How are the Market Matters portfolios tracking?

**This is an extract from the Market Matters Weekend Report from 30 June. Click here to get access to the full report and more

1 – Growth Portfolio

The MM Growth Portfolio enjoyed another good week courtesy of solid performances from Pact Holdings (PGH) which rallied almost 20% and Ausdrill (ASL) +16%. The moves illustrated perfectly when the value elastic band becomes too stretched in either direction they’re liable to snap back extremely hard on news that doesn’t warrant the extreme pessimism /optimism. Last week we added to our Pact Holdings (PGH) position while taking a 57% profit in Bingo (BIN) and 12% in Aristocrat (ALL) taking our cash position up to a healthy 17%.

While we still think the market can trade higher after this weekend’s G20 stocks are becoming rich and we feel the prudent risk / reward strategy is to slowly start moving to a higher cash / more defensive skew over our portfolios.

Following the recent moves we have a number of stocks close, or at, our objectives, while 2 have blown their respective levels away:

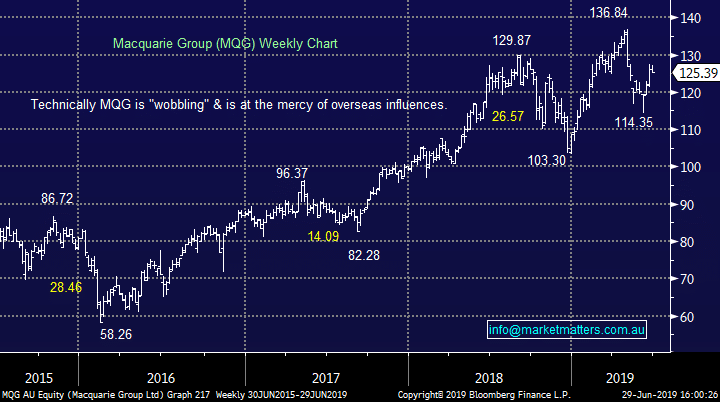

Trading around / close to our initial target area – BHP Group (BHP), Iluka (ILU), Macquarie Group (MQG) and Ausdrill (ASL).

Powering through our initial target area –NIB Holdings (NHF).

As we said previously this has proven to be a good time to give positions a little room as fund managers have been keen to make their portfolios look good for the EOFY rule off but that is now behind us and it’s time to start all over again. The important message remains we are considering increasing cash and becoming slightly more defensive but don’t assume we will be grabbing our large profits just to feel good, we will consider each position on their individual merit at the time.

*watch for alerts over next 2-weeks.

Macquarie Group (MQG) Chart

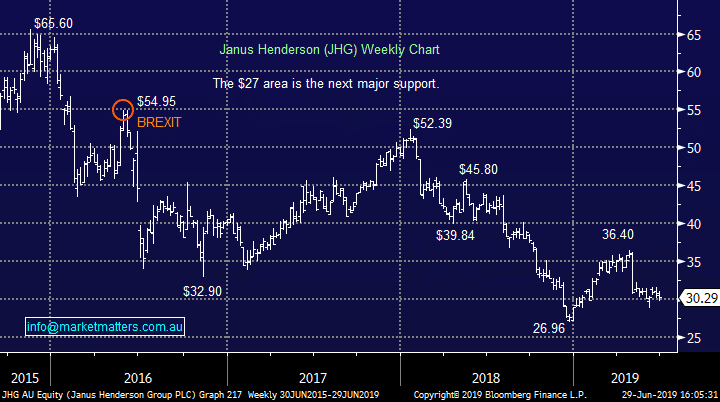

After recent strong rallies by Emeco (EHL), Ausdrill (ASL) and Pact Group (PGH) we only have 3 main “losers” of concern. At this stage we are still not panicking on these underperformers (ORE, CGC and JHG) although I am no longer considering averaging as it’s becoming easy to start feeling they’ve had their opportunity to rally, especially Orocobre (ORE) and Janus Henderson (JHG).

