge tailwind remains for stocks but we would rather play it via stocks who will benefit when interest rates bottom i.e. the banks.

MM prefers the banks to the traditional “yield play” space.

NB Our Income Portfolio will not change dramatically until we see a clear catalyst that signals interest rates are set to rise but obviously we are watching this carefully.

ASX200 Utilities Index Chart

2 Healthcare & Growth

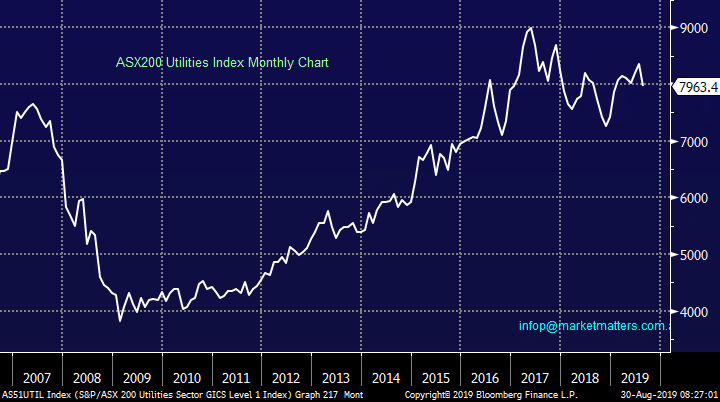

Yesterday we received a warning on high valuation stocks as market favourite Appen (APX) tumbled ~20% from its intra-day high. When the market decides interest rates will rise, or perhaps just not fall any more, these stocks are likely to struggle, just as they did at the end of 2018.

We have no sell signals yet but I could not buy many of them today from a risk / reward perspective.

MM is cautious on high valuation stocks.

ASX200 Software & Services Index Chart

2 Healthcare & Growth

Yesterday we received a warning on high valuation stocks as market favourite Appen (APX) tumbled ~20% from its intra-day high. When the market decides interest rates will rise, or perhaps just not fall any more, these stocks are likely to struggle, just as they did at the end of 2018.

We have no sell signals yet but I could not buy many of them today from a risk / reward perspective.

MM is cautious on high valuation stocks.

ASX200 Software & Services Index Chart

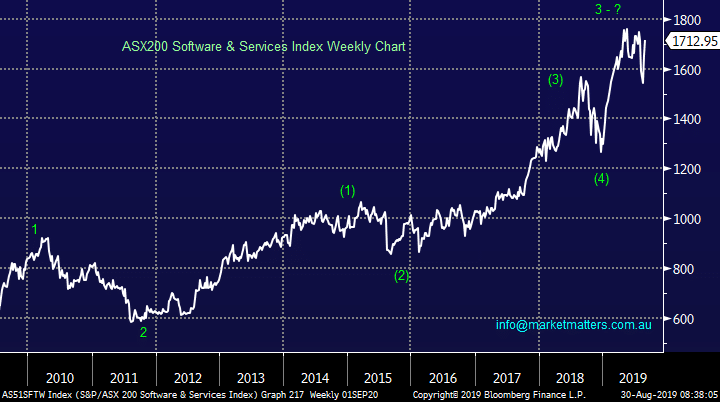

3 Gold sector

We are keen to buy the precious metals (gold & silver), historically they perform strongly when inflation raises its head although if / when interest rate rise it’s a headwind.

MM remains bullish gold stocks with an initial target ~20% higher.

VanEck Gold Miners ETF (GDX ETF) Chart

3 Gold sector

We are keen to buy the precious metals (gold & silver), historically they perform strongly when inflation raises its head although if / when interest rate rise it’s a headwind.

MM remains bullish gold stocks with an initial target ~20% higher.

VanEck Gold Miners ETF (GDX ETF) Chart