Subscribers questions (IGO, BTH, BUB, NABHA, UCM, FLT, WEB, ALK, NCK, IFN, SSM, ERA, ISX, WZR, JBH, MFG)

The current market rhythm continues to be dictated by the news flow around the escalating spread of coronavirus, on Sunday evening the death toll had hit 811 and over 37,198 people were reported as infected worldwide. While things unfortunately still appear destined to get worse before they improve from a local market perspective I can see reporting season fighting hard to become the dominant influence this week with heavyweights Commonwealth Bank (CBA), CSL Ltd (CSL), Woodside (WPL) and JB HIFI (JBH) to name just a few all due to reveal their sins – remember we feel fund managers have positioned themselves defensively over the last few weeks making room for some positive surprises.

Away from the shocking news emanating from China the Australian property market remains very firm with the Sydney initial auction clearance rate coming in over 80% even when listings doubled, very impressively the inclement weather failed to keep the buyers at bay. Overall a great sign that the Australian consumer is not feeling as poor as many had predicted.

Also, in the US on Friday night we saw their monthly employment data come in stronger than most economists had forecast sending another signal to financial markets that the American economy is in good shape – great news for President Trump in Novembers election. The US unemployment rate remains near a 50-year low and with average hourly earnings edging higher our call for inflation to raise its head in 2020 / 2021 remains on track, obviously assuming the coronavirus is contained sooner rather than later. The US economy might not yet be showing signs that an interest rate hike is on the horizon, but further cuts certainly feel off the table.

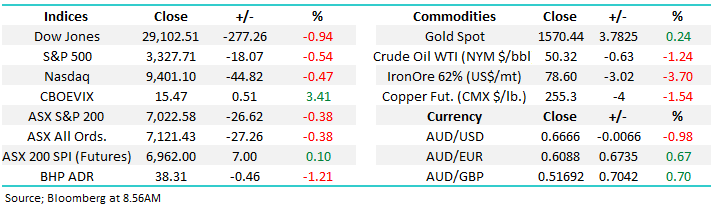

MM is looking to reduce our market exposure around the 7200 area for the ASX200.

On Friday night US stocks gave back some of their strong weekly gains with the Dow slipping 277-points but the SPI futures are still calling the ASX200 to open slightly higher this morning.

Thanks again for the questions today with the coronavirus an understandable underlying thematic, our call for a volatile 2020 feels on track.

ASX200 Index Chart

US stocks enjoyed an impressive recovery last week with the heavyweight indexes all making fresh all-time highs, remember what we said last Monday - “don’t panic, things are unfolding according to plan, so far at least”:

The US has followed our playbook but its most important to MM that the local market follows suit, for that to unfold we now only need ~2.5% further upside from Fridays close.

MM is looking to reduce stock market exposure into these fresh all-time highs.

US S&P500 Index Chart

Question 1

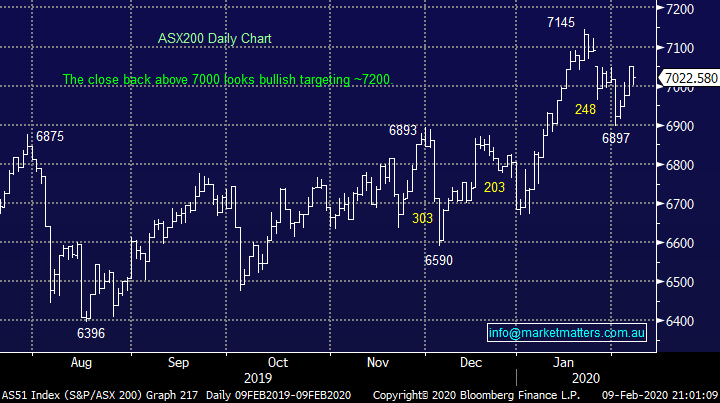

“Hi Guys, If you have time could you give your thoughts on IGO?” – Cheers Richard H.

Hi Richard,

Diversified miner Independence Group (IGO) is regarded by most investors as a nickel / gold play and compared to the other best-known nickel player in Australia Western Areas (WSA) its performed admirably. The nickel price is ~30% below its 2019 highs yet IGO is sitting only 16% below its high set in 2020 largely thanks to their gold exposure.

Technically the stock looks good eventually targeting fresh 2020 highs.

MM is bullish IGO looking for an eventual break towards $7.50.

