Dar Group commits to Worley Parsons

Stock

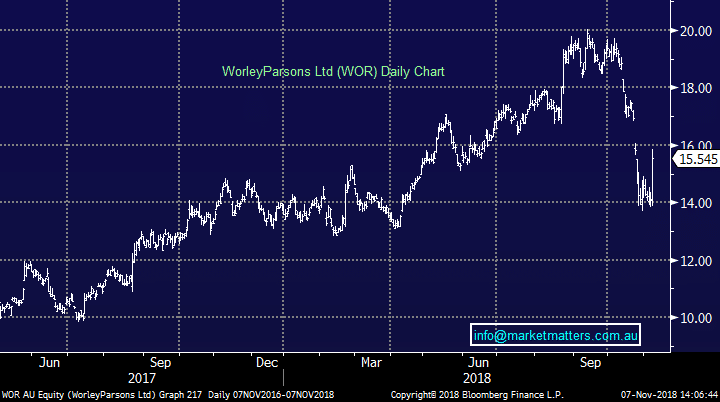

Worley Parsons (WOR) $15.55 as at 07/11/2018

Event

Engineering firm Worley Parson’s has rallied strongly today after announcing that the largest shareholder Dar Group has taken up all of its available rights – totalling around $660M. Originally the company had committed to $185m, or just under 30% of the available rights, quoting availability of cash as an issue. Rumours were circling that banks had offered margin loans to Dar so that they could participate in full, and today JP Morgan landed the big ticket with Worley’s notifying the market all of Dar’s rights would be accepted. Money is being raised to buy energy & resource operation off Jacobs.

The stock has rightfully popped on the news – trading ~10% higher on the day as the market becomes more and more comfortable there won’t be a shortfall in the raise which is closing after market today. Many had feared that the underwriters, Macquarie and UBS, would have to take a sizable portion of the raise considering the original indication that Dar would leave $485m on the table. The stock was also trading at a significant discount to the new shares being issued. As at yesterday’s close, the discount was over 10% - closing at $13.87 vs a $15.56 issue price. This gap has since closed substantially, with the stock now trading in line with the new issue price.

The other consideration would have been from the ‘shorts’. When a short seller is short the stock they ultimately become short the rights. This is good if the share price trades below the right prices, but not good on the other side of the ledger. The news today would / should be a catalyst for shorts to cover with about 2.5% / 6m shares held short.

Worley Parsons (WOR) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook