Caltex (CTX) under the pump

Stock

Caltex (ASX:CTX) $31.04 as at 28/08/2018Event

Caltex’s first half result missed market expectations and the stock has traded sharply lower throughout the morning. The numbers were weak, showing the falling appetite for premium fuel, lower refining margins and a soft retail sales result within the business which posted a first half profit of $296m, sneaking into the bottom end of guidance at $295-315m. Key to the result was convenience retail earnings falling 14% to $161m, while acquisitions in NZ and the Philippines were not enough to offset the issues. The result also came with commentary around its property and fuel portfolios as company conducts asset reviews in an attempt the extract value from current assets. Caltex owns around $2b worth of freehold petrol stations, and announced plans to begin selling down its stake to retail real estate investors rather than going down the IPO route others have used. Initially looking to sell a $500m stake, Caltex eventually plans to be a minority holder of the property business it now owns, seeing strategic property partnerships the way forward to sustainable growth.

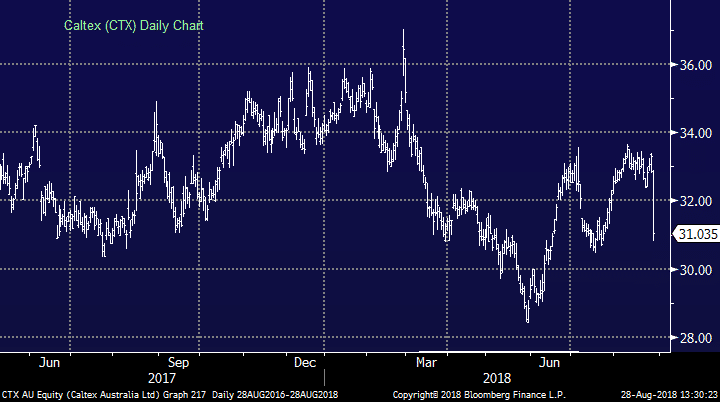

Caltex (CTX) Chart

The result also came with commentary around its property and fuel portfolios as company conducts asset reviews in an attempt the extract value from current assets. Caltex owns around $2b worth of freehold petrol stations, and announced plans to begin selling down its stake to retail real estate investors rather than going down the IPO route others have used. Initially looking to sell a $500m stake, Caltex eventually plans to be a minority holder of the property business it now owns, seeing strategic property partnerships the way forward to sustainable growth.

Caltex (CTX) Chart