Yet again the broad market threw up very few fresh buy ideas this week as it remains above our initial 6600 target area, remember we are generally looking to sell into current strength, not buy. However there are 3 stocks / sectors that we still have our eyes on:

1 Telstra (TLS) $3.87 – we have fallen on our sword and decided we did take profit on TLS too early. Telstra looks good technically however the rise in the stock price means a lot of optimism is now built into its full year results come August, and for that reason – we would not buy it now. A decline post results would have us interested again below the ~$3.70 region

2 Santos (STO) $7.08 – The oil sector looks capable of a decent bounce over the coming weeks with STO looking well positioned for a short-term move towards $8.

3 Golds – we bought Newcrest (NCM) last week only to watch it underperform compared to other precious metal stocks but we still want to increase our sector exposure into any pullback.

Janus Henderson (JHG) Chart

After recent strong rallies by Emeco (EHL), Ausdrill (ASL) and Pact Group (PGH) we only have 3 main “losers” of concern. At this stage we are still not panicking on these underperformers (ORE, CGC and JHG) although I am no longer considering averaging as it’s becoming easy to start feeling they’ve had their opportunity to rally, especially Orocobre (ORE) and Janus Henderson (JHG).

Yet again the broad market threw up very few fresh buy ideas this week as it remains above our initial 6600 target area, remember we are generally looking to sell into current strength, not buy. However there are 3 stocks / sectors that we still have our eyes on:

1 Telstra (TLS) $3.87 – we have fallen on our sword and decided we did take profit on TLS too early. Telstra looks good technically however the rise in the stock price means a lot of optimism is now built into its full year results come August, and for that reason – we would not buy it now. A decline post results would have us interested again below the ~$3.70 region

2 Santos (STO) $7.08 – The oil sector looks capable of a decent bounce over the coming weeks with STO looking well positioned for a short-term move towards $8.

3 Golds – we bought Newcrest (NCM) last week only to watch it underperform compared to other precious metal stocks but we still want to increase our sector exposure into any pullback.

Janus Henderson (JHG) Chart

2 Income Portfolio

The Income Portfolio had yet another quiet week with MM not transacting hence it still holds 4.83% in cash.

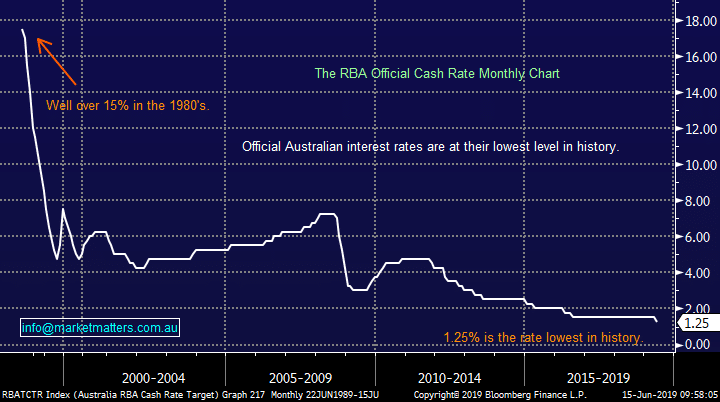

Basically no change, until we see any indications that bond yields have bottomed MM sees no major reason to significantly reduce our large market exposure, or re-position / skew holdings towards higher rates i.e. why hold cash in today’s market when yield / income is your objective.

The RBA Cash Rate Chart

2 Income Portfolio

The Income Portfolio had yet another quiet week with MM not transacting hence it still holds 4.83% in cash.

Basically no change, until we see any indications that bond yields have bottomed MM sees no major reason to significantly reduce our large market exposure, or re-position / skew holdings towards higher rates i.e. why hold cash in today’s market when yield / income is your objective.

The RBA Cash Rate Chart

3 – International Equites Portfolio

The MM International Equities Portfolio was launched last week and has started slowly as intended buying Apple (AAPL), Barrack Gold (ABX) and Ping An (2318 HK).

