What & when should we buy the 25% plunge in oil (STO, BPT, WPL, BLD, EVN)

The ASX200 struggled at the start of this week with a small decline of -0.14%, overall it was a messy day with no clear direction and only a few standout moves catching my eye following company reports i.e. JB HIFI +11.5% and Boral (BLD) -10.6%, unfortunately on this occasion MM is currently riding the wrong horse. Elsewhere we saw gold stocks rally strongly while the IT sector was the worst on ground, I cannot remember many days like that over recent years.

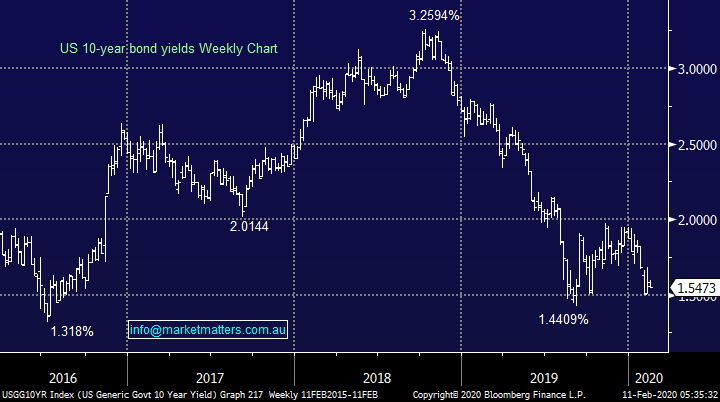

One article that caught my attention in the Australian Financial Review (AFR) overnight was titled “China’s factory prices break deflation spell” – basically prices of goods out of China are rising for the first time in a while plus on the ground the populous hoarding due to the coronavirus has pushed inflation up to an 8-year high. We expect the virus to be a definite hiccup in many ways but since the US & China put away the boxing gloves their economy has been improving sending inflation higher – remember one of MM’s core views for 2020 / 21 is inflation and bond yield will rise. Hence for us to be correct China’s growth has only hit a speed bump and the PBOC will kick start it with a vengeance later this year – i.e. bullish for commodities.

No change to the MM viewpoint: we believe that 2020 will continue to be a choppy year as waves of optimism and pessimism wash through stocks, our current best guess is the ASX200 will make fresh all-time highs up towards 7200 before enduring another ~5% correction. The more time the ASX200 spends rotating around the 7000 area the greater will be our conviction to sell a false break above 7150 if it occurs i.e. a rally to fresh all-time highs which cannot be maintained and the index in this case subsequently falls back below 7140.

MM is currently bullish short-term the ASX200 targeting a test of 7200.

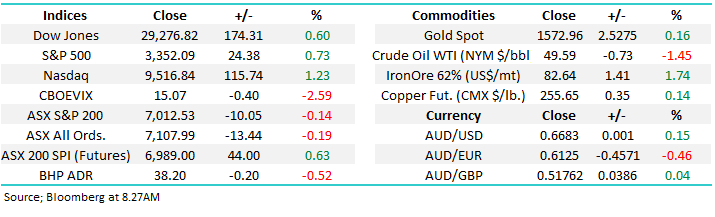

Overnight US stocks rallied steadily with the S&P500 up +0.73% while SPI futures are calling the ASX200 to open up strongly, up over 40-points this morning.

In this morning’s notes we’ve looked at the Australian Oil Sector as the commodity extends its decline to 25% building in a significant amount of demand disruption from China in the process – we know a number of subscribers like to buy stocks “on the cheap”.

Reporting season kicking up locally with a reporting schedule available: CLICK HERE

Today we have reports from companies including: AMC, AVN, BPT, CGF, CLW, MQG, SUN, TCL

ASX200 Chart

US equities continue to trade around their all-time highs with the S&P500 up another 0.73% overnight, our preferred scenario is the S&P500 will now rotate between 3200 and 3400, or in simple terms it’s time for a rest following great gains since mid-2019.

MM is now neutral US stocks after they’ve made fresh all-time highs.

US S&P500 Index Chart

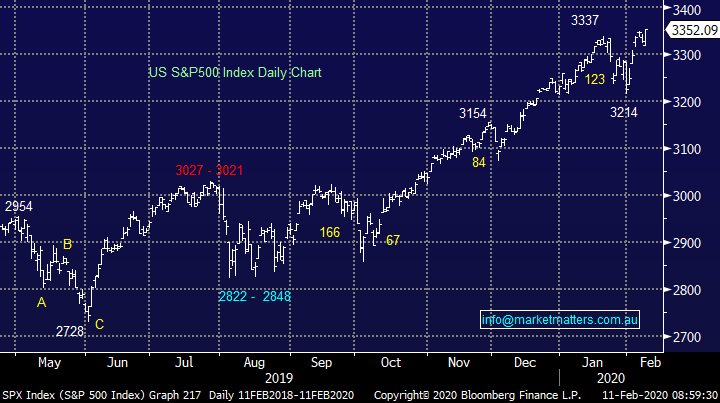

Yesterday after reporting Boral (BLD) was hammered -10.7%, back towards its lows of 2020. Yet another downgrade by BLD saw the back of CEO Mike Kane, from a share price perspective this should probably be a positive moving forward and his performance at BLD has certainly not added a lot of value to his CV. This was the 5th downgrade on his watch which makes the cynic in me question his $1.4m base salary and significant bonuses. While we still like the stock and sector and believe the selling to be overdone, there are now more issues at play that will impact the stock price from here.

