Not a buyer of Myer (MYR)

Stock

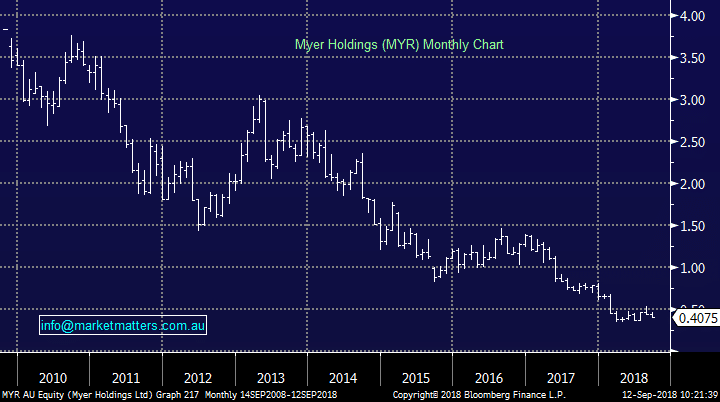

Myer Holdings (MYR) $0.4075 (-6.32%) as at 12/09/2018Event

Myer continues to disappoint investors with another soft result released pre-market. Above the line, the result wasn’t too bad with sales falling 3.2% over the year – better than previous efforts. It was the profit line that saw a big miss to consensus estimates, and no dividend to be paid in the full year was another red flag for investors. The result looks even worse once one-off/implementation costs are added in. A $32m profit drops to a $486m loss as capital is deployed to try and turn this sinking ship around. Even the new CEO John King said the result was disappointing as he laid out his plan to revive Myer – stripping out costs, focus on price and stock offering while restoring the customer experience in Myer stores that has been disappointing for some time. The launch of the new Myer website is also key to John’s “Customer First Plan.” It all sounds well and good, however management has failed to set profit or sales targets into FY19 which will rattle investors.

Myer Holdings (MYR) Chart

Even the new CEO John King said the result was disappointing as he laid out his plan to revive Myer – stripping out costs, focus on price and stock offering while restoring the customer experience in Myer stores that has been disappointing for some time. The launch of the new Myer website is also key to John’s “Customer First Plan.” It all sounds well and good, however management has failed to set profit or sales targets into FY19 which will rattle investors.

Myer Holdings (MYR) Chart