Independence Group (IGO) Chart

Nickel 3-Month Contract Chart

Question 2

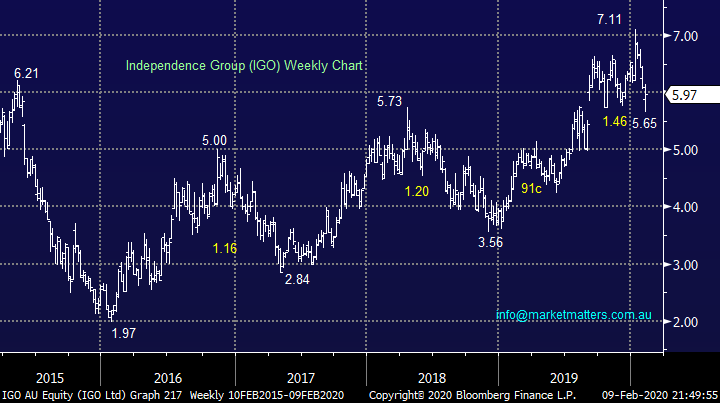

“Hi James, can you please give an opinion on Big Tin Can? Short to medium term outlook and general business views. Is it overvalued at the moment or a good growth stock? I want to purchase but wary it may have run too hard recently. Good work with the publication.” – Regards Jason F.

Morning Jason,

Thanks, Bigtincan holdings (BTH) is a new one for the MM report plus we also appreciate the positive feedback. BTH is now a $290m business that offers Artificial Intelligence (AI) powered sales enabled platforms for engagement with customers. It’s clearly a volatile new player who has been struggling over recent weeks following the news of a director selling around 20% of his holding. With limited financials / news on this stock we would be relying on technicals for any investment but annualised recurring revenue growth of over 50% is certainly eye catching for the correct reasons.

MM feels aggressive players could buy BTH under 88c with stops under 79c.

Bigtincan holdings (BTH) Chart

Question 3

“Hi James & M&M, you spoke about Bubs a while ago stating, "At this stage MM would look at BUB from a risk / reward perspective i.e. buy a panic spike under 90c with stops initially below 75c, however we would wait till they report on the 2nd March". Bubs did dip to 0.69c on Tues 4th February and finished the day at 0.74c, I am just wondering does M&M see opportunity now or intend on sticking to the game plan and wait until they report?” - Thank you. Cheers Tony.

Morning Tony,

An easy answer Tony, wait till they report after they delivered a weak quarterly update at the end of January and dropped sharply. As a general rule, if a stock we like for whatever reason is declining leading into results we’ll wait until they report before buying it, depending on what that report suggests. To be honest, I’ve learnt this the hard way over the years and find this the best approach.

MM is neutral BUB.

Bubs Australia (BUB) Chart

Question 4

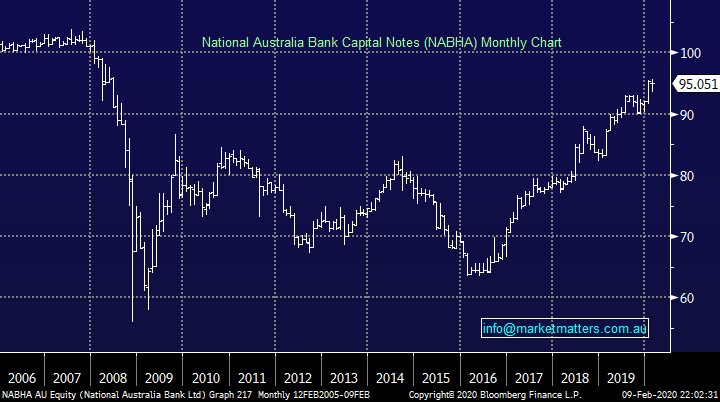

“A subscriber question (is this the correct email address?). My super fund has held NAB perpetual notes (NABHA) for a few years from which their original price has risen from $70-ish to now around $95, with some significant recent upward movements. Given their lousy interest returns I can only assume there has been news - or strong speculation - about them being redeemed at par value of $100 in the not-too-distant future. Have you heard anything of this? Great service - love your work!” – Andrew P.

Morning Andrew,

The NAB perpetual Notes (NABHA) which were issued in the late 1990’s, as the name suggests are perpetual, meaning they have no call date for redemption, however under Basel III regulations they will start to lose their additional tier 1 status over time until January 2022. That essentially means that if they don’t contribute to NAB’s tier 1 capital ratios they become expensive debt and therefore NAB is incentivised to redeem them.

In simple terms, yes, sometime between now and 2022 there is a strong chance these will be redeemed at $100

NB MM does not hold this NAB perpetual note in our Income Portfolio : https://www.marketmatters.com.au/new-income-portfolio-csv/

NAB Perpetual Notes (NABHA) Chart

Question 5

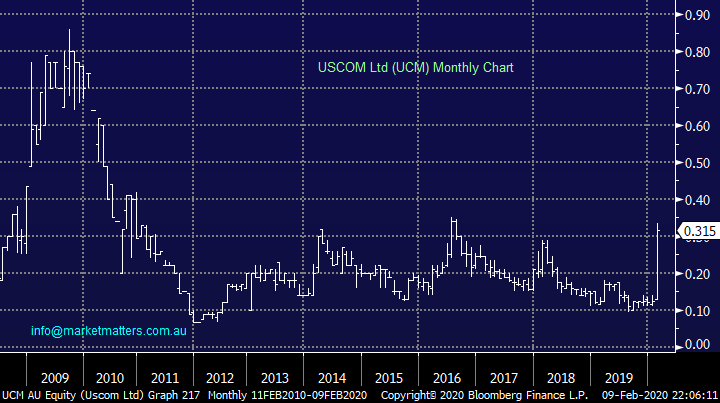

“James and the MM Team do not think you probably have ever come across Uscom but perhaps this is a winner with the ongoing corona-virus. Are you able to get any updates?” – Thanks Paul C.

Morning Andrew,

USCOM Ltd (UCM) manufactures and develops heart monitoring devices, almost any medical / health is hot at present. This is a $47m “speccy” and not in our usual investing spectrum but the company has grown earnings at over 20% pa over the last 3—years making it an interesting option for aggressive players.

MM feel UCM looks ok with stops under 20c which is a high degree of % risk.

USCOM Ltd (UCM) Chart

Question 6

“In view of the coronavirus is it a good time to revisit travel businesses like Flight Centre and WebJet?” – Mike C.

Morning Mike,

We like your thinking of looking out for panic selling however our initial concern is these stocks / businesses were already struggling on a relative basis before coronavirus started dominating the headlines:

1 – Flight Centre (FLT) – FLT downgraded its 2nd half earnings last week because of the coronavirus, no surprises there although the stock has held up ok. This global retail travel business has seen its share price almost half since 2018, at a glance it looks ok value trading on an Est P/E for 2020 of 17.4x (less if its cash adjusted) while looking likely to yield over 4% fully franked, but it’s been a yield trap in the past. Overall were not keen on the businesses direction and significant bricks and mortar presence hence : MM is neutral FLT.

NB, We did trade FLT in the income portfolio between May and September of 2019 buy around $40 and selling around $47 while also picking up a dividend for a 19% return in the period, hence it’s one we do monitor.

2 – Webjet (WEB) – Online travel business WEB is far more interesting to MM at current levels, its simply the direction we believe the industry will head in the future: MM likes WEB with stops under $10.90.

Flight Centre (FLT) Chart

Webjet (WEB) Chart

Question 7

“Hi James, A few weeks back I asked about ALK. You may want to re-visit because you look like scoring a 10 on this one. I must admit I got a bit wobbly when the price went down as part of the SPP but hung in there. Your analysis was part of that. Great work and thanks” - Kind Regards, Peter H.

Hi Pete,

With the stock breaking out above its 2019 highs we would now consider using technical stops under 84c if we were long.

Alkane Resources (ALK) Chart

Question 8

“Hi James, there have been several queries in recent times about gaining access to international markets. So, I was wondering if you could comment on “Macrovue” which seems to give investors access to Baskets (Vues) of shares in a thematic and I think you can also hold or dispose of any holding within those Baskets.” - Cheers, Peter M

Hi Peter,

From what I can see, they are owned by Amalgamated Australian Investment Group (aaig), a company I hold in very low regard. I would have no interest in dealing with a company like this.

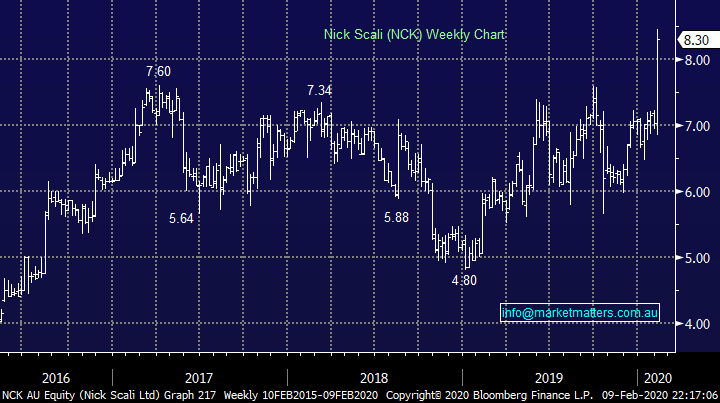

Question 9

“James, further to this, we hear talk at times about some shares being a dividend trap, I'm wondering if Nick Scali may eventually become an overnight capital loss trap.” - Steve S.

Morning Steve,

NCK has a history of under promising and over delivering, history shows it’s actually a good stock to buy leading into results. This is an extremely well-run family business and while we all sit on furniture at home they should remain well positioned, I cannot imagine these large household goods that need “touch & feel” prior to purchase being sold on-line (only) anytime soon.

At this stage we don’t feel NCK’s ~5.5% fully franked yield is a trap, but we are mindful that the risk / reward has diminished significantly over recent weeks.

MM likes NCK with stops under $7.30.

Nick Scali (NCK) Chart

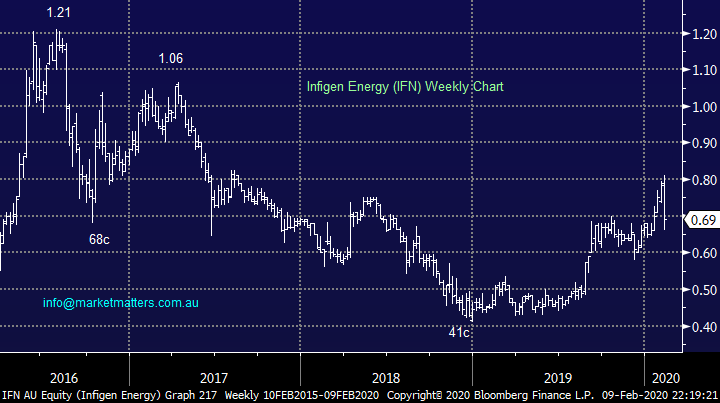

Question 10

“Good afternoon James et al. A very quick question. Does today’s drop in IFN and SSM represent a buying opportunity? Also, can I follow up an earlier question concerning the ERA rights issue. Should be a no brainier but why does the price languish? Realise tricky questions but if you could assist my thinking...” - Cheers Graham R.

Hi Graham,

A trifecta of questions hence 3 quick answers:

1 – Renewable energy business IFN continues to struggle and we see no reason to chase this stock, another 10% decline back towards 60c feels likely.

Infigen Energy (IFN) Chart

2 – We hold wireless and broadband provider SSM in our Growth Portfolio hence we haven’t enjoyed the treatment the stocks received post their report which at MM we felt was ok, hence MM likes SSM around $2.50.

Service Stream (SSM) Chart

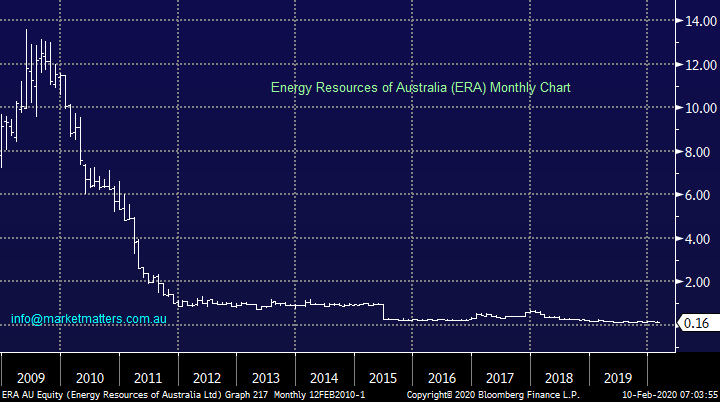

3 –ERA despatched more information on the 24th January about the entitlement offer. In short, a subsidiary of RIO Tinto which owns more than 60% of ERA, from what I understand was underwriting a rights issue as a way of compulsorily acquiring ERA. The takeovers panel has intervened saying that cannot happen, and RIO has objected. Full details are in the ASX release dated 24th January.

Energy Resources Australia (ERA) Chart

Question 11

“Hi Market Matters, can you give an update on your thoughts with regard to ISX and the court proceedings, possible relisting and likely outcome? The highly restricted outcome of the SPP for WZR was disappointing - but we can’t be greedy. It appears that the restricted allocations have created a buying mania. Where to now?” - Thanks & Kind regards John H.

