Whats our take on the Monadelphous (MND) result?

Stock

Monadelphous (MND) $17.50 as at 20/08/2019

Event

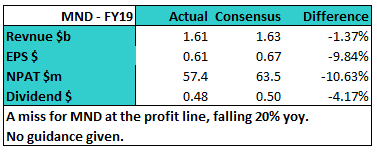

The resources construction and maintenance contractor has slipped today with the FY19 result coming in below expectations. Profit of $57.4m was 10% below expectations, and 20% below FY18 in what has been a tougher year for MND. While the top line figure was marginally below expectations, higher than expected depreciation number and higher interest expenses contributed to the profit line miss.

The maintenance & industrial services division enjoyed a decent year, seeing revenue grow nearly 20%, however this was more than offset by a 35% fall in revenue across the engineering & construction division to see revenue for the group decline by around 7% in FY19.

While no guidance was provided, the company did talk up FY20 with significant increases in CAPEX spend and maintenance requirements expected to lead to increased revenue for MND. They did also point to an increase in competition with margins continuing to decline. The market consensus is looking for 13% revenue growth, and a huge 40% profit growth in FY20.

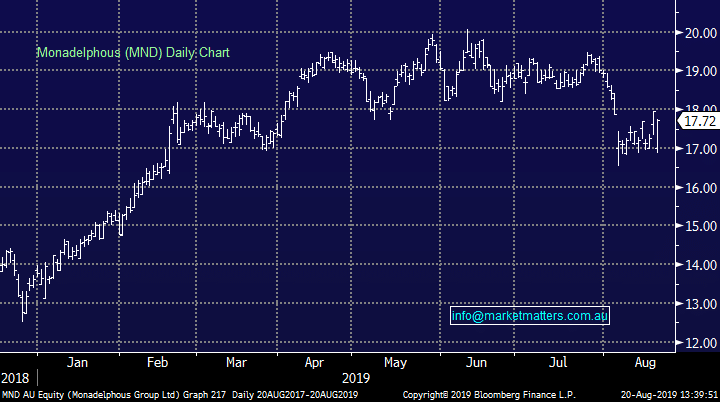

Monadelphous (MND) Chart

The maintenance & industrial services division enjoyed a decent year, seeing revenue grow nearly 20%, however this was more than offset by a 35% fall in revenue across the engineering & construction division to see revenue for the group decline by around 7% in FY19.

While no guidance was provided, the company did talk up FY20 with significant increases in CAPEX spend and maintenance requirements expected to lead to increased revenue for MND. They did also point to an increase in competition with margins continuing to decline. The market consensus is looking for 13% revenue growth, and a huge 40% profit growth in FY20.

Monadelphous (MND) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook