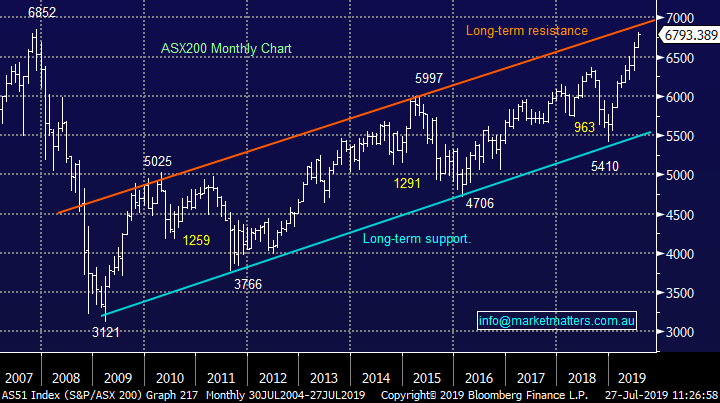

How far can this market run?

**This is an extract from the Market Matters Weekend Report from 28 July. Click here to get access to the full report and more

Winners: NRW Holdings (NWH) +6%, Seven Group (SVW) +5%, Emeco Holdings (EHL) +5.9%, Bingo (BIN) +8%, Breville Group (BRG) +5.7%, Flight Centre (FLT) +6.7%, Corporate Travel (CTD) +6%, HUB24 (HUB) +7.9%, Magellan (MFG) +6.2%, Pendal Group (PDL) +5.4%, IOOF Holdings (IFL) +12%, Worley Parsons (WOR) +11%, Oil Search (OSH) +5.9%, Beach Energy (BPT) +8.7%, Viva Energy (VEA) +6.3%, Cooper Energy (COE) +8.4%, Treasury Wine (TWE) +7.9%, Bellamys (BAL) +11.9%, ResMed (RMD) +7.4%, Mineral Resources (MIN) +10.9%, James Hardie (JHX) +5.4%, Sims Metal (SGM) +7.6%, Nufarm (NUF) +7.4%, Incitec Pivot (IPL) +7.1%, Carsales.com (CAR) +6.2%, Southern Cross (SXL) +5%, Clinuvel (CUV) +6.5%, Aveo Group (AOG) +8%, Webjet (WEB) +5.1%, Afterpay (APT) +8.8%, Wistech (WTC) +9.1%, Xero (XRO) +5.7%, Nearmap (NEA) +5.1% and Vocus (VOC) +5.4% -13.5% - a total of 35 stocks.

Losers: Iluka (ILU) -14.7%, Lynas (LYC) -5.7% and Regis Resources (RRL) -13.5% - a total of 3 stocks.

I knew when I started typing today’s report that the markets internals were strong from just watching the screen but I was still extremely surprised to see almost 12x more stocks rally by 5%, or greater, than decline by the same degree. At this stage of the cycle we still see no reason to “fight the tape”, hence while we believe its time to structure portfolios with a more conservative skew than over the previous 6-months it certainly doesn’t feel like the time to abandon ship. Our “Gut Feel” that the local market had a very good chance of making fresh 2019 highs has proved to be on the money but we should all remain open-minded to actually how far it can run.

We simply must not be the proverbial ostrich burying our head in the sand and forgetting the relative value supporting equities, its not rocket science - term deposits appear headed towards 1% while Commonwealth Bank (CBA) is still yielding around 5% fully franked. The second surprise I had writing todays Weekend Report and compiling the Chart Pack was the number of stocks that I found which are still offering both compelling stories & attractive risk / reward for the bulls, not what I expect to see if the market is about to fall apart.

At MM we continue to adopt a more defensive stance than over the previous 6-months; the specific thoughts and skews across our 4 Portfolio’s will be discussed later. Note a defensive stance largely dictates which sectors we are keen to own as opposed to piling into cash and / or going short.

ASX200 Chart

At MM we continue to believe it’s time to keep stock market investing simple (KISS), today’s market is all about interest rates and relative value. Last week Australian 3-year bond yields again made fresh all-time lows, trading well below the RBA Cash Rate of 1%. Over the last few weeks we’ve received a constant barrage of dovish news flow including comments from Westpac chief economist Bill Evans and the RBA themselves:

1 – The market is now pricing in a rate cut by Melbourne Cup Day as a given with another in 2020 is a strong likelihood, they are even pricing in a greater than 20% chance of a second cut to 0.5% in 2019!

2 - Importantly RBA Governor Phillip Lowe also said just 3-days ago that “its reasonable to expect an extended period of low interest rates”.

At MM we continue to believe it’s time to keep stock market investing simple (KISS), today’s market is all about interest rates and relative value. Last week Australian 3-year bond yields again made fresh all-time lows, trading well below the RBA Cash Rate of 1%. Over the last few weeks we’ve received a constant barrage of dovish news flow including comments from Westpac chief economist Bill Evans and the RBA themselves:

1 – The market is now pricing in a rate cut by Melbourne Cup Day as a given with another in 2020 is a strong likelihood, they are even pricing in a greater than 20% chance of a second cut to 0.5% in 2019!

2 - Importantly RBA Governor Phillip Lowe also said just 3-days ago that “its reasonable to expect an extended period of low interest rates”.