BHP launches a big capital return

Stock

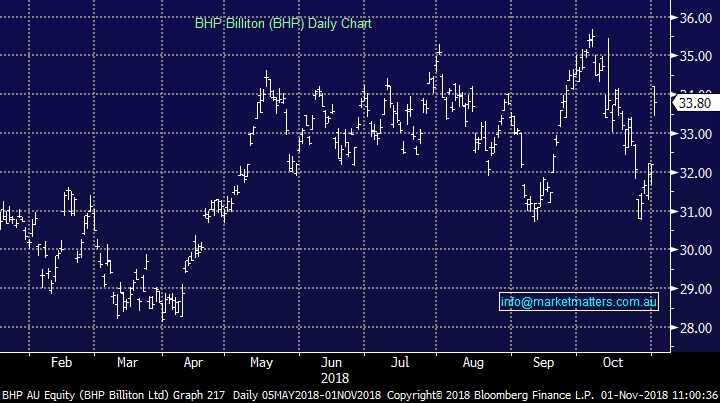

BHP Billiton (BHP) $33.65 as at 01/11/2018

Event

The big Australian has today announced a big capital return to shareholders, ending months of speculation as to how BHP would return over $US10b of asset sale proceeds to shareholders. The bulk of the sale of BHP’s US shale assets went to BP, which paid half of the consideration today with 6 equal monthly instalments to cover the other half. From the company:

“BHP plans to return US$10.4 billion to its shareholders through the combination of an off-market buy-back and a special dividend.

The program will commence immediately with BHP targeting an off-market buy-back of US$5.2 billion (A$7.3 billion)(1) of BHP Billiton Limited shares (Off-Market Buy-Back) under which BHP Billiton Limited can buy back shares at up to a 14% discount. BHP intends to pay the balance of the net proceeds from the sale of its Onshore US assets (expected to be US$5.2 billion) to all shareholders in the form of a special dividend (Special Dividend) to be determined following completion of the Off-Market Buy-Back, and to be payable in January 2019.”

So special dividends and buy-backs, not too dissimilar to Rio’s ongoing capital return and is much the same as what the market was expecting - although the lack of on-market buyback of UK listed Plc shares is surprising. The structure allows a large amount of the company’s franking credits to be paid away attached to both the special and the buy-back. Expect the special dividend to be around $1.40 depending on exchange rates.

BHP Billiton (BHP) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook