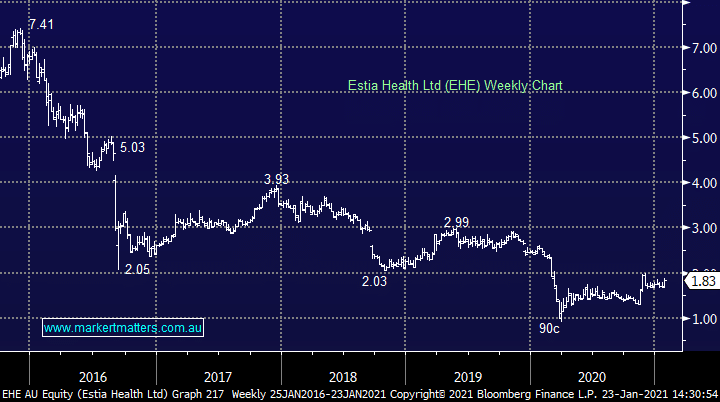

Aged care business EHE is now only a $478m business after suffering an awful few year along with other major listed aged care providers, firstly it was the Royal Commission which saw their costs increase and more recently from COVID which led to another spike in their cost base, all at a time when occupancy levels had been down. To give some context here, in 2015 Japara generated 15k worth of EBITDA per bed while in FY20 that number was 8k. The sector is clearly at a low point and we think that clarity from the Royal Commission findings can be the catalysts for a meaningful re-rating. The findings are due on 21st February and like the banks, once the findings are delivered and become history, we believe the stock / sector can enjoy a meaningful recovery.

While February presents a definite wildcard MM likes EHE believing they’ll be higher in the next few years plus their estimated 5.9% fully franked yield moving forward offsets some of Februarys risk