On the positive side, a global search for a new CEO is underway and given the markets dislike for Mr Kane, an announcement here could be a positive. However, I would be very surprised if a new CEO didn’t take the opportunity to rebase earnings lower, and that’s one of the key risks now going forward in this stock.

MM is now neutral BLD

Boral Ltd (BLD) Chart

On a more positive note one of our gold holdings Evolution Mining (EVN) was the 2nd best performer in the ASX200 rising almost 8% with no major news, gold was only up around $US5/oz for most of the day, certainly no big deal compared to its recent appreciation. MM holds EVN in its Growth Portfolio making this move even sweeter after the last 6-months pain / frustration, we’ve been very close to selling this position over recent weeks.

Technically MM is now bullish EVN with stops below $3.90.

Evolution Mining (EVN) Chart

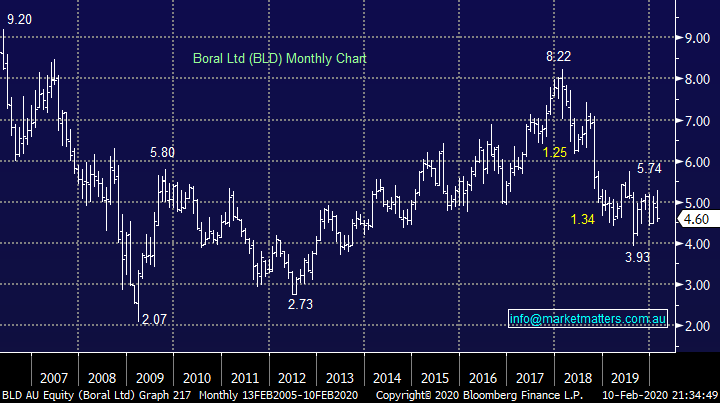

Bond yields have arguably been the main fuel for the major post GFC equity bull market which is no major surprise when we consider its low interest rates that both increases the relative valuation of risk assets, including shares, and produces favourable borrowing conditions for companies. In our opinion this tailwind has a touch further to unfold with US Bond Yields looking poised to make fresh swing lows with the coronavirus a major factor, at present equities continue to focus on bond yields not the reason they’re falling. Bond yields have an understandable strong correlation to crude oil prices, with the commodity generally leading by 3-4 weeks, if this holds true bond yields are perfectly positioned to break lower.

MM’s preference is we still see US Bond Yields break their 2019 lows.

US 10-year Yields Chart

When & where will value unfold in Oil Stocks?

Since the coronavirus outbreak we’ve seen the price of crude oil tumble 25% with China the world’s largest importer of crude oil basically “shutting up shop” to contain the virus. With the current death toll at 910 and over 40,000 infected the Chinese economy is unlikely to kick back into gear in the next few weeks but we should remember stocks generally look around 6-months ahead. As touched on earlier we continue to believe that bond yields will have one final spike to fresh swing lows to create an excellent risk / reward buying opportunity, similarly we feel oil is positioning itself for a buying opportunity. There are 2 classic ways that we feel oil may generate an optimum entry into the sector:

1 – Simply a panic washout to the downside by crude oil.

2 – A day when crude falls but the Australian oil stocks surprisingly rally against expectations – a classic buying catalyst, perhaps today?

We are now looking for an opportunity to buy oil stocks.

Crude Oil Chart

The chart below illustrates how we anticipate bond yields unfolding in 2020, a picture we’ve painted for all of 2020. Until our fundamental & / or technical picture deviates from this path we plan to invest accordingly:

1 – MM is looking to buy an inverse bond ETF for our Global Macro ETF Portfolio : https://www.proshares.com/funds/tbf.html

2 – For our Platinum / Income Portfolio’s skew holdings away from the yield play and increase exposure to reflation stories, like crude oil.

US 30-year Bond Yields Chart

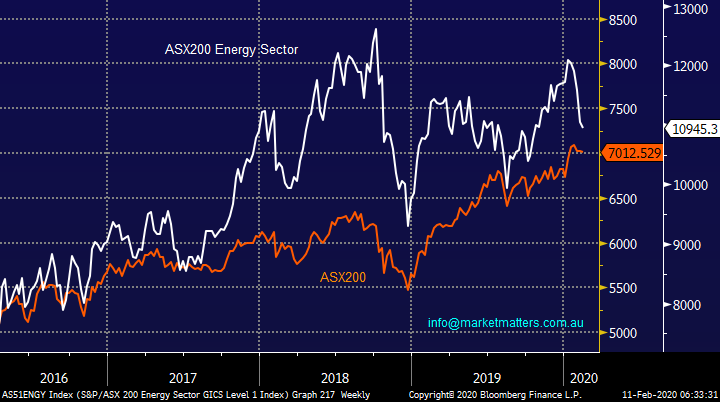

Hence today I’ve looked at our favourite 3 oil stocks to buy, or average, into the current weakness in the sector – as can be seen below its clearly been a major underperformer in 2020.