No change, we are still sticking with this for now - “We remain bullish global equities but the “easy money” on the long side feels well and truly behind us hence our construction of an international portfolio is going to be a steady careful process.”

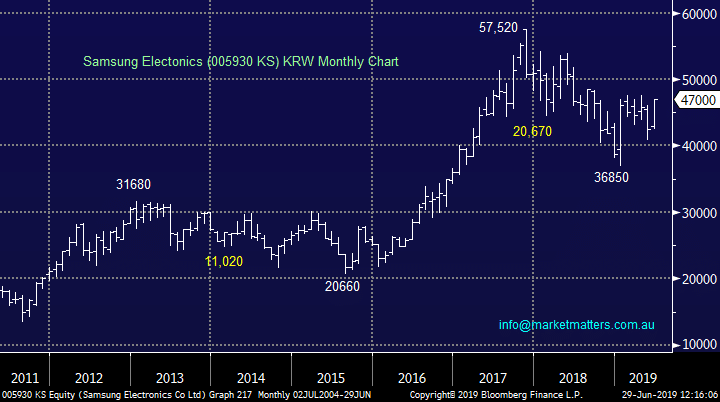

Our favourite overseas stock today is Samsung which we have covered a number of times over the last 6-months – expect a “buy alert in Samsung next week”.

MM is bullish Samsung with an initial target over 15% higher and a stop ~7% lower – solid risk reward.

Samsung Electronics (005930 KS) Chart

3 – International Equites Portfolio

The MM International Equities Portfolio was launched last week and has started slowly as intended buying Apple (AAPL), Barrack Gold (ABX) and Ping An (2318 HK).

No change, we are still sticking with this for now - “We remain bullish global equities but the “easy money” on the long side feels well and truly behind us hence our construction of an international portfolio is going to be a steady careful process.”

Our favourite overseas stock today is Samsung which we have covered a number of times over the last 6-months – expect a “buy alert in Samsung next week”.

MM is bullish Samsung with an initial target over 15% higher and a stop ~7% lower – solid risk reward.

Samsung Electronics (005930 KS) Chart

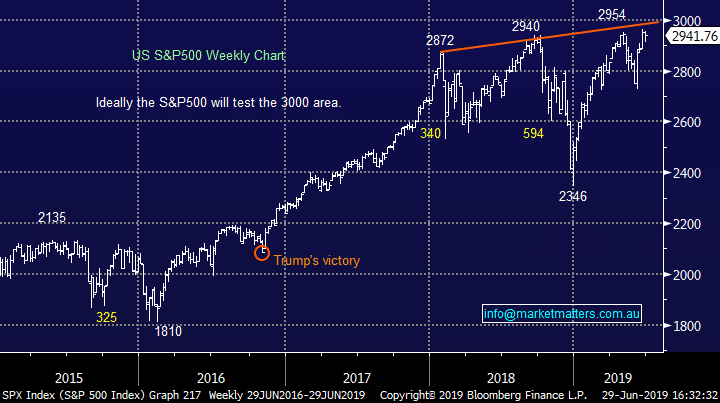

The US S&P500 is only 2-3% below our medium-term target for the main barometer of US stocks, hence making us extremely reticent to invest too many funds at current levels i.e. remember we are in “sell mode” overall.

On a regional basis we will be looking for value in the Emerging Markets (EEM) before Europe due to our concern for the future of the EU and bearish view on the $US which should benefit the EEM.

US S&P500 Chart

The US S&P500 is only 2-3% below our medium-term target for the main barometer of US stocks, hence making us extremely reticent to invest too many funds at current levels i.e. remember we are in “sell mode” overall.

On a regional basis we will be looking for value in the Emerging Markets (EEM) before Europe due to our concern for the future of the EU and bearish view on the $US which should benefit the EEM.

US S&P500 Chart