How to short the stock market? Taking short positions

ASX 200 & S&P 500 – Taking short positions

Event

Overnight stocks were sold off pretty hard with the broad based S&P500 down -1.37% and the Dow Jones falling -328 points for its ninth decline in 10-days. The ASX200 is set to open just below 6150, already a 100-point decline from yesterday morning’s high and likely to generate technical sell signals for MM. Last night’s weakness on overseas markets was the worst since April and was primarily attributed to further trade tensions courtesy of Donald trump, potentially one step too far for a bull market that’s trading at historically expensive levels. It's time to look into short positions in the market. The ASX200 has ignored most of the bad days on US / overseas markets over the last 10-days but we feel today may be the day the chickens come home to roost.- Short-term MM is now neutral with a close below 6140 generating a clear sell signal - we remain in “sell mode”.

Two ETF’s we may use in the coming days / weeks.

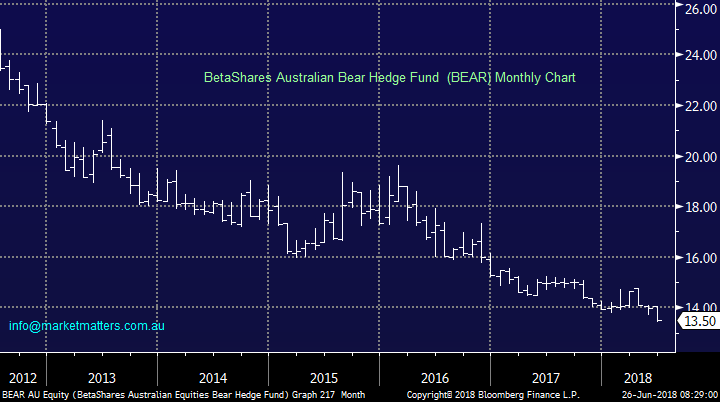

The 2 ETF’s we are considering have excellent liquidity, reasonable costs for “shorting” and satisfy our objective of protecting investors to market declines. I actually spoke with Betashares a few months ago about their products – with the video available here – goes into more detail about their suite of ETFs with an emphasis on the two outlined below.1 BetaShares Australian Equities Bear Fund (BEAR) $13.50.

The BEAR has a market cap of around $50m while being designed to generate returns negatively correlated to the ASX200, its actual depth (liquidity) is determined by the ASX200 stocks and SPI futures hence no issues for investors. The fund is on the expensive end of the scale costing 1.38% p.a. to administer but we believe this is fair for an ETF that allows us to easily short the ASX200. Buying the BEAR is like purchasing shares in a company for $13.50 which benefits from the ASX200 falling, two examples:- The ASX200 rallied +7.4% from early April into Mays 6146 high while the BEAR fell -7.2%, good enough correlation for us.

- In January / February the BEAR rallied 6% when the ASX200 corrected -5.9%, again excellent correlation.

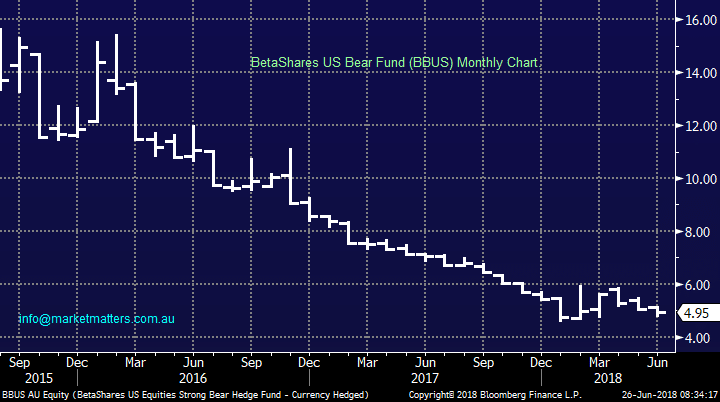

2 BetaShares US Equities Strong Bear Hedge Fund – currency hedged (BBUS) $5.06

The BBUS is designed to be negatively correlated to the US share market (using the S&P500) while being hedged to the $A. The ETF currently only has a market cap of $57m but its liquidity is determined by the S&P futures where the depth makes our own ASX200 feel like a child’s toy hence no issues there for MM. Like the BEAR this fund is on the expensive end of the scale costing 1.38% p.a. to administer but we again believe this is fair for an ETF that allows us to easily short the US stock market. Its important investors understand the leverage in this ETF, which is implied by the “Strong” in its title:- The BBUS at one stage rallied over 30% in January when the actual S&P500 only fell -12% at its worst.

- Similarly, from the S&P500’s low in February 2016 to its top in January 2018 the BBUS fell by over 70% while the Index only rallied by 59%.