ASX200 v ASX200 Energy Sector Chart

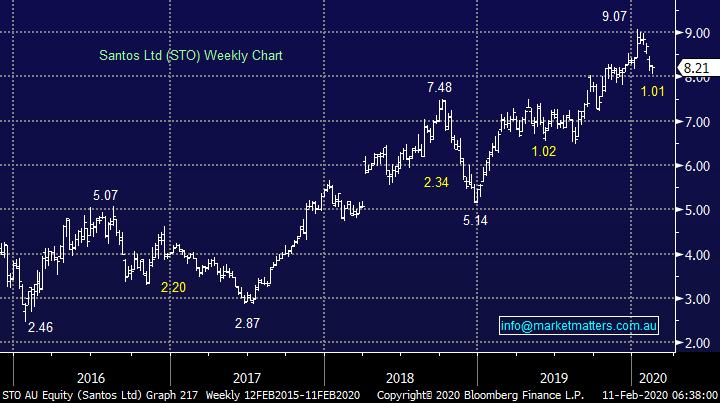

1 Santos (STO) $8.21

Santos (STO) is clearly one of the strongest members of the Australian Energy Sector but it’s still corrected 11% in 2020 due to coronavirus and OPEC failing to agree on production cuts – a common situation that usually gets resolved. We like STO as they continue to execute their strategy in an enviable manner plus there’s always the potential for another takeover offer in the background although the stocks clearly no longer in the bargain basement arena. Lastly for good measure a 2% fully franked yield is ok in today’s environment but as we’ve so often seen over the last 12-months a high yield does not follow into outperformance, if anything the opposite has been the case.

MM are keen buyers of Santos around $8.

Santos (STO) Chart

2 Beach Energy (BPT) $2.37

While STO can be described as the strongest stock in the sector BPT probably carries the torch of being the most volatile, its already corrected 20% from its 2020 high, almost double Santos. Shaw’s analyst is bearish BPT relative to STO describing it as a mini STO without the development upside, however I’m less downbeat. Price action shows this stock is simply a leveraged take on the oil price with the correlation at almost 0.8.

The market wasn’t particularly excited by the companies quarterly update at the end of last month but after an initial dip the stock actually closed up ok.

MM likes BPT around $2.30 and is considering averaging. **Note, the stock reports today**

Beach Energy (BPT) Chart

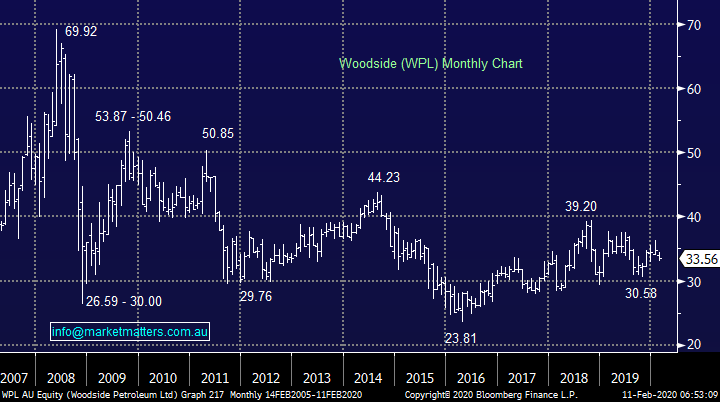

3 Woodside Petroleum (WPL) $33.56

Woodside (WPL) is clearly the largest player in the space however our concern is that many now view it as an income play, a ‘rich’ comment coming from us as we hold it in the income portfolio. We were looking to cut WPL and we too fussy with the price, our rationale being around increasing capex putting pressure on the dividend which would disappoint many holders.

WPL is currently forecast to yield 5.4% fully franked, however this is not a stock we would be buying for capital growth and we are sellers of the next bounce rather than buyers of current weakness.

MM is neutral / slightly positive WPL.

Woodside Petroleum (WPL) Chart

Conclusion (s)

MM now likes the Oil Sector into current weakness with Santos (STO) and Beach Petroleum (BPT) our favourite 2 picks followed by heavyweight Woodside (WPL).

Overnight Market Matters Wrap

- A see-saw of risk off, risk on continues across the globe, compliments to the ever so growing Coronavirus. Overnight however, risk was back on, with the US equity markets hitting new all-time highs yet again.

- Commodities continue to struggle in the face of the China growth concerns, with crude oil hitting its lowest level in over 12 months to US$49.59/bbl., having now fallen 18.78% so far this year.

- Base metals were flat to slightly weaker while the iron ore price eased with BHP expected to underperform the broader market after ending its US session off an equivalent of -0.52% from Australia’s previous close.

- Domestically, corporate earnings for the following are today – Challenger (CGF), Beach Energy (BPT), Suncorp (SUN) and Transurban (TCL) .

- The March SPI Futures is indicating the ASX 200 to follow the US and open 48 points higher, towards the 7060 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.