Hi John,

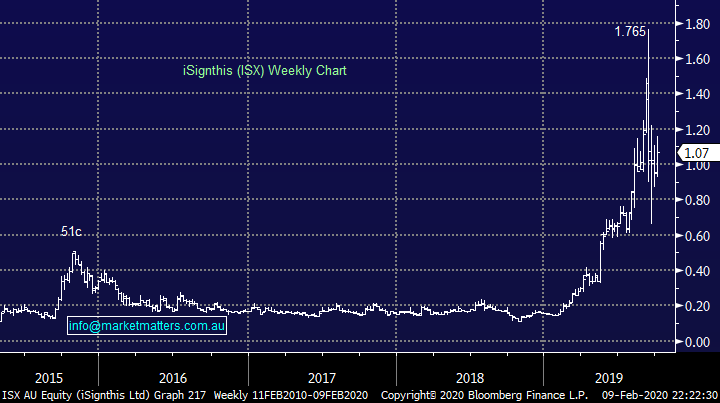

ISX has been in suspense since mid-January after a massive cut to this financial years earnings by almost 40% from over $10m to $6.5m amid claims of extreme dodgy dealings. The company has since blamed the ASX for its suspension and things have moved to the courts– only winner will be the lawyers!!

MM would expect ISX to come back on at a fraction of the $1.07 price it last traded, if at all

iSignthis (ISX) Chart

WZR is a neo bank which has done particularly well in recent times. The SPP was well oversubscribed with holders getting around 9.5% of their desired shares. We remain bullish on WZR, although in the short term, some consolidation would not surprise around 30c

MM remains bullish on WZR

NB: Shaw and Partners (a shareholder of Market Matters) acted as the Sole Lead Manager to the capital raise at 18.5c and were paid a fee.

Question 12

“Dear MM I purchased MFG, JBH and FLT before joining market matters. These are 3 of my successes amongst many fails before joining MM. I need to reduce financials and consumer discretionary sectors to get a more diversified portfolio. Which of JBH and FLT would you recommend reducing, given I follow the income portfolio closely and is MFG overpriced and could be reduced?” - Thanks Tim A.

Morning Tim,

Obviously, MM cannot give personal advice hence we’ve given a simple snapshot of our views across the 3 respective stocks:

1 – MM is not particularly keen on FLT as we said in Question 6, we prefer Webjet (WEB).

2 – JBH is a quality business but it feels fully valued above $40.

3 - MFG is also quality business which similarly feels fully valued around $70.

JB HIFI (JBH) Chart

Magellan Financial Group (MFG) Chart

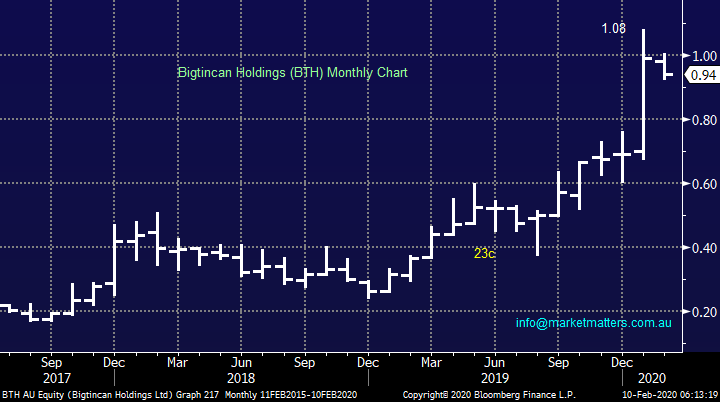

Overnight Market Matters Wrap

- Global equity markets retreated from all time high levels on Friday, despite a stronger than expected US jobs report, as the growing coronavirus epidemic raised fears of a slowdown in China’s economic growth. The infection rate climbed on the weekend to over 37,500 and the death toll to 813.

- US employment growth in January exceeded expectations at 225,000 vs forecasts of 158,000 as did wages growth of 3.10%. meanwhile, the weaker commodities market has resulted in the A$ dropping to US66.64c with BHP expected to underperform the broader market after ending its US session off an equivalent of -1.21% from Australia’s previous close.

- Locally, the half yearly earnings period gathers momentum today with JB HiFi (JBH), Aurizon (AZJ) and GPT scheduled to report.

- The September SPI Futures is indicating the ASX 200 to open marginally higher, towards the 7035 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.